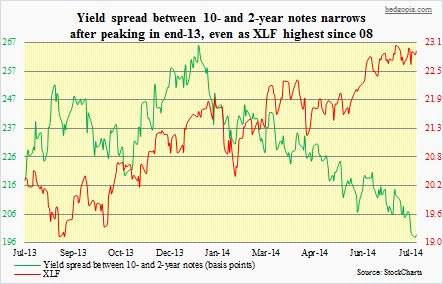

Depending on how mature an economic cycle is, different sectors, and industries within them, act differently. Some lead, some lag, yet others are coincident. Investors gravitate toward sectors such as technology and consumer discretionary when they are more optimistic and are on a risk-on mode. When it is time to pull in horns, sectors to shine include utilities and consumer staples. In this respect, financials carry a lot of weight on investor psyche. Obviously so, as they are the ones that help lubricate the wheels of an economy. Hence it pays to pay heed to how financials are acting at any given point in an economic cycle. Enter the adjacent chart. Since almost the beginning of the year, the spread between 10- and two-year notes has been narrowing. Banks live and die by spreads. A slight exaggeration there, but the fact remains that these entities make their living by borrowing short and lending long. The steeper the curve, the bigger the spread. And this tends to bode well for bank profits, which rather obviously gets reflected into stocks. As can be seen in the chart, for the past three months, the two have diverged. Financial stocks, represented by XLF, have continued to find bids even as the 10-2 spread continues to make new lows.

Depending on how mature an economic cycle is, different sectors, and industries within them, act differently. Some lead, some lag, yet others are coincident. Investors gravitate toward sectors such as technology and consumer discretionary when they are more optimistic and are on a risk-on mode. When it is time to pull in horns, sectors to shine include utilities and consumer staples. In this respect, financials carry a lot of weight on investor psyche. Obviously so, as they are the ones that help lubricate the wheels of an economy. Hence it pays to pay heed to how financials are acting at any given point in an economic cycle. Enter the adjacent chart. Since almost the beginning of the year, the spread between 10- and two-year notes has been narrowing. Banks live and die by spreads. A slight exaggeration there, but the fact remains that these entities make their living by borrowing short and lending long. The steeper the curve, the bigger the spread. And this tends to bode well for bank profits, which rather obviously gets reflected into stocks. As can be seen in the chart, for the past three months, the two have diverged. Financial stocks, represented by XLF, have continued to find bids even as the 10-2 spread continues to make new lows.

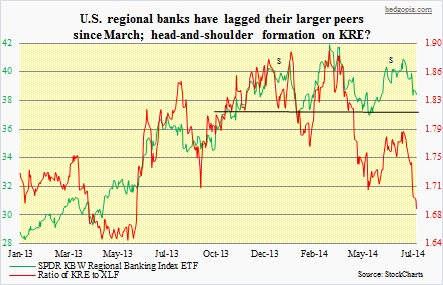

To be clear, yes, financials have risen, but they have also been lagging the S&P 500 Index since late-March. It is probably too soon to say if, as with small-caps, this is a canary in the coal mine. Traditionally, the risk of a recession rises once the yield curve inverts. The curve is still positive. At the same time, if the U.S. economy is as strong as we are told it is, why then are there more buyers than sellers for 10-year notes? This is particularly so as the Fed increasingly has been purchasing smaller amounts of Treasury bonds and in all probability will cease to be a player by October. Nevertheless, yields on 10-year notes have been under pressure since they briefly traded north of three percent in the final weeks of 2013. At the same time, two-year notes have sold off since Fed Chair Janet Yellen suggested back in March they may begin raising interest rates by the middle of next year. Hence the afore-mentioned narrower spread between 10- and two-year notes. A tighter policy is going to mean a flatter curve and more demand for the back-end. Is this the reason why regional banks are beginning to lag then? Money-center banks have operations overseas. Regional banks are U.S.-exposed. The latter, represented by KRE, have lagged their larger counterparts since the middle of March, and, rather ominously, seem to be forming a head-and-shoulders top formation, which will complete if the ETF violates 36.50-37.00.

To be clear, yes, financials have risen, but they have also been lagging the S&P 500 Index since late-March. It is probably too soon to say if, as with small-caps, this is a canary in the coal mine. Traditionally, the risk of a recession rises once the yield curve inverts. The curve is still positive. At the same time, if the U.S. economy is as strong as we are told it is, why then are there more buyers than sellers for 10-year notes? This is particularly so as the Fed increasingly has been purchasing smaller amounts of Treasury bonds and in all probability will cease to be a player by October. Nevertheless, yields on 10-year notes have been under pressure since they briefly traded north of three percent in the final weeks of 2013. At the same time, two-year notes have sold off since Fed Chair Janet Yellen suggested back in March they may begin raising interest rates by the middle of next year. Hence the afore-mentioned narrower spread between 10- and two-year notes. A tighter policy is going to mean a flatter curve and more demand for the back-end. Is this the reason why regional banks are beginning to lag then? Money-center banks have operations overseas. Regional banks are U.S.-exposed. The latter, represented by KRE, have lagged their larger counterparts since the middle of March, and, rather ominously, seem to be forming a head-and-shoulders top formation, which will complete if the ETF violates 36.50-37.00.