The Russell 2000 rallied huge the last seven sessions, as post-Pfizer news in particular investors have rerated value versus growth. With this, next year’s earnings estimates are front and center.

Small-cap stocks have delivered big gains for investors November-to-date. With seven sessions in, the Russell 2000 (1737.01) is up 12.9 percent. In the process, it posted a new intraday high of 1745.69 on Monday, surpassing the prior record high of 1742.09 from August 2018 (Chart 1).

Leading up to this week’s action, a month ago the small cap index broke out of 1600-plus, which has been an important price point going back to January 2018. Bulls, however, were unable to hang on to that breakout. The subsequent drop bottomed at 1530s, leading to another assault at that ceiling, which gave way last Thursday.

Last week, stocks rallied big as President-elect Joe Biden inched closer to victory. The S&P 500 large cap index increased 7.3 percent, the Nasdaq 100 index 9.4 percent and the Russell 2000 6.9 percent. This week, small-caps are outperforming, with the Russell 2000 up 5.4 percent, the S&P 500 up one percent and the Nasdaq 100 down 3.9 percent.

Investors rotated heavily from growth to value this week, as they gravitated toward small-caps on the back of positive Pfizer data that showed its coronavirus vaccine is more than 90 percent effective. If Pfizer’s first analysis holds up, it would mean mass vaccination can begin next year in the US, which would then mean an economy that begins to get back to normal.

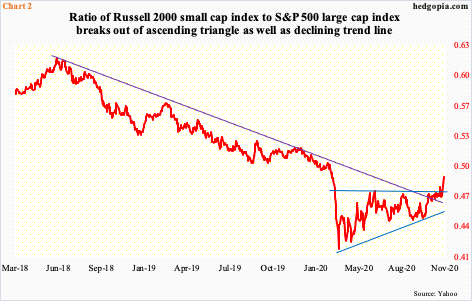

Small-caps inherently have larger domestic exposure than their larger-cap brethren that also have international exposure. Hence investor fascination with the Russell 2000. This was evident in the ratio of the Russell 2000 to the S&P 500 as well.

The ratio had trended lower since June 2018. Since the low in March this year, the ratio has acted constructively, with higher lows. But rally attempts were getting rejected at 0.47. A breakout occurred on Monday. This was preceded by the takeout mid-October of the trend line in question.

Investors are voting with their money that small-caps’ fortunes are changing.

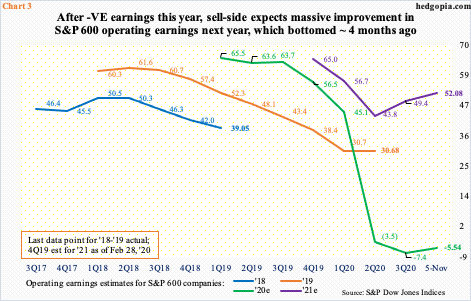

Speaking of which, as of November 5th, S&P 600 companies are expected to lose $5.54 in operations this year. This is a slight improvement from September 24th when the sell-side had them losing $8.35. That said, in February last year these analysts expected operating earnings of $67.63 (Chart 3).

As Covid-19 disrupted the economy, the consensus simply collapsed – both for this year and next year. But 2021 estimates were always positive. In February this year, estimates for this year were as high as $64.96, which then came under pressure before bottoming at $42.99 mid-July. Since then, the revision trend has persisted higher, with the latest estimate of $52.08 as of last Thursday.

The number of investors believing these companies are capable of hitting 2021 estimates went up big the last couple of weeks, particularly this week. The vote of confidence will be stronger should the Russell 2000 manage to stage another breakout. Currently, the index has essentially rallied to the August 2018 high (Chart 1). A decisive breakout, attracting more devoted longs, will lend greater conviction to next year’s estimates.

Thanks for reading!