The Russell 2000 broke out last week – a big victory for small-cap bulls. They will have scored a bigger one should they decisively defend breakout retest, which looks imminent.

Last week, the Russell 2000 staged a major breakout, rallying 6.4 percent to push through 1600-plus, which has been an important price point for both bulls and bears going back to January 2018. Late February this year, bulls lost that level, just before a waterfall dive (Chart 1).

After the small cap index bottomed at 960s in March, the rally that followed stopped early August at – you guessed it – 1600-plus. The Russell 2000 then dropped to 1450s-60s, which was defended. Soon, bulls regrouped and charged at that ceiling again – successfully this time.

The resistance gave way last Thursday, leading to more gains through Monday. From the low on September 24 through Monday’s high, the index (1636.85) jumped 15.3 percent. It peaked as far back as August 2018 at 1742.09.

In an ideal world, last week’s breakout should have opened the door to a test of its record high. Before that happens, bulls need to take care of trend-line resistance from that high, which lies around 1670s. Monday, the Russell 2000 tagged 1652.05 before coming under slight pressure.

After the three-week sharp rally, it is perfectly normal for a rest. What bulls do not want to see happen is a failed breakout retest in the sessions ahead. In the event they fail to save the breakout, bears would once again be eyeing 1450s-60s, which is where the 200-day moving average lies.

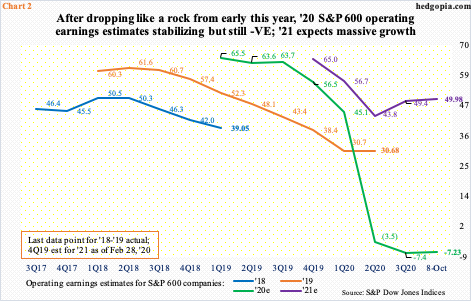

Last week’s breakout came just before the onset of 3Q earnings season. As of last Thursday, the sell-side was expecting S&P 600 companies to earn $7.61 in operations, which was substantially lower than the $17.46 expected in January last year but up from the low of $5.71 early July this year. In other words, the revision trend the past three months is pointing up.

This is also true particularly for next year. This year, these companies are expected to lose $7.23, which is a slight improvement from a loss of $8.35 expected as of September 24th. For perspective, they were expected to earn $67.63 in February last year. This is a reminder how not to take sell-side estimates at face value all the time.

Speaking of which these analysts now expect $49.98 next year. Once again, as recently as February this year they were expecting $64.96, although estimates have trended higher since bottoming at $42.99 mid-July (Chart 2).

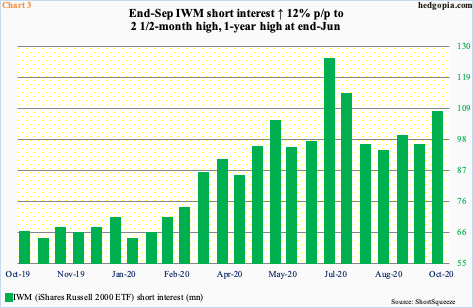

If imminent breakout retest is successful, shorts could end up providing a tailwind – magnitude notwithstanding. At the end of September, short interest on IWM (iShares Russell 2000 ETF) jumped 12 percent period-over-period to 105.8 million, which is a two-and-a-half month high.

By the end of June, short interest had risen to 124 million. The Russell 2000 was trying to break out of 1450s-60s at the time, which it achieved in July. Shorts covered, cutting short interest to 92.3 million by mid-August (Chart 3). They again got aggressive in the second half last month.

It is possible last week’s breakout caused some short-covering, which could be behind the 6.4-percent jump. But it is equally possible quite a few shorts are waiting to see what happens next. If the impending retest in the sessions ahead is successful, they likely would not be sticking around. This could potentially act as a self-fulfilling prophecy. Of course, if the retest fails, odds grow they will wait until the index hits 1530s, with the 50-day at 1550s, and 1450s-60s thereafter.

Thanks for reading.