Back on October 4, spot gold collapsed 3.3 percent. The one-day decline probably owed more to technicals than to fundamentals.

From the December 3rd low of $1,045.4/ounce through the July 6th high of $1,377.5, the metal rallied nearly 32 percent. It then traded within a descending channel, with support at $1,300-plus, which provided support several times in July through September. On October 4, that support gave way, probably resulting in that steep decline.

From October 7 through November 2, gold then rallied 5.3 percent, unwinding the daily overbought condition it was in. The rally stopped right at that support-turned-resistance – $1,309.3 was the intra-day high on November 2 (Chart 1). This level can be extended as far back as September 2010.

With the 1.9-percent drop Monday, spot gold lost its 50-day moving average, and is merely 0.2 percent from its still-rising 200-day moving average. On a daily basis, there is room for more downward pressure.

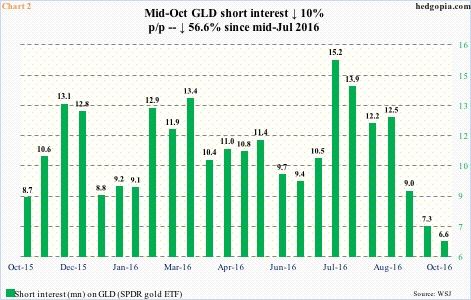

As of mid-July this year, short interest on GLD, the SPDR gold ETF, rose to 15.2 million. This was the highest since the end of September last year. Since that mid-July high through mid-October, short interest has been more than cut in half, to 6.6 million. Shorts have either given up or been squeezed out. A high level of short interest in the right circumstances can act as fuel for squeeze, and this is lacking currently.

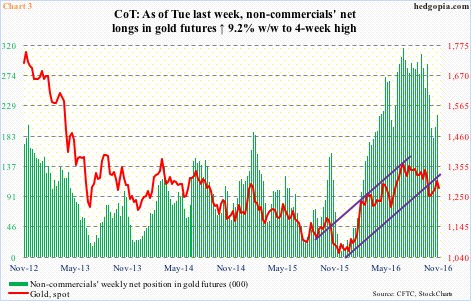

As of July 5, non-commercials held record 315,963 net longs in gold futures, the spot closed at $1,358.7 then. By October 18, they had cut holdings to 179,618 contracts, with the metal closing at $1,262.9. Gold has rallied since, but these traders are yet to show aggression in adding to net longs. As of Tuesday last week, they held 215,131 contracts.

Gold is also struggling to attract new flows. In the five sessions through Wednesday last week, the spot rallied 3.3 percent, yet GLD saw activity only once – inflows of $109 million on Tuesday. It did attract $199 million on Thursday, and none on Friday. From October 7 when the metal began to rally through last Friday, only $92 million came in (courtesy of ETF.com).

Should this trend not change, GLD ($122.15) probably continues to unwind its overbought condition. Especially if Clinton prevails in today’s election. The 200-day moving average lies at $121.75, which approximates a rising trend line drawn from the October 7th low (Chart 4).

That said, should Trump win, gold potentially rallies big.

Amidst this uncertainty, it is probably prudent for traders to lock in profits, if any.

Back on October 6, October 14th weekly GLD 120.50 put was sold for $0.96. The hypothetical short put got assigned as the ETF closed at $119.36 at expiration, essentially going long at $119.54. Time to lock in gains.

Thanks for reading!