Here is a brief review of period-over-period change in short interest in the December 1-15 period in the Nasdaq and NYSE Group as well as nine S&P 500 sectors.

Nasdaq – short interest ↓ 2% p/p; Nasdaq composite ↑ 2.5%

The composite found support at its 50-day moving average early in the month, defended the November 29th high of 5403.86, and proceeded to score a new all-time high of 5486.75 on December 13.

Tech has been a laggard post-election. That said, shorts have been covering, and that has helped the index.

In the November 16-30 period, short interest fell 3.9 percent p/p. In the December 1-15 period, this dropped another two percent – to the lowest since February 2014.

NYSE Group – short interest ↓ 0.1% p/p; NYSE composite ↑ 2.7 %

The index closed the November 16-30 period right underneath resistance at 10900, even as the rising 10-day moving average was providing support. Early in December, that resistance got taken out. It then went on to rally to 11256.07 on December 13, testing resistance from May last year as it retreated from 11254.87. It is not going to be easy to take out this resistance; on December 14, the index dropped 1.2 percent. Bulls have expended lots of energy in rallying it up to this resistance, and are in need of at least a breather, if not a reversal.

…

Of the nine S&P 500 sectors below, short interest rose in six p/p (XLB, XLE, XLF, XLI, XLP, XLV). During the period, all nine sectors were above their 50-day moving average.

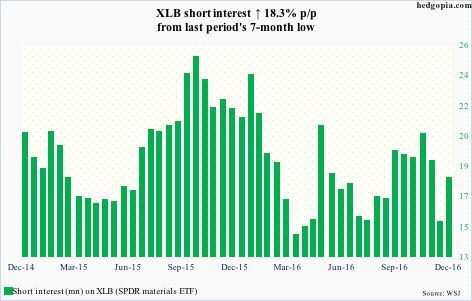

XLB (SPDR materials ETF) – short interest ↑ 18.3% p/p, ETF ↑ 2%

XLB rallied to a new all-time high of $51.35 on December 8 – later revisited on the 12th – but that proved fleeting. By the 15th, it was barely hanging on to its 10-day moving average.

Traders are probably closely watching $50, and then $49. The latter resistance got taken out during November 16-30.

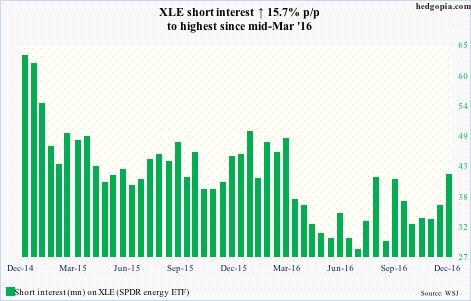

XLE (SPDR energy ETF) – short interest ↑ 15.7% p/p, ETF ↑ 2.7%

On December 12, XLE rallied as much as 2.4 percent intra-day but was unable to hang on to the gains, closing up only 0.45 percent to $78.04 – the highest since May last year. That reversal candle was followed by a spinning top on the 13th, and a two-percent drop on the 14th.

The ETF also broke out of an ascending channel from April this year. Shorts are not convinced this is for real. They added.

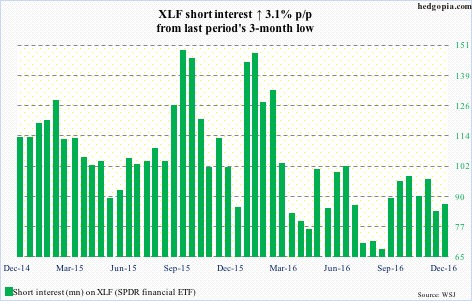

XLF (SPDR financial ETF) – short interest ↑ 3.1% p/p, ETF ↑ 5.1%

XLF rallied strongly to $23.76 – the highest since October 2007. Since the end of October this year through that December 15th high, XLF rallied nearly 21 percent. Short interest since has only gone down from 88.6 million to 85.3 million – probably because shorts are still not convinced of the rally. That said, they have not been adding.

On a monthly chart, XLF now has back-to-back large hollow candles, with solid support at $20.

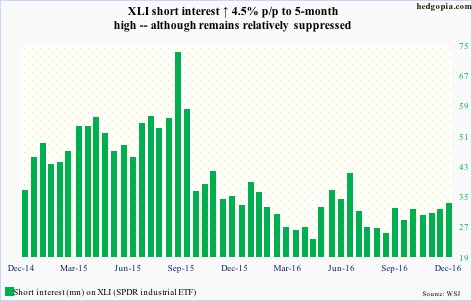

XLI (SPDR industrial ETF) – short interest ↑ 4.5% p/p, ETF ↑ 1.1 %

XLI rallied to a fresh new high of $63.68 on December 7, but was not able to build on that.

Early in November, it defended horizontal support at $56-plus extending back to February last year. This kind of laid the foundation for the post-Trump rally. The ETF in fact took care of that resistance this July. A measured-move target comes to $66. The December 6th high came close.

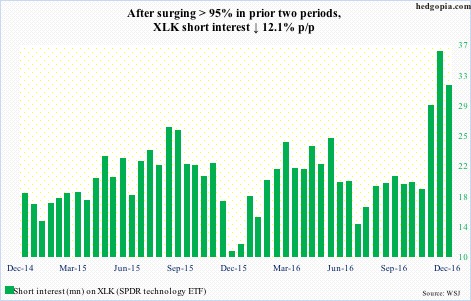

XLK (SPDR technology ETF) – short interest ↓ 12.1% p/p, ETF ↑ 3.5%

Leading up to this, XLK had not been able to break out of resistance at $48, which had resisted breakout attempts in the past three months, with a monthly doji in October and a long-legged doji in November. In November, short interest surged 95 percent.

Come December 8, XLK broke out, subsequently rising to $49.19 on December 15 – the highest since April 2000. Shorts covered, but not a whole lot. This is something the bulls can potentially use to their advantage in the right circumstances.

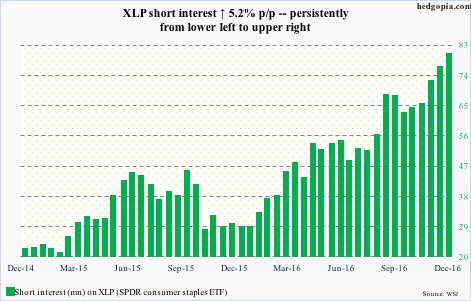

XLP (SPDR consumer stables ETF) – short interest ↑ 5.2% p/p, ETF ↑ 3.1%

XLP had been in a downtrend since July this year. Post-Trump win, it further came under pressure. The ETF bottomed early this month just under $50. The subsequent rally saw it recapture the 50-day moving average, closing right on that downtrend line.

Shorts remain unconvinced. They continue to add.

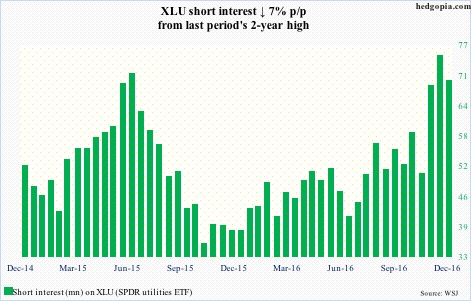

XLU (SPDR utilities ETF) – short interest ↓ 7% p/p, ETF ↑ 3.3%

Similar to XLP, XLU had been under pressure since July this year, and similar to XLP, it closed the reporting period right on that downtrend line. It also recaptured its 50-day moving average.

Leading up to this, short interest had gone up from 49.8 million at the end of October to 74.3 million at the end of November. For the most part, shorts are staying put.

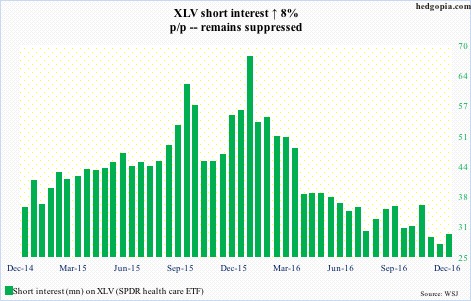

XLV (SPDR healthcare ETF) – short interest ↑ 8% p/p, ETF ↑ 1.6%

In August this year, XLV came within pennies of the July 2015 all-time high. This unsuccessful test led to a sharp drop into a November bottom. The drop by the way was not aided by shorts piling on. Short interest remains suppressed.

If there is any consolation for the bulls, it is that the ETF managed a higher low during the reporting period, but continues to struggle to gain traction.

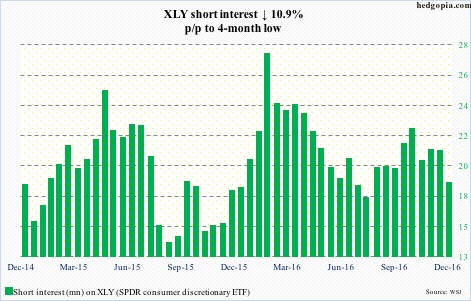

XLY (SPDR consumer discretionary ETF) – short interest ↓ 10.9% p/p, ETF ↑ 2.1%

XLY rallied to a new all-time high of $84.19 on December 13, before coming under slight pressure. The 1.9-percent jump on December 9 probably led shorts to cut back.

Thanks for reading!