US equities surged last week pricing in a divided government – a Democrat in the White House, Republicans in control of the Senate and Democrats of the House of Representatives. Major indices rallied right into important resistance. The focus now shifts from the White House to Georgia, where a runoff election is scheduled for January 5th. If the Senate flips, risks of higher taxes and bigger budget deficit meaningfully go up.

The S&P 500 (3509.44) jumped 7.3 percent last week, rising in four of the five sessions. It began to rally as soon as the week began.

Going into last Tuesday’s election, the large cap index had been under pressure since October 12th when it put in a lower high – 3549.85 versus the all-time high of 3588.11 on September 2nd. The selloff stopped at important support.

Going back to last December, 3220s witnessed several tussles between bulls and bears. That support was defended on October 30th, and a little over a month before that. This laid the foundation for last week’s rally, which then stopped right at a falling trend line from the September 2nd high. Thursday’s high of 3529.05 establishes a pattern of lower highs (Chart 1).

A similar pattern evolved on the Nasdaq 100 as well.

The index peaked on September 2nd at 12439.48. The drop since bottomed at 10677.85 on September 21st. This was followed by a lower high 12204.75 on October 12th. Last Thursday’s high of 12117.04 set another lower high (Chart 2).

Earlier, tech bulls defended 11000 both last Monday and the Friday before that. Last week, the index (12091.35) jumped 9.4 percent, gapping up on both Wednesday and Thursday, ending the week right on the falling trend line in question.

Concurrently, both these indices have established a pattern of higher lows as well.

Amidst this, odds that markets will be on pins and needles until January 5th have now risen. Last week, investors voted with their money in favor of a split government, with a Democrat in the White House and a divided Congress. Democrats kept control of the House and Republicans seemed set to retain control of the Senate. But as the week progressed, it became apparent that Senate control was up for grabs.

Currently, Republicans hold a 53-47 majority in the Senate. Democrats won one seat in last week’s election, with four seats hanging in the balance. They are currently tied at 48/48. If Republicans hold on to seats in North Carolina and Alaska, they will get to 50. This raises the importance of the two seats in Georgia where no candidate reached the 50 percent threshold, hence a runoff is scheduled for January 5th.

As things stand, Republicans need to win three of the four to retain control, and Democrats only two. In the event of a 50/50, Vice President-elect Kamala Harris will break the tie. Power dynamics will significantly change should the two Georgia seats go blue. Susan Collins, representing Maine, is one of the moderate Republican senators. Last month, she was the only Republican to vote against Amy Coney Barrett’s confirmation to the Supreme Court.

In the current setup, markets believe Mitch McConnell, Senate majority leader, wields the power to check on President-elect Joe Biden’s ambitions. In a scenario in which Democrats control both the House and the Senate, markets will need to readjust.

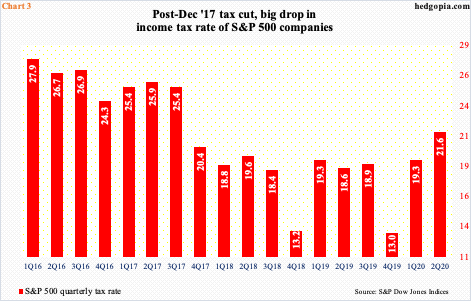

Among others, Biden has talked about raising the corporate tax rate from the current 21 percent to 28 percent. Earlier, the 2017 Tax Cuts and Jobs Act reduced the tax rate from 35 percent to 21 percent.

US corporations’ tax rate has gone down significantly (Chart 3). The annual tax rate for S&P 500 companies was 17.5 percent last year, versus 17.7 percent in 2018, 24.4 percent in 2017, 26.4 percent in 2016, 27.5 percent in 2015 and 28.9 percent in 2014.

If the Senate goes blue, it is likely infighting gets intense between centrists and progressives within the Democratic party regarding issues such as health care, but it is a safe bet to assume that infrastructure spending will have popular support.

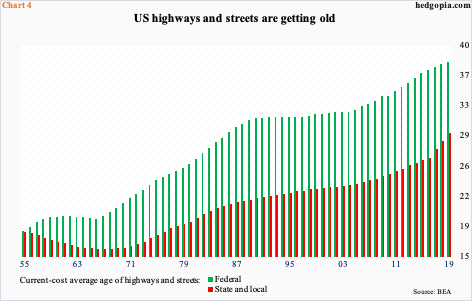

Biden himself has talked about the need to increase infrastructure spending. Rightly so. The nation’s highways, bridges and other structures are crumbling and are in dire need of repair or replacement. In 2019, the current-cost average age of federal highways and streets was 38.2 years (Chart 4).

There is no argument that infrastructure spending needs to go up. The question is if under Biden with both chambers of Congress in support spending goes up several notches. For reference, under President Dwight Eisenhower, the Federal Highway Act of 1956 was signed into law, which marked the birth of the interstate highway system.

Markets have not priced in this possibility. They will begin to wonder precisely that the next two months – particularly if the Democratic candidates pull ahead in the polls.

In a scenario in which Democrats will have a free rein, markets will be quick to reassess if the budget deficit becomes a boon or a bane.

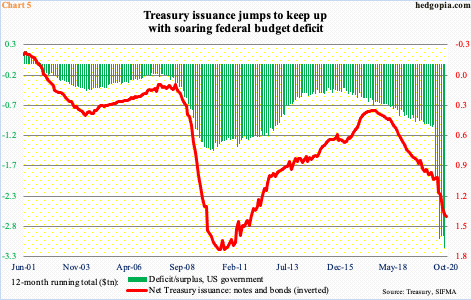

The deficit is already at a record high. In the 12 months to September, the federal government spent $3.13 trillion more than it took (Chart 5). Until March, on a 12-month basis, the red ink was $1.04 trillion. Then it took off, thanks to stimulus measures taken to mitigate Covid-19 disruptions. Treasury issuance similarly has gone up to keep up with this.

Supply of these securities has gone up, as has the Fed’s balance sheet. The central bank continues to buy Treasury notes and bonds. In the week to last Wednesday, it held $3.86 trillion worth, up $8.3 billion for the week. Early March, these holdings were $2.03 trillion. The Fed is buying up in an attempt to push interest rates down, but the supply is rising faster.

In early August, 10-year Treasury notes yielded 0.5 percent. Last Friday, they were yielding 0.82 percent, with Tuesday having posted a high of 0.9 percent. As leveraged as the economy as – be it on a federal, corporate or household level – higher rates will bite, should they continue higher. The Fed is doing its best not to let that happen but will have a tough time achieving that goal should supply of these securities continues on its current path. This is the risk should the Senate split 50/50. Hence the likelihood of markets’ obsession with Georgia runoff election for the next two months. It can get volatile.

Thanks for reading!