The Federal Reserve would like some inflation. In fact, every major central bank would. Or, for that matter, every debtor would – be it an individual, a corporation, or a sovereign nation.

For debtors, a little inflation goes a long way… toward eroding the value of the principal and interest payment. (Unless, of course, one is in Denmark, Sweden, Switzerland, Japan, and the Eurozone that have instituted negative interest rates, which, by the way, is a different topic altogether.)

Small wonder then that central banks in the Eurozone, Japan and the U.S. – all of them in debt up to the gills – are all trying to ignite inflation, pining for pricing pressure. But not getting it.

Mario Draghi, ECB president, recently said Eurozone inflation was weaker than expected. No kidding! Inflation rose 0.4 percent year-over-year in January. The annual rate of inflation has been below the ECB’s two-percent target since March 2013.

Over in Japan, the so-called “core-core” inflation rose by 0.8 percent year-on-year in December. Haruhiko Kuroda, BoJ governor, says, “we wouldn’t hesitate adjusting policy, including easing policy, if necessary to achieve our two percent price target.”

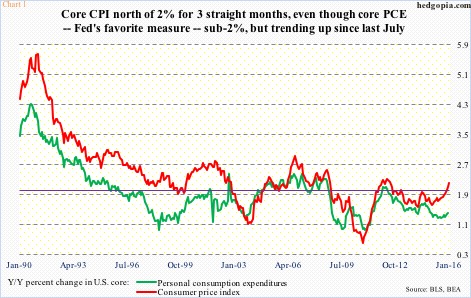

Annual core personal consumption expenditures (PCE) inflation – the Fed’s favorite measure of consumer inflation – has been below the bank’s two percent target since April 2012. The 10-year Treasury yield is once again languishing under two percent. Bond vigilantes do not see sustained inflationary pressure for miles and miles.

Then came last Friday, and January’s consumer price index (CPI) report. Overall, inflation came in a little higher than expected. Noticeably, in the 12 months through January, core CPI advanced 2.21 percent – the largest rise since June 2012 (when it rose 2.22 percent). This was the third straight month of two-plus percent increase in core CPI (Chart 1).

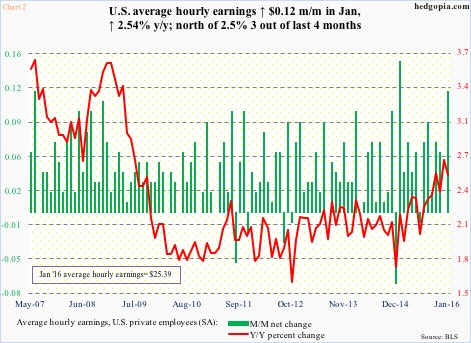

In addition to core CPI that is perking up of late, wages are showing a similar trend. In January, average hourly earnings of private-sector employees rose $0.12 month-over-month to $25.39. Year-over-year, they grew 2.54 percent, on the heels of a 2.68-percent rise in December (Chart 2). Earnings have grown north of 2.5 percent in three of the last four months.

But the collective wisdom of markets is not worried. Last Friday, the day the CPI was published, the 10-year yield fell 11 basis points to 1.75 percent. Earlier on February 11th, it had dipped to as low as 1.57 percent.

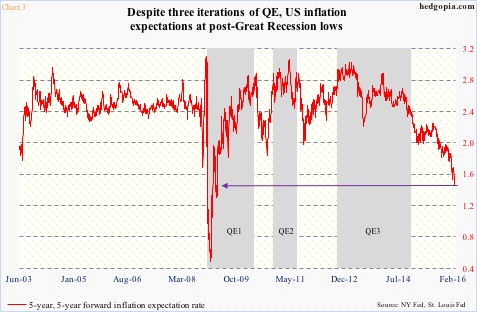

Separately, the five-year, five-year forward inflation expectation rate keeps hitting new lows. On February 11th, it dropped to 1.42 percent, and has since risen a tad, to 1.46 percent. On Friday, the day the CPI report came out, it closed unchanged. Notice the inability of three iterations of quantitative easing (QE) to uplift inflation expectations (Chart 3).

Once again, markets are not worried, and they are probably right.

Given the amount of leverage in the system and the resulting deflationary pressure, it is hard to imagine sustained upward pressure on inflation intermediate- to long-term. Near-term, there can always be surprises.

As stated earlier, core CPI has been percolating for a few months. Ditto with core PCE. The latter is still below two percent, but has been trending up year-over-year – from 1.26 percent last July to 1.41 percent in December (Chart 1).

January’s PCE numbers will be published this Friday, and is worth a close watch. Any sign – real or perceived – that core PCE is inching toward the Fed’s two percent goal has the potential to put downward pressure on TLT, the iShares 20+ Year Treasury Bond ETF. This thing is looking for a reason to go lower.

Thanks for reading!