With spring in their step, tech bulls Tuesday rallied the Nasdaq 100 to trend-line resistance from the all-time high set in July. A new high has the potential to squeeze shorts. Nasdaq short interest is at a four-year high. There is room for investor sentiment to rise further.

US equity indices of late have pep in their step. With three sessions to go this week, the Nasdaq 100 is up 1.3 percent. Should this stick, this will be the third consecutive up week. Last week, the index reclaimed horizontal resistance at 7700-7750 as well as a broken trend line from last December, not to mention the 50-day moving average. The latter is beginning to curl up.

Last Friday, tech bulls were unable to hang on to all the gains, resulting in a nasty-looking shooting star. Tuesday, the index (7942.85) surpassed that high, although it ended the session right on a falling trend line from July 26 when it peaked at 8027.18 (Chart 1). The index is only 1.1 percent from that high. A convincing takeout of trendline resistance from that high opens the door to new highs. Bulls hope so.

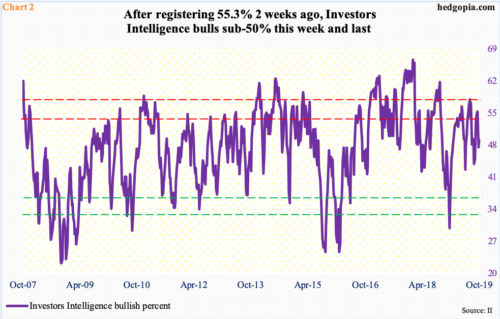

There is room for investor sentiment to rally further.

Investors Intelligence bulls this week rose 1.5 percentage points week-over-week to 49.1 percent (Chart 2). This was the second straight week of sub-50 reading. Before that, bulls peaked at 55.3 percent, which was a nine-week high.

When the Nasdaq 100, and other indices including the S&P 500 large cap index, reached record highs late July, bulls hit 57.2 percent.

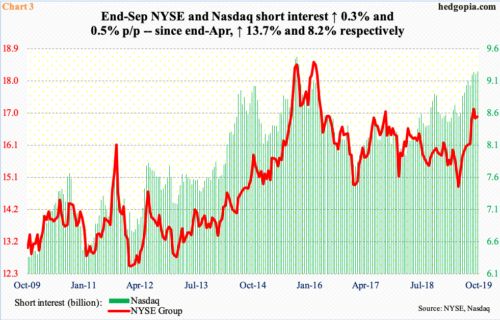

Short interest can help.

At the end of September, NYSE and Nasdaq short interest respectively rose 0.3 percent and 0.5 percent period-over-period to 16.9 billion and 9.2 billion. On the latter, in particular, short interest is at a four-year high (Chart 3). This raises the odds of a squeeze should the Nasdaq composite rally to new highs. Like the Nasdaq 100, the composite, too, ended Tuesday right at a trend line from its July peak – 2.3 percent away. This is the risk shorts face right now. Should things evolve this way, their pain is bulls’ gain.

Thanks for reading!