The Nasdaq 100 index/QQQ could be potentially forming the right side of a bearish head-and-shoulders pattern. This week’s action could provide further clues.

The US economy is one month short of completing nine years of expansion. The recovery has been subdued, to say the least. Real GDP has averaged growth of 2.2 percent, a full percentage point below the long-term average going all the way back to 2Q47 of 3.2 percent. This despite the fact that growth has been decent the last three quarters, with 1Q18 growing at 2.3 percent, 4Q17 at 2.9 percent, 3Q17 at 3.2 percent and 2Q17 at 3.1 percent.

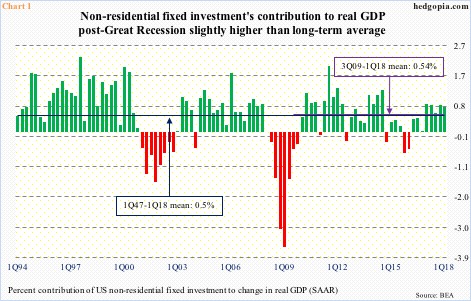

Business capex relatively is not faring that badly, but is when considered on an absolute basis. In the current recovery, non-residential fixed investment contributed an average 0.54 percent to the afore-mentioned 2.2 percent GDP growth. This compares favorably to the long-term average contribution of 0.5-percent to the average 3.2-percent growth in GDP (Chart 1).

That said, post-Great Recession, the share of non-residential fixed investment in GDP has averaged 12.3 percent, versus an average 12 percent going back to 1Q47.

Subdued capex comes with a cost.

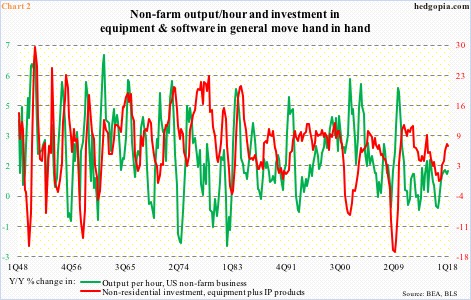

In Chart 2, non-farm output per hour is pitted against non-residential investment in equipment and intellectual property products (investment in structures is excluded). In 1Q18, the latter came in at a seasonally adjusted annual rate of $1.97 trillion ($1.16 trillion and $809.9 billion, respectively), growing 7.2 percent year-over-year.

Since 4Q16, non-residential investment in equipment and IP products has trended higher. Non-farm productivity has followed. In 1Q18, the latter rose 1.34 percent y/y. As early as 2Q16, it contracted 0.41 percent.

Despite the uptrend in recent quarters, productivity has been anemic. The last time it grew y/y with a two handle was in 3Q10.

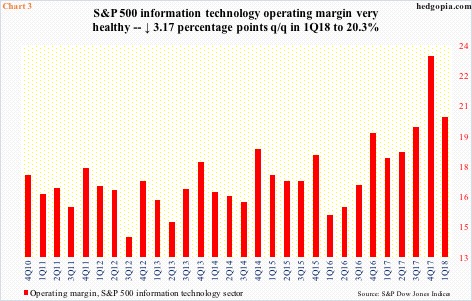

The good thing – if it can be called that – is that low productivity has not much impacted corporate margins, raising questions about the latter’s sustainability.

With 93 percent results in, 1Q18 operating margin (blended) for S&P 500 companies is currently pegged at 11.1 percent. Of the 11 sectors, information technology has the highest margin. In 1Q18, it was 20.3 percent, with 4Q17 even higher at 23.4 percent (Chart 3). (At 6.4 percent, consumer staples had the least operating margin in 1Q18.)

It is too soon to say if this margin contraction in 1Q18 has anything to do with how tech-heavy indices are performing this year.

The Nasdaq 100 index/QQQ (PowerShares QQQ Nasdaq ETF) peaked on January 26 before coming under massive pressure in the next 10 sessions. The rally post-reversal low of February 9 resulted in a new high on March 13. But it turns out the breakout was false, followed by an island reversal (box in Chart 4).

While the bulls can point to the fact that QQQ ($167.46) has made higher lows since that February 9 low, bears showed up last week at a critical level. Last Monday’s intraday high of $170.82 can potentially form the right side of a head-and-shoulders pattern. The neckline is not tested until $156-157, which is where the 200-day moving average lies. Still, the fact that selling pressure rose at that level is a concern.

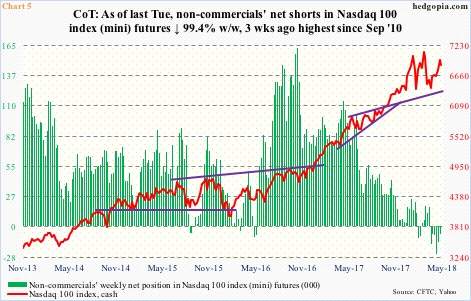

Amidst this, non-commercials are not getting very aggressive. In fact, three weeks ago they were net short nearly 25,000 contracts in Nasdaq 100 index (mini) futures – the most since September 2010. Last week, this dwindled to 38.

If history repeats itself and these traders start building net longs, the cash gets a tailwind. But will they?

At least near term, it increasingly looks like they are better off waiting.

One of the consistent knocks on the Nasdaq 100 of late is that the rally is led by the big guys, which is not all that surprising given the top five – AAPL (12.1 percent), AMZN (9.9 percent), MSFT (9.5 percent), GOOG/L (8.8 percent, both A and C class) and FB (5.5 percent) – constitute nearly 46 percent of QQQ.

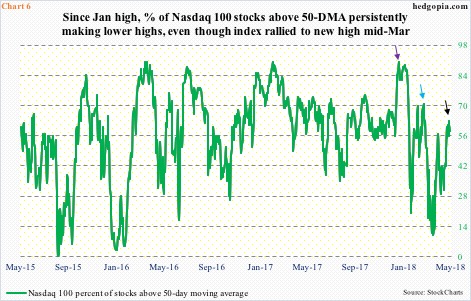

This year, participation persistently got thinner. Early January, the percent of Nasdaq 100 stocks above the 50-day was 90 percent (indigo arrow in Chart 6). Later in March when the index rallied to a fresh high, less than 71 percent were above that average (blue). Last Wednesday, the green line retreated from 63 percent (black) to end the week at 58 percent.

At least on the daily chart, there is room for this metric to continue lower.

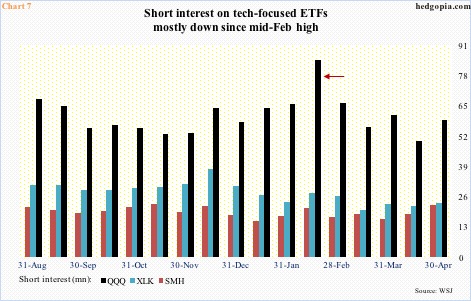

All this does not make for a conducive environment for short squeeze. Short interest is low – relatively speaking, that is.

Chart 7 plots short interest for QQQ, XLK (SPDR technology sector ETF) and SMH (VanEck Vectors semiconductor ETF) going back to last August. Their most recent peak occurred mid-February (arrow). All three ETFs bottomed on February 9. Then came the squeeze. From that high through end-April, short interest fell on both QQQ and XLK, while SMH’s is a little higher.

In the event that, let us say, QQQ manages to rally toward last week’s highs, shorts likely get active, with decent odds of success near term. Wait and watch for now.

Thanks for reading!