NIPA profits are now down three quarters in a row. The downward momentum likely continues in an environment in which the fed funds rate has gone up by 500 basis points over 14 months. This will force the sell-side to continue to lower their currently optimistic 2023/2024 operating earnings estimates for S&P 500 companies.

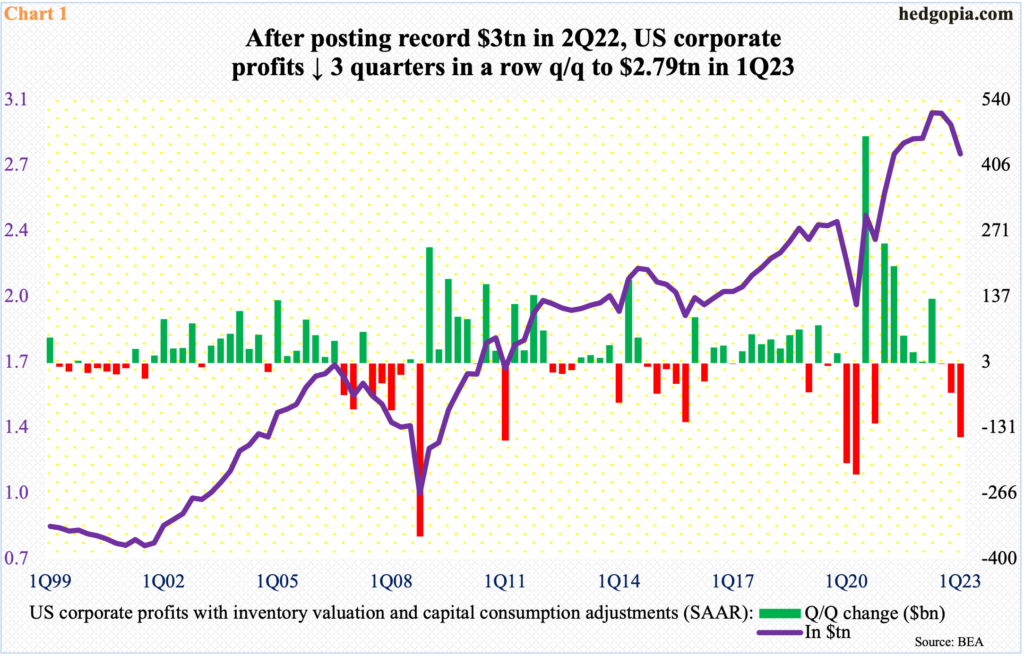

US corporate profits with inventory valuation and capital consumption adjustments contracted 5.1 percent – or by $151.1 billion – quarter-over-quarter in the first quarter this year to a seasonally adjusted annual rate of $2.79 trillion (Chart 1).

NIPA (national income and product accounts) is a comprehensive measure of the value and composition of national output and the incomes generated thereof.

Profits peaked in the second quarter last year at $3 trillion and has since fallen in each quarter. The last time NIPA profits declined in three quarters in a row was 2014/2015 when they were in the red for five consecutive quarters. Profits did drop in three quarters in 2020 but they were not in succession, with the third quarter producing hugely positive results.

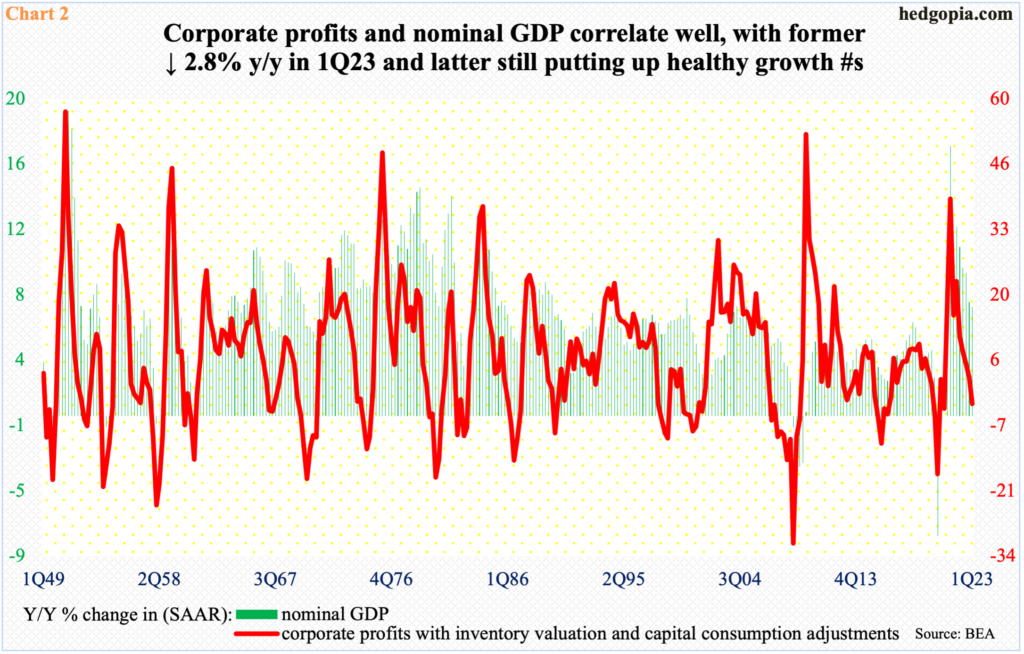

Not surprisingly, profits and nominal GDP move together directionally. From a year ago, they both peaked in 2Q21, with respective growth of 39.2 percent and 17.4 percent (Chart 2). The deceleration since has now resulted in a slight divergence.

In 1Q23, corporate profits shrank 2.8 percent year-over-year, while nominal GDP was still growing at a 7.1 percent clip; at $26.5 trillion (SAAR), in fact, the latter was at a new high last quarter, even as profits, as mentioned earlier, peaked in 2Q22.

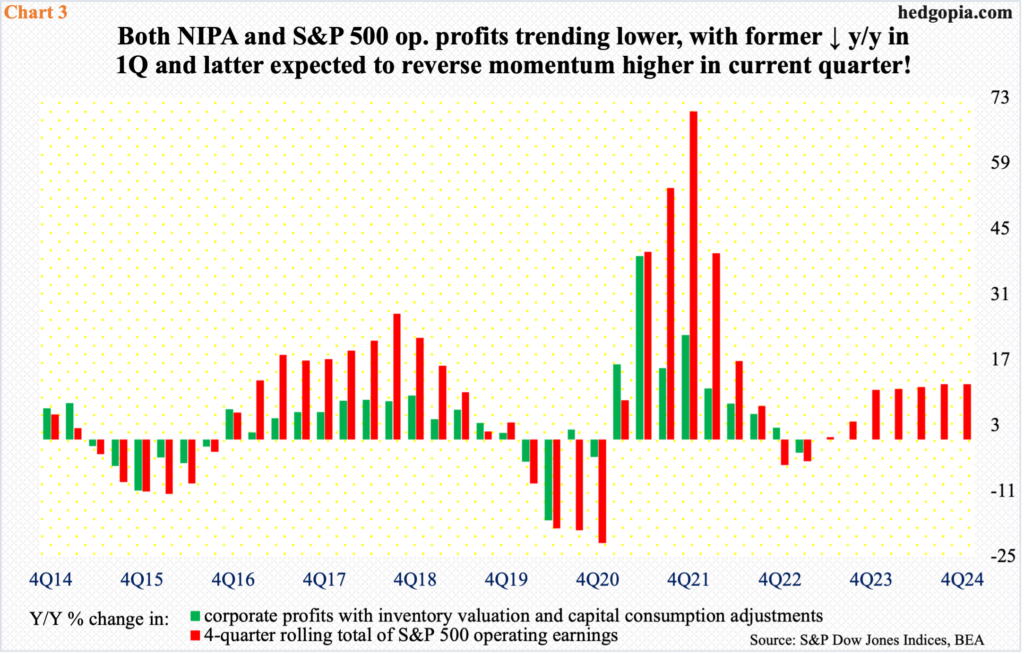

Not surprisingly, NIPA profits also tend to correlate well with the four-quarter rolling total of S&P 500 operating earnings. From a year ago, the latter is now down two quarters in a row, which is in line with NIPA profits, which were down in 1Q.

If past is prelude, the downward momentum in NIPA profits should last a while. In this scenario, nominal GDP, too, should continue to decelerate. But this is not how the sell-side thinks things are headed.

These analysts expect the current year-over-year downward momentum in earnings (12-month total) to end in the current quarter, with a rise in S&P 500 operating earnings of 0.5 percent and then pick up speed from there, rising in low-double-digits in 4Q23 through 4Q24 (Chart 3).

In fact, on a quarterly basis, with 95.1 percent of the earnings results out as of Tuesday, blended S&P 500 operating earnings are on track to grow in 1Q. This will have come after three straight quarterly declines – 2Q22-4Q22 – year-over-year. The sell-side expects the upcoming quarters to continue to build on last quarter’s momentum. This is probably very optimistic.

In 14 months through this month’s 25-basis-point hike, the fed funds rate went up 500 basis points to a range of 500 basis points to 525 basis points. The Federal Reserve may pause in the June meeting but given the elevated inflation and a solid job market the central bank may not be done raising the benchmark rates. Besides, because rates rose so quickly, it is difficult to imagine they have all been filtered through to the economy.

The Fed wants low inflation – much lower than where it is currently – and for that it would not mind hurting the job market, and by default the economy. In this scenario, both NIPA profits and nominal GDP should remain on the current downward momentum, and in this environment the sell-side will have no option than to revise their current pie-in-the-sky 2023/2024 estimates.

Thanks for reading!