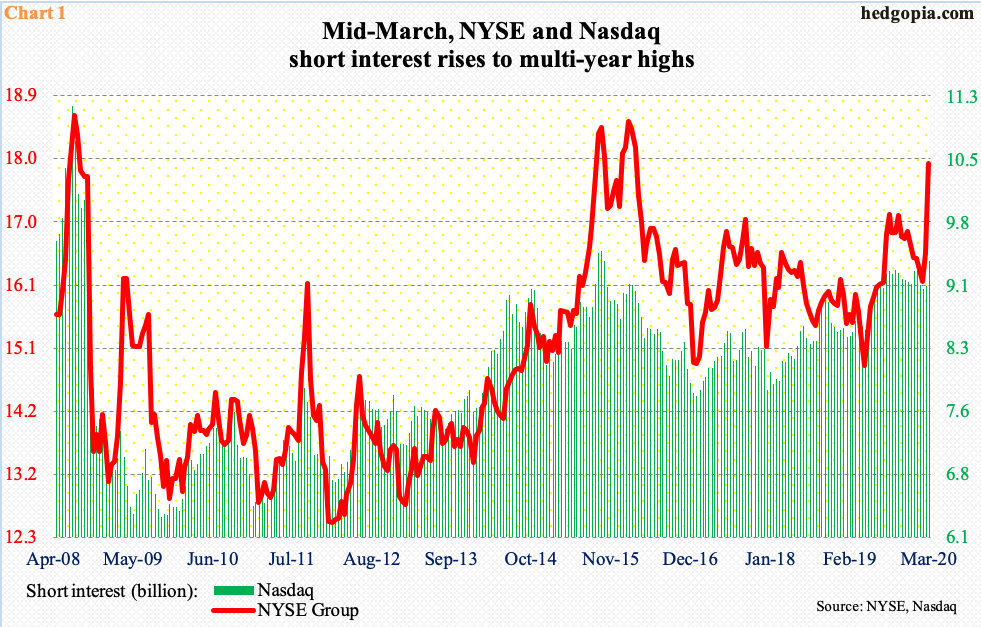

NYSE and Nasdaq short interest jumped mid-March, to multi-year highs. Bears could not have ridden the latest crash in stocks any better. At the same time, bulls this week defended crucial support on both the S&P 500 and Russell 2000, among others. This could potentially tempt shorts into locking in profit.

Having smelled blood, shorts got aggressive in the mid-March period. The S&P 500 large cap index, and several other major indices, peaked on February 19, but it was not until early this month stocks began to unravel.

By the middle of the month, NYSE and Nasdaq short interest stood at 17.9 billion and 9.3 billion shares, respectively up 8.1 percent and 3.3 percent period-over-period. This was a four-year high on the NYSE and the highest since October 2015 on the Nasdaq (Chart 1).

Shorts were spot on as stocks continued to unravel. This month alone, through Monday’s intraday low of 2191.86, the S&P 500 crashed just under 26 percent. Tuesday’s 9.4-percent surge reduced this to a decline of 17.2 percent, but as far as shorts are concerned these are massive gains for a month’s work. The question is, will they be tempted – or forced – to lock in these gains?

This is an opportunity for bulls if they can execute. It is possible some level of short-covering took place on Tuesday. It is equally possible shorts continued to add as downward momentum accelerated in the second half. If so, there is a bigger pool of fuel for potential short squeeze.

The advantage bulls currently have is that they have managed to put their foot down at/near crucial support on both large- and small-caps.

On the S&P 500 (2447.33), Monday’s low marked a collapse of 35.4 percent in merely 24 trading sessions intraday. That low combined with Tuesday’s jump has formed a potentially bullish hammer on the weekly (Chart 2). The low was formed right above crucial support just north of 2100. In the overnight futures market, in fact, Monday’s low was lower than in the cash market.

On the Russell 2000, support of similar significance was in play. A major bottom was formed in February 2016 at 943.10 intraday (arrow in Chart 3). Both Wednesday and Thursday last week, the index dropped to 960s intraday before bids started showing up. This occurred again on Monday. By then, the Russell 2000 crashed 43 percent from February 20th high.

Needless to say, on both these indices, and several others, there is plenty of room to rally on the daily as well as weekly. The rally can feed on itself should shorts concurrently decide to lock in profit. As long as last week’s lows are not breached, bulls deserve the benefit of the doubt.

Thanks for reading!