Major US equity indices continue their two-and-a-half-month momentum. Short squeeze helped. As did the Fed backstop. On an FOMC day, Chair Powell’s body language is worth a listen. For equity bulls, there is this thing called the law of gravity.

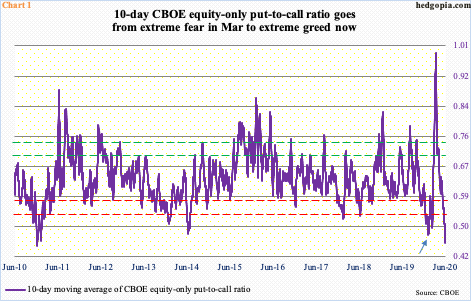

On Tuesday, the CBOE equity-only put-to-call ratio hit 0.397. This was preceded by two more 0.30s readings in the prior four sessions – 0.374 on Monday and 0.398 on Wednesday last week. How rare is this? Before this latest jump, the prior 0.30s reading took place six years ago – 0.383 on June 18, 2014, to be precise.

The 10-day moving average as a result dropped to 0.457 on Tuesday. This is lower than the readings in January-February this year (arrow in Chart 1) and the lowest since December 2010. Greed is pervasive. Just before major US equity indices bottomed on March 23rd, this metric signaled extreme fear. Now, it is the opposite.

To be fair, as extreme as these readings are, it has been right to bet on the long side. Since the aforementioned bottom through Monday’s high, the S&P 500 large cap index surged 47.5 percent. That is in two and a half months! At Monday’s high, it was merely five percent from its prior high of February 19th. In fact, the Nasdaq 100, as well as the composite, just posted new highs.

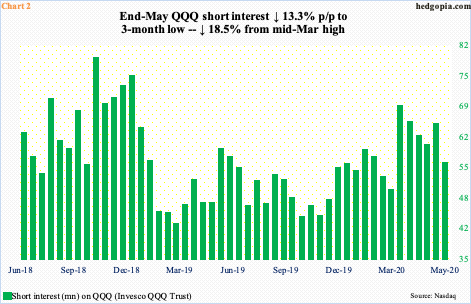

Shorts are getting killed. At the end of May, NYSE short interest dropped 2.7 percent period-over-period to one-year low. On the Nasdaq, it declined 1.1 percent p/p to one-month low; it is, however, down 4.1 percent from mid-March. On QQQ (Invesco QQQ Trust), also from mid-March, short interest is down 13.3 percent (Chart 2). Shorts got aggressive as QQQ/Nasdaq 100 came apart in March. After the March 23rd bottom, it was shorts’ turn to turn tail.

Fundamentally, bears’ pessimistic thesis was spot-on as the US economy quickly unraveled. The NBER (National Bureau of Economic Research) declared Monday that the longest expansion in US history (120 months) came to an end in February. Recession has begun. But before shorts could profit from it in a big way, the Fed came in the way.

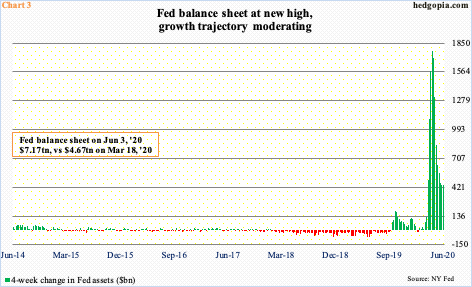

To deal with the Covid-19 crisis, the White House and Congress already passed $3 trillion in fiscal stimulus. More likely is on the way. But it is a whole new game at the Fed, which on March 23rd announced an open-ended QE (quantitative easing). To recall, that was the day US stocks bottomed. Subsequently, the bank said it would begin to buy corporate bonds, including junk. Previously, it only purchased Treasury and mortgage-backed securities.

As of last Wednesday, its assets were up $2.9 trillion from early March, to $7.2 trillion. Markets have recovered. The question on the back of investors is whether or not the Fed feels necessary to continue to expand its balance sheet. The pace of growth has indeed slowed down (Chart 3), but overall holdings continue to rise.

Later today, the FOMC concludes its two-day meeting, and Chair Powell’s comments in the post-meeting press conference will be closely scrutinized. It is possible May’s jobs report in which the economy added 2.5 million non-farm jobs – against expectations of a loss of 7.5 million – has backed the Fed into a corner. We will find out.

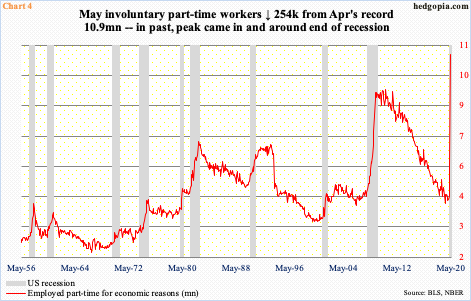

Covid-19 was one of those black swan events that was sudden and came out of nowhere. The decline in economic activity was brisk. In April, the ‘employed part-time for economic reasons’ category soared to 10.9 million. These are involuntary part-time workers. In May, their count decreased 254,000 from the prior month.

Here is the thing. In the past, a peak in this metric was recorded in and around the time recession ended (Chart 4). If indeed the economy is setting up for a V-shaped recovery – not a base case on this blog – then bulls perhaps need to rethink their bias. They already have several frothy metrics (Chart 1, for example) to worry about. A V will not only give Republicans an excuse not to help pass another stimulus bill but also could put the Fed under pressure to rethink their continued balance-sheet expansion. Powell’s body language later today could be a tell in this regard.

Risk is rising for equity bulls, who continue to hold the momentum card but are at risk of losing it to the bears.

Thanks for reading!