Volatility has picked up in US stocks. This is a perfect environment for traders who are nimble enough and ready to take ones and twos, quickly locking in what markets give them.

It is increasingly becoming clear why stocks began selling off last October, and why selling accelerated in December. From an unexpected drop in South Korean exports to weaker-than-expected Chinese and US manufacturing, it seems the global economy meaningfully downshifted in December.

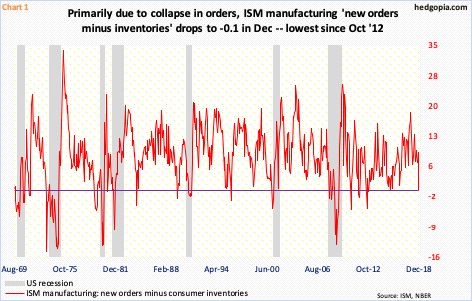

In the US, the ISM manufacturing index fell 5.2 points month-over-month in December to 54.1, which was the lowest since November 2016. The m/m drop was the widest since October 2008. A collapse in new orders was the main culprit. Orders declined 11 points m/m to 51.1. Backlog of orders fell as well, down 6.4 points m/m to 50. The only saving grace was customers’ inventories, which edged up two-tenths of a point m/m to 41.7. That said, manufacturers’ inventories were still north of 50, down 1.7 points m/m in December to 51.2. As a result, the orders-inventories spread went negative last month, although by a touch (Chart 1).

Macro-wise, things look very fluid.

Thursday, stocks were already under pressure owing to Apple (AAPL)’s December-quarter warning. The ISM data did not help. SPY (SPDR S&P 500 ETF) dropped 2.4 percent in that session. After bottoming at $233.76 on December 26, the ETF ($244.21) rose as high as $251.40 Friday last week. That level was tested again on Wednesday – unsuccessfully. It remains oversold particularly on the weekly. Several other metrics are panicky. In the very near term, several daily momentum indicators have reached the median and could very well turn back down. Things are so volatile it does not take long before profits turn into losses, and vice versa. In times like these, it is prudent to lock in what markets give you.

On December 24, a hypothetical SPY trade involving a January 25th 238 short put, 241 long call and 260 short call was initiated. At the time, they respectively sold at $6.45, $7.54 and $0.95, costing $0.14 overall. Two weeks in, they are now selling at $3.43, $7.79 and $0.43, in that order. A closure nets $3.79.

Thanks for reading!