The following are futures positions of non-commercials as of April 14, 2015. Change is week-over-week.

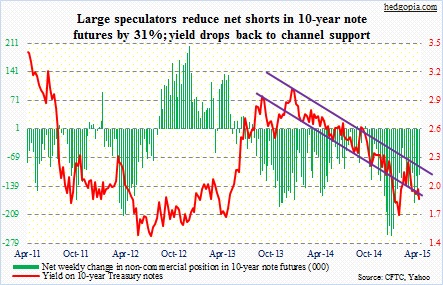

10-year note: The 10-year yield fell in all five sessions. Friday could have been different as March core CPI was initially treated as hawkish, but buying pressure for the notes proved way too strong. Earlier in the week, both retail sales and housing starts (March) came in softer than expected. Weaker-than-expected macro data points have become a theme the past several months.

When it was all said and done, yields were down 10 basis points for the week. With that, once again the bottom end of that downtrend channel is in play.

The U.S. is not an exception. Barring countries like Greece, where bonds sold off hard, yields continued to come under pressure. In the middle of the week, Germany sold 10-year bonds at a record low yield of 0.13 percent. By Friday, these bunds were yielding under five basis points. Already in the money!

It must be a very difficult time to be managing pension funds, insurance funds, etc. In Germany, if you want positive yield, be prepared to lock your money for 10 years; the yield curve is negative out to nine years. How long before the 10-year goes red? Mid-week, Mario Draghi, ECB president, promised QE would continue through September 2016, which means bonds yielding above the ECB’s deposit rate will be in demand.

At least this week, these traders decided not to fight this trend. They cut back net shorts by 31 percent.

Currently net short 111.9k, down 50.5k.

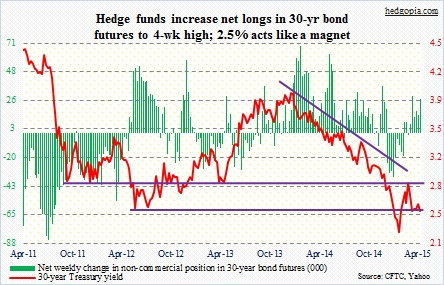

30-year bond: Among S&P 500 companies in 2014, the 50 largest defined-benefit pension plans held 41 percent of assets in bonds, versus 37 percent in stocks (courtesy of Goldman Sachs). This is the first time since 2002 that bonds have been given a larger weight than stocks. By nature, such funds do not trade in and out. They are buy-and-hold types. This should bode well for high-quality corporate bonds.

Is it any wonder then that 30-year Treasury yields fell to their lowest ever in February?

For the week, they fell eight basis points. Friday could have been different, but the 50-day moving average repelled the early surge.

Next week, existing home sales is Wednesday, new home sales Thursday. In February, the latter was strong, the former not so much. One thing impacting sales is the rapid rise in home prices. New home prices in particular were $302.7k last November – an all-time high. They have dropped since, to $275.5k in February, but remain high. Durable goods orders come out on Friday. This is an advance report for March. The trend has not been encouraging. Orders have dropped from $299.9 billion last July to $230.9 billion in February. Non-defense capital goods ex-aircraft (proxy for business capital expenditures) peaked in June at $73.1 billion and were $69.3 billion in February. There is no underlying momentum. Businesses are not in a mood to accelerate spending. Plain and simple. Who can blame them?

Currently net long 26.4k, up 12.6k.

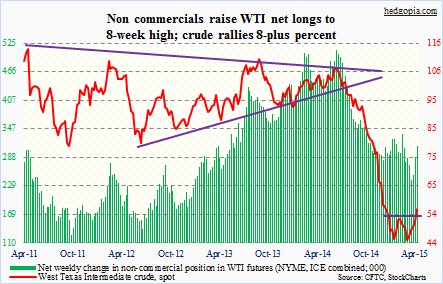

Crude oil: These are rare but do happen once in a while. Raymond James made a rare admission, saying no one (including them) has a really good handle on energy industry earnings estimates over the next few years. Such has been the impact of the collapse in crude oil.

Yet forecast we must.

The Energy Department predicted that oil production from shale fields would fall this month by 45k barrels a day – the first monthly decline since 2011. Along the same lines, the EIA said shale output will decline 57k barrels a day in May. This, by the way, is earlier than expected by shale producers such as COP and EOG (largest U.S. shale producer), who have said output would begin declining before year-end. Should this transpire, production will decline even as refineries start processing more oil. This is the yang.

Here is the yin. Wood MacKenzie estimates that the backlog of drilled wells has grown to more than 3k. These are uncompleted wells that can be quickly put into service as soon as prices recover, hence can act as a ceiling on crude rally.

Right at this moment, we have a breakout. Spot WTI this week pushed through 53-54, out of a three-month base. If the breakout holds, we have a double bottom at hand. For several weeks now, the WTI has consistently tried to latch on to the positives and overlook the negatives. The dollar has helped as well.

Technicals are extended short-term (fifth consecutive up week), but have room to run medium-term. Here are some Fib retracement levels to keep in mind (of June 2014-March 2015 decline): .236 retracement = 57.81; .382 = 67.34; and .618 = 82.75. These are levels where selling pressure can intensify. Thursday’s high was near .236 retracement. From that high, crude is down 2.4 percent. If it is a genuine breakout, that broken resistance should provide support.

These traders are optimistic. Net longs are at an eight-week high.

Currently net long 310.8k, up 23k.

E-mini S&P 500: Domestic equity ETFs have seen $15.6 billion in total outflows this year, even as internationally oriented funds have received $51 billion (courtesy of Ned Davis Research). That pretty much sums up what is going on out there.

Stocks are in desperate need of new funds to continue to push higher. Last year, S&P 500 companies bought back $565 billion in shares (courtesy of FactSet). Repurchase authorizations were $257 billion in 1Q (courtesy of Birinyi Associates). However, this potent source is not participating right now. It likely will, come May, when the buyback window reopens.

Until that happens, there is no firepower. Thursday saw a spinning top/doji on the S&P 500, suggesting things are stalling. Friday was ugly, with the S&P 500 having lost its 50DMA. Transports have lagged this rally for a while, having peaked last November. The Dow transportation index is near the bottom of the channel it is in; hopefully, it finds support. Or, maybe not.

The line in the sand on the S&P 500 is near 2070, which is the bottom of the wedge it is in. On Friday, it did attract buyers, but risks are rising. Daily momentum indicators seem to want to go lower.

Non-commercials were right, having added to net shorts last week. The S&P 500 lost one percent for the week. This week, they are at it again, adding, but just a tad.

Currently net short 50.6k, up 2.2k.

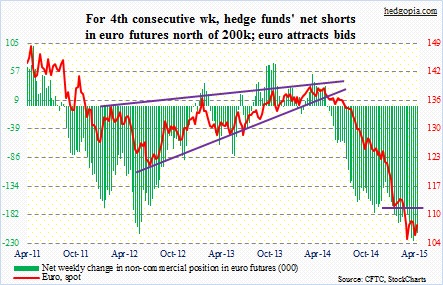

Euro: Since the March 13th intra-day low, the euro has carved out higher lows, and is showing encouraging action. Last week’s rally attempt was cut short by its 50DMA (currently just under 110), which is dropping. So another test of that average will be at a lower level, and seems imminent.

At the same time, it is hard to imagine the currency blowing past that resistance. On tap is a Eurogroup meeting next week, and one can come up with a whole host of scenarios, both in favor of and against the currency. In the end, it could just end up treading water – perhaps a good time to generate some income in options (similar to the SMH trade early this month).

These traders remain steadfast in their bearish stance.

Currently net short 212.3k, down 3k.

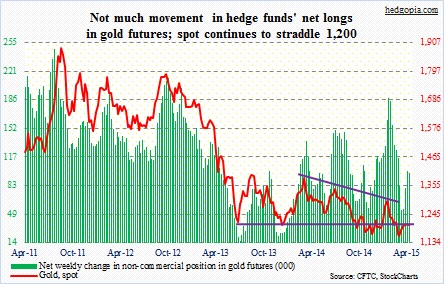

Gold: The metal fell for the week – not able to cash in on a weaker dollar. For the month, however, after a lousy February and March, April so far is up. The constant barrage of weaker-than-expected U.S. data points probably helped. On the other hand, Friday was a risk-off session as far as equities were concerned, and one would not get that feeling looking at how gold traded (up only 0.5 percent).

For four consecutive weeks, gold has hugged the 1,200 line, give and take. The good thing is, the 1,180 level once again drew buyers in this week. But momentum could be slipping. The weekly RSI is turning lower from the middle of the range.

Currently net long 98.4k, down 2.4k.

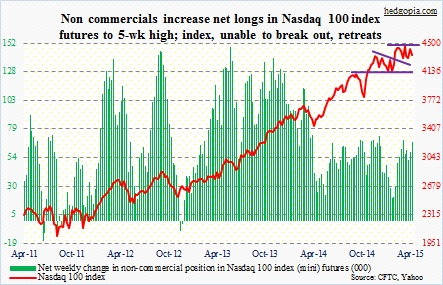

Nasdaq 100 index (mini): Oh, boy! With a pattern of lower highs the past month and a half, the index has once again lost its 50DMA, and is fast approaching a must-hold 4280-4300. On QQQ, this approximates 104. The QQQ to SPY ratio has been trending lower since early March. AAPL, which stayed close to but was not able to rally off of its 50DMA for 15 consecutive sessions, finally lost that average on Friday. It reports Monday (27th), and better deliver.

On the Nasdaq, one can even argue a head-and-shoulder pattern forming on a daily chart. The neckline lies at 4800-plus, a break of which could set up a test of its 200DMA, at 4653.

These traders are not anticipating this scenario at all. They increased their net longs to a five-week high.

Currently net long 68.1k, up 8.8k.

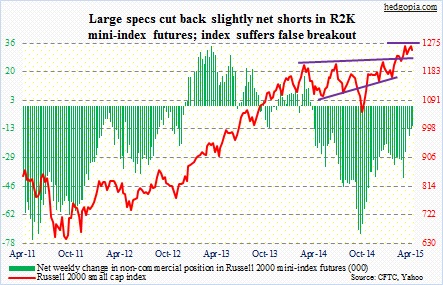

Russell 2000 mini-index: Small-caps did break out on Wednesday (the chart does not show it as it uses weekly close), but bulls could not hang on to it. Small-caps have led large-caps since late February, but have lagged in April. On Thursday, the Russell 2000 (as well as IWM) produced a doji inside day, which can be a sign of exhaustion and that a trend is likely to reverse. Friday’s action now gives us a false breakout. There is plenty of room for these stocks to continue to come under pressure. Weekly overbought conditions in particular have a long ways to go before they get unwound. The 50-day moving average is just over a percent away.

Currently net short 11.2k, down 1.8k.

U.S. Dollar Index: The dollar has been in a downward trend since the middle of March, with a shooting star on the 13th, which preceded the weakness in the subsequent three sessions. It is currently approaching its 50DMA, which provided support on the 6th. Dollar bulls obviously are hoping for a repeat. Most large U.S. companies would like a different outcome. From GE to HON to AXP to SLB to AMD, they all missed on the top line. The greenback got its share of blame. JNJ cut guidance citing FX headwinds. But it also cuts both ways. DAL CEO says the dollar does not hurt him.

Bulls really need to save 50DMA, and the horizontal support right underneath. On a weekly chart, there is risk of a bearish MACD crossover; it is not complete yet.

Currently net long 76.4k, up 3.6k.

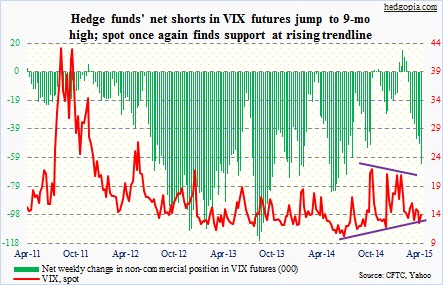

VIX: These traders are really going for it. They have continued to add to net shorts – now at a nine-month high. Equity bears once again stepped up to defend the July 2014 trendline on spot VIX. The Friday session in particular was interesting. The spot at one point was up north of 2.4 points, but got slammed hard the final two hours – from as high as 15.02 to 13.89 at close. It got rejected at its downward sloping 50DMA. Is it a sign of things to come next week or was it options expiration-related? These traders are betting it is the former.

Currently net short 63.4k, up 14.2k.

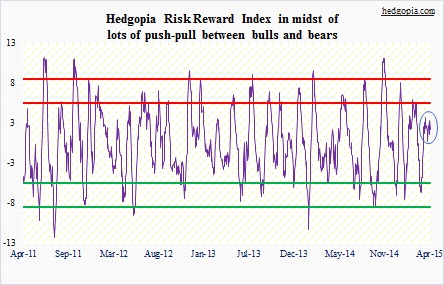

Hedgopia Risk Reward Index