Pfizer’s positive vaccine news on Monday last week elicited favorable investor response. Moderna’s positive news this Monday generated a lukewarm response. Fatigue is setting in. Major US equity indices are in overbought territory, particularly daily, with several sentiment readings already elevated. The risk is to the downside.

Last week, primarily on the back of a positive Covid-19 vaccine news from Pfizer (PFE), the S&P 500 rallied 2.2 percent. The Pfizer news was published on Monday. Investor sentiment popped.

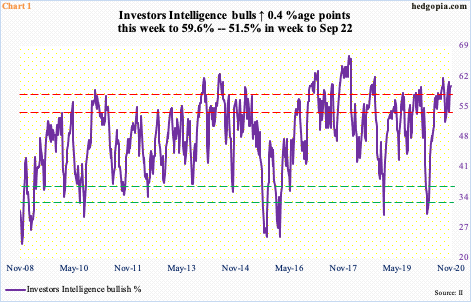

In the week to Tuesday last week, Investors Intelligence bulls rose 5.6 percentage points to 59.2 percent. There was a similar increase in American Association of Individual Investors (AAII) and NAAIM (National Association of Active Investment Managers) readings.

Unlike the Investors Intelligence survey that surveys independent newsletter writers, the NAAIM Exposure Index represents members’ average exposure to US stocks. The AAII survey is geared more toward retail investors.

In the week to Wednesday last week, the NAAIM Exposure Index shot up 27.1 points week-over-week to 96.3, which is the highest since 102.9 four weeks ago. Historically, it has been hard to sustain readings above 100.

Along the same lines, in the week to last Thursday, AAII bulls jumped the most since mid-July 2010. Back then, their count rose 18.4 percentage points to 39.4 percent. This time around, it rose 17.9 percentage points to 55.8 percent. This is elevated territory. Last week’s reading is the highest since early January 2018; from January’s high to February’s low back then the S&P 500 quickly tumbled 11.8 percent.

This Monday, it was Moderna’s (MRNA) turn to deliver a positive news, and stocks again opened strong, as the S&P 500 rallied 1.2 percent. Be that as it may, this was unable to lift Investors Intelligence bulls much. Their count only edged up four-tenths of a percentage point to 59.6 percent (Chart 1), while bears dropped 1.2 percentage points to 18.2 percent.

This week’s AAII and NAAIM are not out yet (NAAIM’s is not published yet, AAII’s comes out later today). Inability for sentiment to meaningfully firm up on Moderna’s news will be a tell. This could very well be the case considering all these measures are already elevated, which, in turn, suggests a lack of buying power.

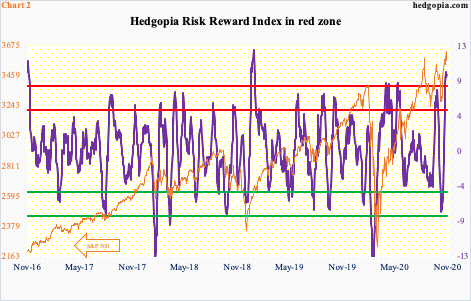

Our own Hedgopia Risk Reward Index, which is designed to capture short-term swings, just entered the red zone (Chart 2).

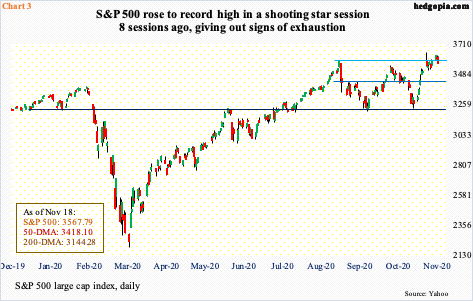

In the meantime, the S&P 500 has been pushed further into overbought territory. Already, there have signs of exhaustion. The day the Pfizer news came out, the large cap index rallied to a new intraday high of 3645.99 but only to close at 3550.50. As a result, the session produced a shooting star, with a weekly long-legged doji last week. This week, reacting to the Moderna news, it rallied strongly on Monday, but in the very next session a doji showed up, followed by Wednesday’s 1.2-percent decline.

Wednesday, the index (3567.79) closed just above the 10-day (3561.50). Bulls will do their best to save this, but a breach looks imminent in the sessions ahead. Should a rally ensue off of the average, bears are likely to get active at 3580s (Chart 2).

In the event of downward pressure, nearest support lies at 3420s, which approximates the 50-day at 3418.10.

Thanks for reading!