The treasury yield curve, crude and copper are seriously worried about prospects for the economy. Not the sell-side, which continues to expect a banner year – both 2023 and 2024 – for S&P 500 operating earnings. Odds heavily favor their estimates face serious downward revision ahead.

This week, in the wake of the Silicon Valley Bank collapse, interest rates – and their outlook – across the board got turned on their heads.

Most noticeably, the two-year treasury yield, which tends to be the most sensitive to the Federal Reserve’s monetary policy, collapsed from 5.05 percent on the 8th to Wednesday’s close of 3.93 percent. On the long end of the yield curve, the 10-year yield went from 4.02 percent on the 9th to Wednesday’s intraday low of 3.39 percent, closing at 3.49 percent.

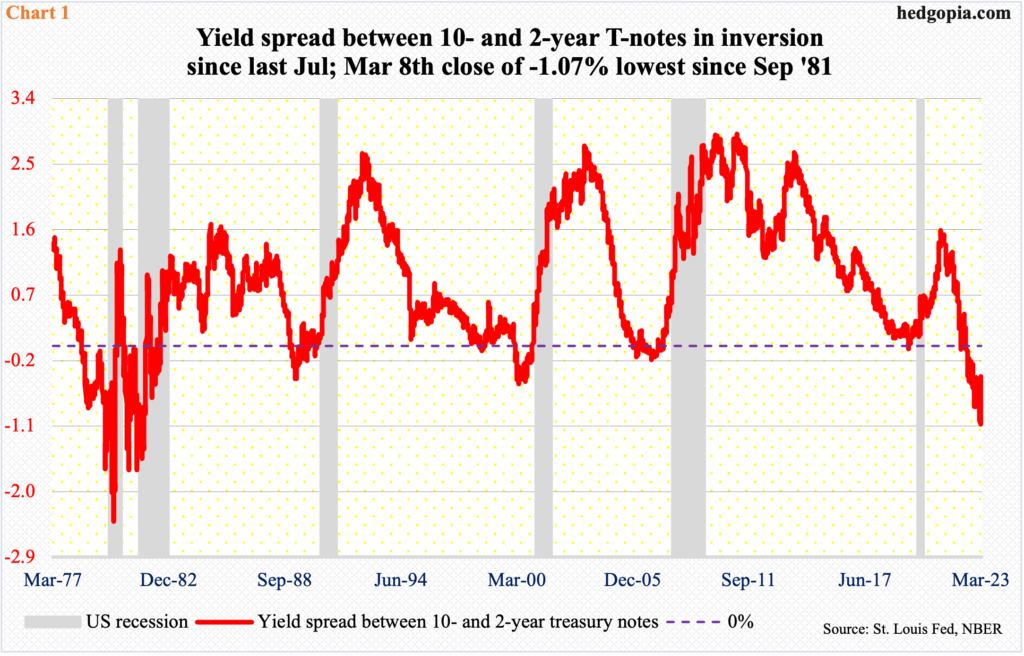

On the 8th, the yield spread between the 10- and two-year T-notes was minus 107 basis points, which by Wednesday was more than cut in half to 42 basis points. The March 8th spread was the widest inversion since September 1981 (Chart 1). The yield curve, which has inverted since last July, is shouting at the top of its lungs that the US economy is headed for contraction.

Crude and copper increasingly are beginning to agree.

Dr. Copper peaked last March at $5.04/pound, with the most recent peak occurring this January at $4.36. On Wednesday, the metal sliced through horizontal support at $3.90s. This level has seen several bull-bear duels going back nearly 17 years. Wednesday’s trade has swung the odds in bears’ favor, closing the session at $3.84.

Similarly, the West Texas Intermediate crude peaked last March at $130.50/barrel, making a lower peak of $123.68 in June and then $93.74 in November. This was followed by a rangebound action for nearly four months between $72-$73 and $81-$82. This week, it broke down. Last Friday, the crude closed at $76.68, followed by Monday’s close of $74.80, Tuesday’s $71.33 and Wednesday’s $67.61. The black gold is beginning to worry about global demand.

And then there is the sell-side and their earnings estimates for this year and next. They continue to paint a rosy picture.

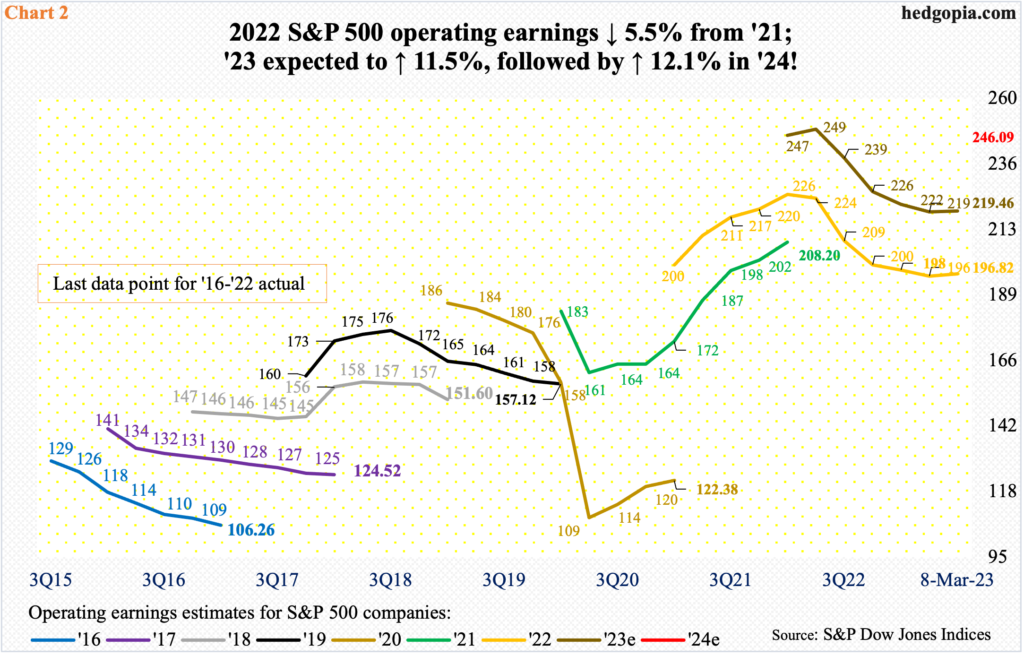

As of Wednesday last week, S&P 500 companies were expected to earn $196.82 in operations in 2022, down from $208.20 in 2021 (Chart 2). For whatever it is worth, these analysts expected 2022 earnings to come in at $227.51 last April, before suffering a sharp downward revision as the year progressed. Estimates for 2023 and 2024 in all probability will meet the same fate.

Currently, 2023 is expected to grow 11.5 percent to $219.46, followed by another 12.1-percent increase next year to $246.09! This is not going to happen if the message from the yield curve, crude and copper proves correct – it probably will.

The sell-side is notorious for starting out optimistic and then bring out the knife as the year progresses. In fact, 2023 has already been revised lower, with a peak of $250.12 last April. More downward revisions lie ahead for both this year and next.

Thanks for reading!