- Bulls have consistently climbed wall of worry, that is, elevated short interest

- Past 3 months, Naz/NYSE short interest sideways, shorts giving up?

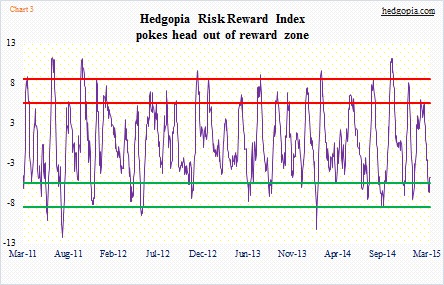

- Hedgopia Risk Reward Index pokes head out of reward zone

Post-FOMC, Wednesday sure felt like a session in which shorts likely got bulldozed over. Earlier in the session that day, the S&P 500 large cap index did attract tentative bids near its 50-day moving average. But what was a trickle turned into a tsunami after 2 o’clock. The index had already taken out 2064 on Monday. This followed by Wednesday’s action probably gave enough reason for shorts to take cover.

A persistently high short interest has persistently worked to bulls’ advantage. To be fair to bears, there are simply too many issues globally for them not to get worked up and go short. But in a weird manner this very factor has also been working against them.

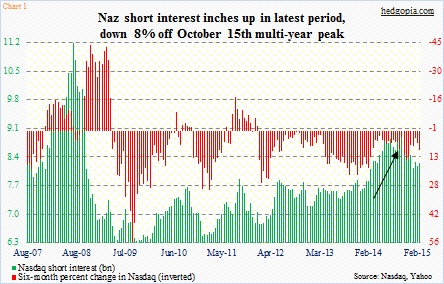

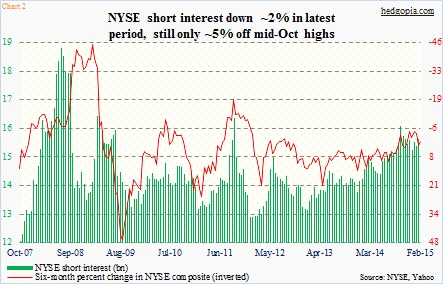

Between the end of 2013 and the mid-October (2014) high, short interest rose 19 percent on the Nasdaq (Chart 1) and 18 percent on the NYSE (Chart 2). Coming into 2014, the Naz was already up 38 percent in 2013. Then until the mid-September (2014) high, it tacked on another 11 percent. Despite this 50 percent rally, the bears had to make do on two 10-percent sell-offs in 2014, and both were bought hand over fist. The buildup in short interest leading up to these sell-offs was too steep (black arrow on Chart 1). The Fed put was still alive and well. The result was a squeeze. Since that mid-October high, short interest has decreased eight percent on the Naz.

Nonetheless on both indices, short interest remains elevated.

Rather interestingly, the past three months it has essentially gone sideways on both indices. This at a time when both indices have rallied – eight percent and six percent, respectively. And stocks are near their highs.

Not sure what this means. Shorts think markets are headed higher for now, and they are waiting for better opportunities to go short/add to positions? Or they are simply too tired of fighting the trend, and the Fed?

Longer-term from bulls’ perspective, the latter scenario in particular is not so good. Elevated short interest has consistently given them a proverbial wall of worry to climb, and force a squeeze in the process.

Another in the cards, maybe? If market reaction on Wednesday is a risk-on sign of things to come, then there is plenty of room for those green bars on the right of the charts above to get shorter.

There is fuel in the tank.

The Hedgopia Risk Reward Index just poked its head out of the reward zone, and has a ways to go before it gets to the risk zone. If the momentum continues, that is. Bulls have the ball, and it is their loss if they fumble.