XLF shorts who are slightly underwater can use options to repair the damage.

Hypothetically last Thursday, XLF ($28.06) was shorted intraday at $27.96 ($27.84 adjusted for dividends).

The ETF remains overbought on nearly all timeframe. It has rallied nearly 23 percent year-to-date.

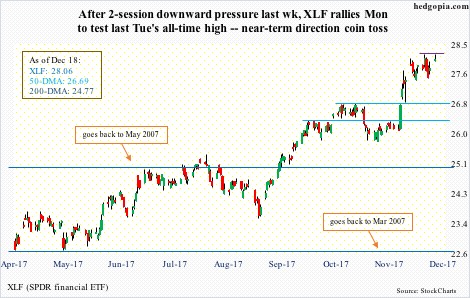

After breaking out of decade-old resistance at $25 this September, it enjoyed another mini break out of $26.80 on November 29 (chart above). Just in the past three months, it rallied 19 percent, following two-year Treasury yields higher, but not the yield curve. The former has been rising, and the latter shrinking.

The Fed last Wednesday raised the fed funds rate by 25 basis points – its fifth hike since December 2015 and third this year – to a range of 1.25 percent to 1.5 percent. Markets do not expect a hike in the January (30-31) meeting, while the odds in the futures market for a 25-basis-point hike in the March (20-21) meeting currently stand at 56 percent – decent, but not a slam dunk.

As December began, XLF began to digest its recent gains by going sideways, with some signs of fatigue. On the weekly chart, last two weeks produced spinning top candles.

After peaking at $28.19 last Tuesday, it dropped both Wednesday – when the interest rate decision was announced – and Thursday. But the downward pressure proved fleeting, bottoming at $27.53 on Thursday. The subsequent rally had it yesterday test last week’s high.

As overbought as it is, at this moment in time XLF can go either way. Seasonality remains favorable and in three weeks financials will start reporting their 4Q.

In this situation, a short put can come in handy – a covered put write in this case.

The weekly 28 puts are selling for $0.16. If the underlying comes under pressure in the remaining sessions and closes the week under $28, the short position gets covered for breakeven. The $0.16 loss in the short position is offset by the $0.16 premium.

If instead XLF stays above $28, it ensures remaining short but at a higher price of $20. In this scenario, the risk to the upside remains.

Thanks for reading!