Turns out short interest was indeed a tailwind for stocks in the two weeks ended October 15th.

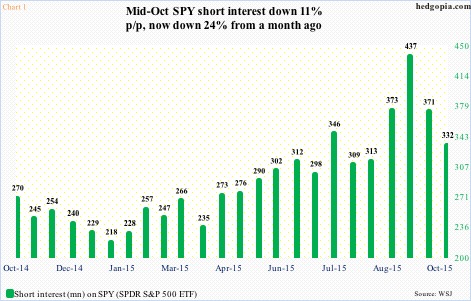

On SPY, the SPDR S&P 500 ETF, short interest declined 10.6 percent, to 332.1 million (Chart 1). The ETF rallied 5.6 percent during the period. It is possible more shorts gave up, as by last Friday SPY rallied another 2.8 percent. Stops probably got taken out as the ETF not only took care of resistance at $204 but also its 200-day moving average.

Go back one more period, to mid-September, SPY is up 2.5 percent. In the meantime, short interest fell 24 percent during the period. It almost feels like equity bulls were not able to fully take advantage of the drop in short interest.

The only way to explain this is if longs took advantage of the rally and exited even as shorts were getting squeezed. Equity flows indeed point to that direction.

Stocks – most of them, anyway – bottomed on August 24th. Since the week ended September 9th, on a cumulative basis $7.6 billion has left U.S.-based equity funds (courtesy of Lipper).

This behavior is also evident elsewhere.

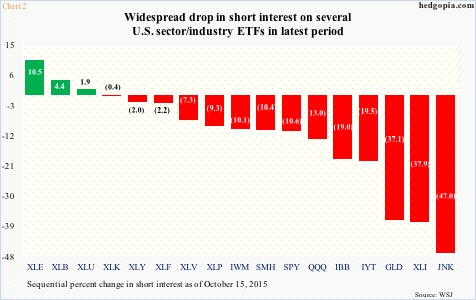

Between the October 2nd intra-day low of $35.10 and high of $36.28 on October 15th, JNK, the SPDR High Yield Bond ETF, rallied 3.4 percent. On the surface, it might look like traders were gravitating toward risk-on. Probably not. Short interest collapsed 47 percent, to 18.2 million – a six-month low.

Chart 2 highlights period-over-period decline in short interest on several ETFs across sectors and industries. The only ones to see decent increase in short interest even as they rallied are XLE, the SPDR Energy ETF, and XLB, the SPDR Materials ETF. On the former in particular, shorts were spot-on as the ETF is coming under renewed pressure. They have not shown the same level of conviction — willing to add to shorts even as the underlying rallies – as relates to other sectors or industries.

In fact, as stated previously, stocks in general have continued to rally since October 15th, so it is possible shorts got squeezed even more. QQQ, the PowerShares Nasdaq 100 ETF, for example, rallied another five percent in the past eight sessions, nearing an all-time high. Short interest has substantially come down – from 71.7 million in the middle of September to 46.5 million one month later, but was 42.4 million as early as two months ago, and even lower if we go back further. The point being there is room for it to come down more.

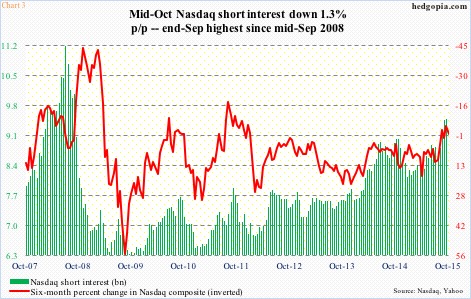

On an index level, short interest continues to remain elevated. In the latest period, it fell 1.3 percent on the Nasdaq Composite, but the prior period was the highest since the middle of September, 2008 (Chart 3). The green bars are nowhere near as tall as they were in 2008, but remain near cycle highs. As and when the bars shrink, the red line, which is shown inverted in the chart, rallies.

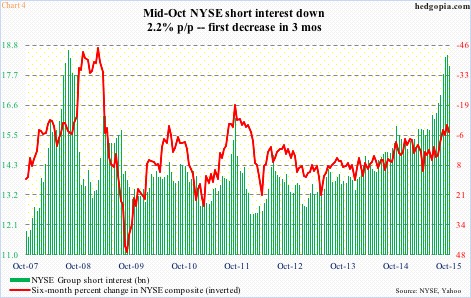

It is the same relationship in Chart 4, which shows short interest on the NYSE Group. In the latest period, short interest fell 2.2 percent – nothing material considering the buildup that has gone on for the last several months. At the end of September, short interest was the highest since the end of August, 2008 (Chart 4) – a potential recipe for squeeze.

This is what the bulls are hoping for. But are the ingredients in place for this to occur?

Fundamentally, as things stand, there is not much to get excited about. Operating earnings of S&P 500 companies are expected to drop 2.7 percent this year, to $109.95. The economy continues to act tentative, with even the erstwhile-hot job market showing some cracks of late, and businesses continuing to shy away from capital expenditures.

Technically, major U.S. indices have repaired a lot of the damage inflicted during the August sell-off, thanks in particular to last week’s dovish talk/action by the ECB and PBoC. But this is transitory. When it is all said and done, buyers need to be willing to put new money to work. That is what is lacking. Corporate buybacks may soon pick up, but equity flows and margin debt are not cooperating. Mid- and small-caps are severely lagging large-caps.

Hardly a recipe for continuation of short squeeze. Particularly considering signs that longs may be using the rally as an opportunity to exit/lighten up.

Thanks for reading!