Small-caps continue to act tentative. It is a group of stocks with the most exposure to the domestic economy, and their performance runs counter to the nearly-consensus view that the economy will do just fine next year. Oddly enough, small-cap performance is in line with futures traders that expect the Federal Reserve to begin to ease as early as next June.

Small-caps cannot get it going. The Russell 2000 has been stuck in a 200-point range between 1900 and 1700 since January last year. The small cap index peaked in November 2021 at 2459 before tumbling 33.2 percent through June 2022 when it tagged 1641. That low was successfully tested a few months later in October when the index touched 1642.

After the June 2022 low, the Russell 2000 rallied past 1900 several times – in August last year, January this year and again in May – but only to soon drop back into the range with progressively lower highs. The lows of June and October last year were again tested late last month when the index dropped to 1630s-1640s. Once again, the level was defended. And once again, the rally that followed has been anemic.

In the week before, the Russell 2000 jumped 7.6 percent. Last week, it declined 3.2 percent – this in a week in which the S&P 500 and Nasdaq 100 respectively rallied 1.3 percent and 2.9 percent.

The risk going forward for small-cap bulls is that the Russell 2000 (1705) in due course will breach 1640s on the way to testing 1600, which not only represents multi-year horizontal support, but this is where a head-and-shoulders pattern, the neckline of which was broken in September at 1800, completes (Chart 1).

Small-cap stocks are getting no help from earnings.

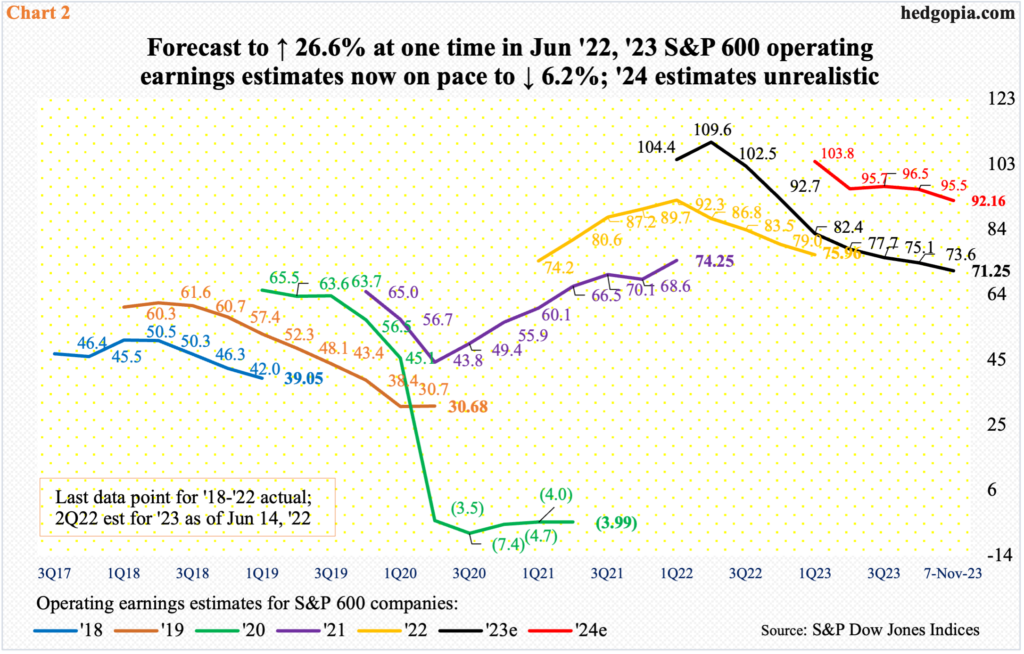

In 2022, S&P 600 Small Cap companies took home $75.96 in operating earnings, up from $74.25 in 2021. In April, in fact, 2022 was expected to ring up as high as $92.70, before reality sunk in. The downward-revision trend also hit 2023 estimates, as in June last year, earnings were forecast to come in at $111.23, up 26.6 percent. Fast forward to now, as of last Tuesday, 2023 is on course to $71.25, which will be down 6.2 percent from last year (Chart 2) – this at a time when the economy is growing at a decent clip.

Ironically, once again, 2024 estimates are high – very high. Granted they have been progressively revised lower since hitting $105.68 in March this year, but at last Tuesday’s $92.16, estimates remain way elevated. The thing is, if next year’s estimates come through, this would represent growth of 29.3 percent! This is nothing but pie-in-the-sky. Small-cap stocks are not in agreement with this scenario.

If things were as gung-ho as these estimates would have us believe, small-business sentiment would not remain as suppressed as it has been. The last time the NFIB Optimism Index crossed 100 was in August 2021 (100.1), with the record high 108.8 posted in August 2018. Since then, the metric reached as low as 89 this April – the lowest since January 2013 – with September at 90.8, down five-tenths of a point month-over-month.

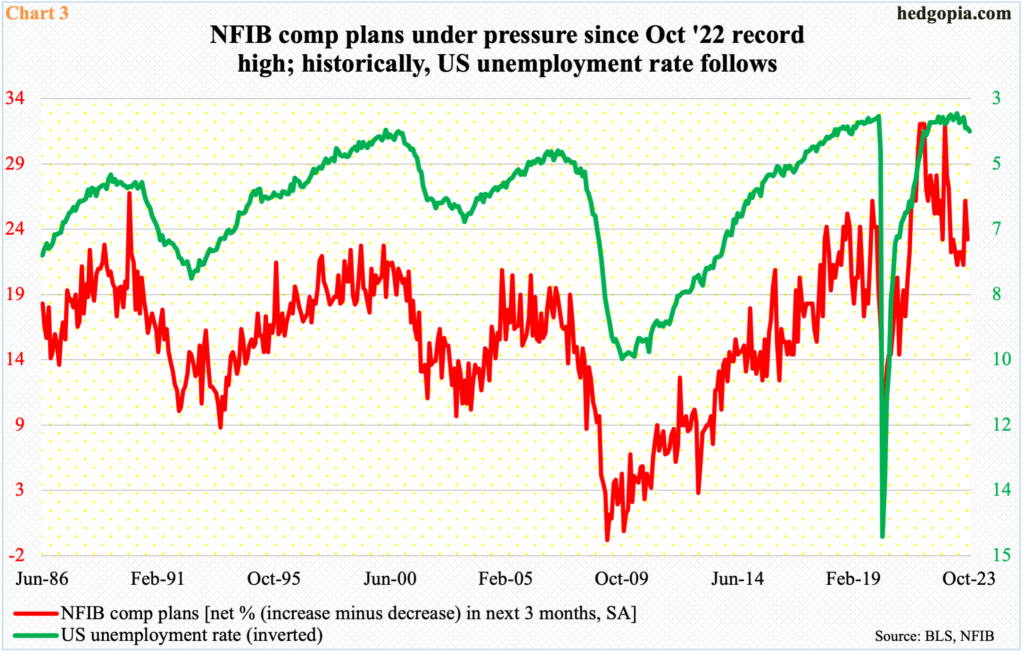

Other sub-indexes paint the same gloomy picture. The compensation plans hit 32 in October last year. This was the fourth time the metric rose as high, with the other three being October through December of 2021. Since last year’s high, it fell as low as 21 in April and July this year, with September down three points m/m.

Here is the thing, small-business comp plans historically tend to peak ahead of the unemployment rate. In October, the latter rose to 3.9 percent from September’s 3.8 percent. In Chart 3, the unemployment rate is inverted and has a long way to go on the upside – timing notwithstanding – as it sits near all-time lows.

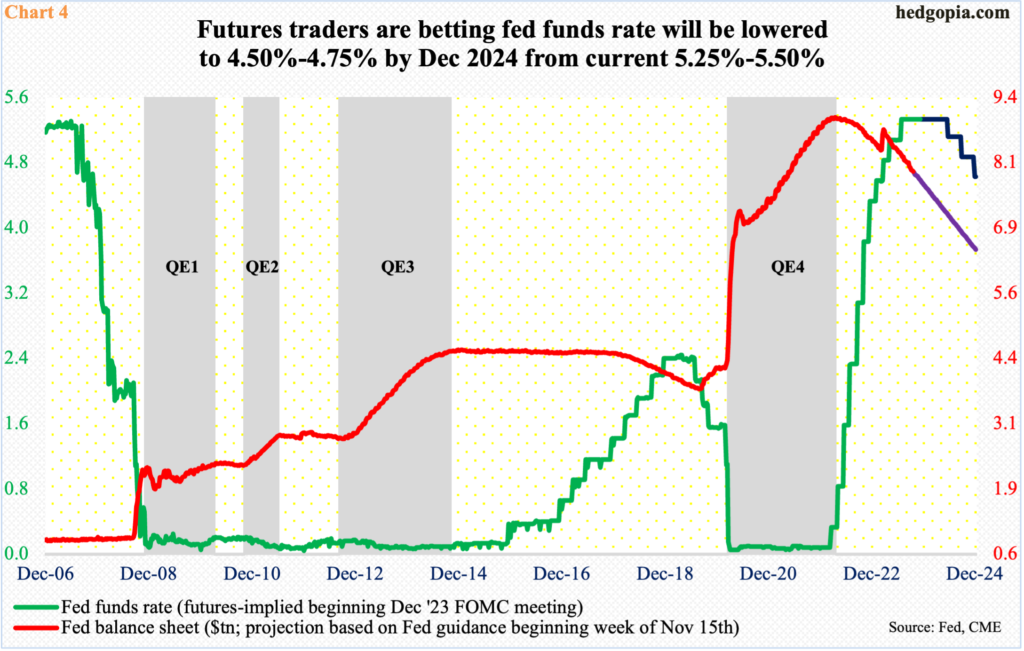

As things stand, small-cap investors are on the same page with futures traders, who are a lot more dovish than the Fed in terms of next year’s rates outlook.

The central bank tightened the fed funds rate from between zero and 25 basis points in March last year to between 525 basis points and 550 basis points, with the last hike this July. (It is concurrently reducing its balance sheet.) Although the Fed continues to wax data dependency, it kind of dropped hints during the latest FOMC meeting (October 31-November 1) that it is done hiking, at the same time emphasizing that there would be no cuts anytime soon.

Futures traders are in disagreement. Although they at one time expected the benchmark rates to end 2024 below 400 basis points, they have currently priced in three 25-basis-point cuts next year, ending the year between 450 basis points and 475 basis points. For this scenario to come true, the economy must decelerate substantially at best or enter recession at worst. This is precisely what small-cap action is foreboding.

Thanks for reading!