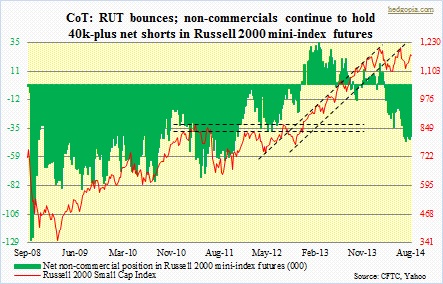

The answer to the question above is a probable yes.  Twice since early March this year, small-caps have come under decent amount of pressure. The first was a nine-week, 11-percent decline that began early March, followed by a nine-percent drop beginning late June lasting five weeks. On both occasions, as can be seen in the adjacent chart, the Russell 2000 Small Cap Index, or IWM for that matter, dropped from around the same level, give and take, opening up possibility of a double top (or a triple top depending on how far the current rally goes and if those peaks provide resistance). A top gets confirmed if and when the index breaks down below 1100, or thereabouts. We simply do not know if that is going to occur anytime soon. What we do know is that the index has been lagging the S&P 500 Large Cap Index since that early-March peak. The latter acts well. As far as small-caps are concerned, investors are on a risk-off mode. The sector has clearly taken a back seat. Since early-August low of 1107, the RUT has added 6.5 percent, but conviction is lacking. The IWM has added seven points the last four weeks, with persistently receding volume. In fact, the monthly MACD line has already flashed a sell signal. Probably why non-commercials are sticking with their 40k-plus net shorts in Russell 2000 mini index futures. So far, they have not given up on their bearish bias. Since the current rally began early August, net shorts have gone down by 4k contracts, with nearly all of it having come from a reduction in shorts. Interestingly, longs have not been adding despite the rally. This probably tells us that short-covering is playing a role here. IWM short interest as of end-July stood at 172.5mn, which by mid-August dropped 12.7 percent to 150.6mn. This at a time in which short interest on the SPY went up by 12.6 percent between the periods. Since mid-August, the RUT has risen another 3.3 percent. So it is entirely possible more short-covering has taken place since. Hence the low-volume, conviction-lacking grind higher.

Twice since early March this year, small-caps have come under decent amount of pressure. The first was a nine-week, 11-percent decline that began early March, followed by a nine-percent drop beginning late June lasting five weeks. On both occasions, as can be seen in the adjacent chart, the Russell 2000 Small Cap Index, or IWM for that matter, dropped from around the same level, give and take, opening up possibility of a double top (or a triple top depending on how far the current rally goes and if those peaks provide resistance). A top gets confirmed if and when the index breaks down below 1100, or thereabouts. We simply do not know if that is going to occur anytime soon. What we do know is that the index has been lagging the S&P 500 Large Cap Index since that early-March peak. The latter acts well. As far as small-caps are concerned, investors are on a risk-off mode. The sector has clearly taken a back seat. Since early-August low of 1107, the RUT has added 6.5 percent, but conviction is lacking. The IWM has added seven points the last four weeks, with persistently receding volume. In fact, the monthly MACD line has already flashed a sell signal. Probably why non-commercials are sticking with their 40k-plus net shorts in Russell 2000 mini index futures. So far, they have not given up on their bearish bias. Since the current rally began early August, net shorts have gone down by 4k contracts, with nearly all of it having come from a reduction in shorts. Interestingly, longs have not been adding despite the rally. This probably tells us that short-covering is playing a role here. IWM short interest as of end-July stood at 172.5mn, which by mid-August dropped 12.7 percent to 150.6mn. This at a time in which short interest on the SPY went up by 12.6 percent between the periods. Since mid-August, the RUT has risen another 3.3 percent. So it is entirely possible more short-covering has taken place since. Hence the low-volume, conviction-lacking grind higher.