- Laggards since March, small-caps continue to fall behind large-caps

- With increasing signs of distribution, RUT, IWM face technical hurdles

- More pressure ahead if/when non-commercials start adding to net shorts

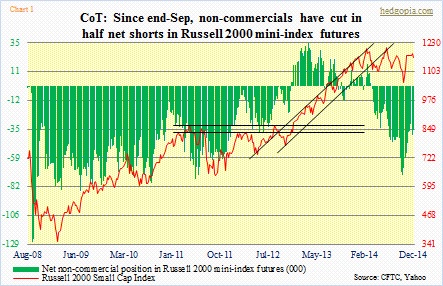

Since end-September, large speculators have drastically cut back on their net shorts in Russell 2000 mini-index futures – from 73k contracts to 36k (Chart 1). That has been a good move on their part. The small-cap index has risen about six percent since then. The last time these traders were net long was in the latter weeks of March. That was when the index first peaked, followed by a break in April of a two-year trendline. That March high was later revisited in June, but the advance was repelled at the underside of that broken trendline. That must have prompted these traders to gradually add to their net shorts, leading up to the September peak.

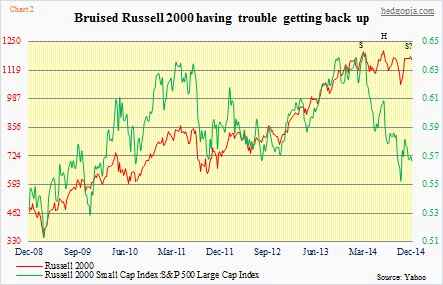

Non-commercials – essentially hedge funds – tend to follow the trend. The Russell 2000 is absolutely stuck in a range. Hence the flattish non-commercial net shorts the past five weeks, as is the Russell 2000. This is bound to break one way or the other. While December has shown a tendency to be a good month for small-caps, the Russell 2000 needs to break out of the congestion it is in. Until that happens, we will probably not see non-commercials cut back further on their net shorts. Increasingly, the odds are lining up against that. There are signs of distribution. Prior to last week, there were four consecutive weekly dojis. These are classic signs of indecision. And they have appeared following a 12-percent rally post-October 15th low. Further, the Russell 2000 could very well be forming the right half of a head-and-shoulder pattern (Chart 2), which is bearish. It is a little early to say for sure, though.

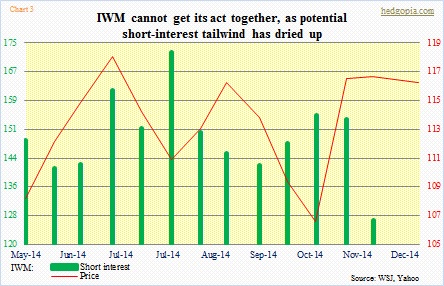

Short interest is not helping either. On IWM, the small-cap ETF, it is down by more than a fourth since end-July. In the two weeks ended mid-November, short interest dropped nearly 18 percent, yet the ETF treaded water. Another sign of distribution. We should get the end-November numbers this week, and that will probably give us some clues, as will non-commercials’ futures position as of today (the CFTC will publish this Friday).

For now, the path of least resistance continues to be down, December or not. Since that March peak, there have been trading opportunities both ways. But this one could be setting up on the downside.