In the past month, as U.S. stocks persistently climbed to high altitudes, air has progressively gotten thinner as far as shorts are concerned. With that said, the action last Friday raises the odds that the latter is about to get a fresh dose of oxygen.

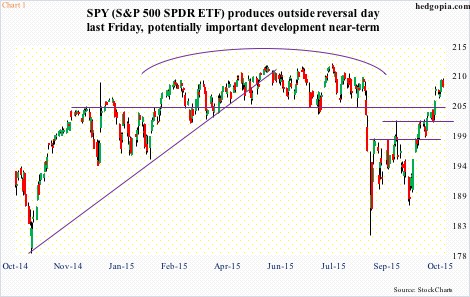

On SPY, the SPDR S&P 500 ETF, Friday was an outside reversal day (Chart 1). Having come on the heels of a one-month-long, 11-percent rally, this has the potential to be an important development.

Needless to say, the ETF remains grossly overbought, but has been that way for a while now. So kudos to the bulls for keeping the momentum alive for as long as they have.

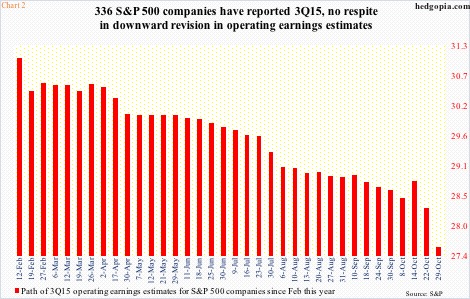

Lowered earnings expectations have helped. At the end of September, third-quarter operating earnings estimates of S&P 500 companies stood at $28.61, down from $34.86 at the end of June last year and $31 as early as February this year.

Even with this level of downward revision, as of Thursday last week, only 70 percent have beaten on an operating basis (and only 42 percent on an as-reported basis). With two-thirds of the way through, 3Q estimates – now at $27.55 (Chart 2) – continue to head lower; 2015 is at $109.11, down from $110.98 when the quarter ended.

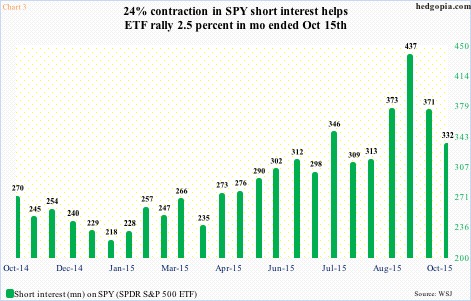

Central bank talk/action has helped as well. On October 22nd, Mario Draghi, ECB president, hinted of additional stimulus (perhaps as soon as December). A day later, the People’s Bank of China cut its benchmark lending and reserve requirements for banks. In those two sessions combined, SPY tacked on 2.8 percent. Shorts probably got squeezed even more.

SPY short interest had been building a while, having jumped 86 percent between the end of March and the middle of September (Chart 3). Then in the next month, it declined 24 percent, lending a hand to SPY’s 2.5-percent rally.

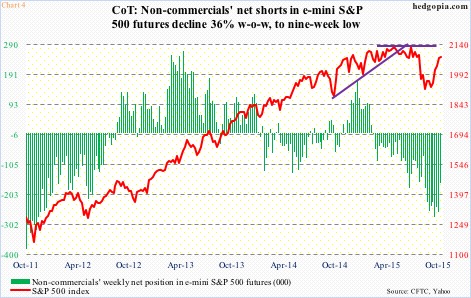

A similar phenomenon could be observed in the futures market.

Non-commercials have stayed net short e-mini S&P 500 futures since March (Chart 4) – with gradual accumulation. In the week ended October 6th, they held 278,179 contracts, and have been reducing since, even as SPY has grinded higher. In the latest reporting period (last Tuesday), net shorts declined 36 percent, to 166,039 contracts, with SPY rallying 1.7 percent. The ETF rallied another 1.4 percent from the Tuesday close to the Friday high. So it is possible net shorts have gone down even more. We will find out this Friday.

The point is, bearish positions have gone a long way in pushing stocks up as they got unwound. Can it continue? Theoretically yes. Short interest remains high, as are non-commercials’ net shorts.

But here is the rub.

With each passing day, there are fewer and fewer companies left to report to provide earnings push. Central banks are done providing carrots – at least near-term. And last but not the least, flows are not cooperating. In the week ended Wednesday, inflows into U.S.-based equity funds were $8.4 billion – the largest in six weeks (courtesy of Lipper). Going back to the September 9th week, however, it is a wash – up a mere $761 million.

In the midst of all this, we have stocks as overbought as they are – needing to unwind overbought conditions and looking for an excuse to do so.

Put it all together, risk-reward favors staying short SPY ($207.93).

Last week’s hypothetical short put has raised the short price to $204.72. To refresh, back on October 12, weekly October 16th 202.50 calls were sold for $0.84, resulting in in an effective short at $203.34. This was then followed by October 23rd 202 short put for $0.82, raising the short price to $204.16. Then last week, October 30th 204.50 puts were sold for $0.56.

In a scenario in which SPY rallies further this week, a short collar strategy would not be a bad idea – stay short the underlying and at the same participate in the upside. Else, short put makes sense.

November 6th 204.50 puts bring $0.51. SPY’s 200-day moving average lies at $204.59. The $204 level has been an important price point going back to last December. After it was lost during the August sell-off, the 200-DMA has not been tested from above. Bulls will fight tooth and nail to save this, that is for sure. Should they defend the average, the short price rises further, to $205.23. If on the other hand, the ETF drops 1.7 percent and the short position gets covered, a small profit of $0.73 follows – not bad given the trade did not quite go as intended initially.

Thanks for reading!

Please keep in mind that this article was originally published yesterday (November 2nd) by See It Market, where I am a contributor.