- Short interest inched up on NYSE and Nasdaq, and hovers near multi-year highs

- Shorts squeezed out of several sector ETFs since mid-Oct bottom in stocks

- Shorts probably will get active and rebuild position in XLU, XLE, IWM

Short interest inched up in the latest period on both the NYSE composite – from 15.1bn to 15.3bn – and on the Nasdaq composite – from 8.17bn to 8.26bn. On both indices, short interest is not that far away from the mid-October multi-year highs – 15.8bn and 9bn, respectively.

The above is more of a top-down view. When we drill down to more of a micro level, the picture changes.

In some sectors, short interest is down more, some others, less. Which is perfectly normal, depending on which sector or industry is going through what kind of tribulation, or a lack thereof.

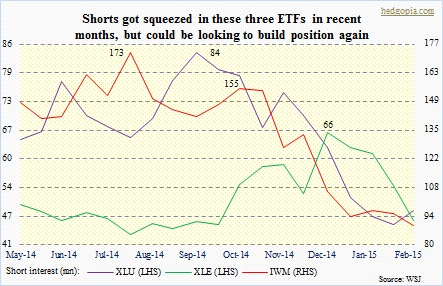

The chart below shows three different ETFs that shorts earlier found it alluring to aggressively attack, only to suffer a squeeze. As a result, short interest has dropped quite a bit. Now it is beginning to look like shorts will go at it again.

XLU (45.28)

Short interest has dropped from 83.9mn mid-September to 48.6mn. From mid-September to late-January, the ETF went on to rally 20 percent. After that peak in price, it has corrected nine percent, and is looking like it will at least test its 150-day moving average (44.46) and possibly 200DMA (43.80). We will find out when the current period is reported in two weeks, but shorts may very well be active already.

Resistance lies at $46. Down below, support is at $44.50.

XLE (79.37)

Short interest peaked mid-December at 66.1mn and currently stands at 46.5mn – a nine-week low. The ETF first put in a low mid-December, which was successfully tested one month later. Short interest has persistently shrunk since that first low. There are signs XLE is ready to once again come under pressure. Depending on how much it weakens near-term, there is room for intermediate-term indicators to roll over.

Support lies at $78.

Interestingly, both XOM and CVX saw a rise in short interest in the latest period, even as XLE’s dropped. They each make up 16 percent and 13 percent of the ETF, respectively. CVX’s short interest rose from 23mn to 24.4mn, which at least is a one-year high; short interest has been gradually rising since 13.9mn mid-October. In the latest period, XOM’s went up from 39.5mn to 43.7mn, but it has essentially gone sideways the past eight periods.

IWM (123.25)

Short interest has decreased from 172.5mn at the end of July last year to 89.2mn currently. The latest peak was 155.3mn in the middle of October, even as stocks were bottoming. And then the squeeze began. In the most recent period, short interest fell six percent. The ETF rallied five percent in the period.

IWM has experienced a mini breakout of sorts, and that level drew buyers in last week. Dips are getting bought. The ETF has been up for 10 consecutive sessions. Obviously extended! Price action is good, but there is not much conviction. Volume is anemic, not what one would like to see after a break out of a one-year range. This has the potential to be a nice short, may be next week. It is only a matter of time short interest goes back up.

121 is a must-hold.