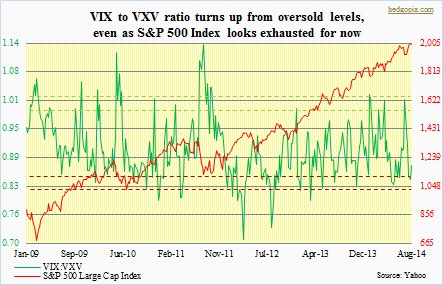

Since we got that VIX-spike signal four weeks ago and subsequent signs that equities are regaining momentum, this is the first time we are getting signals that they are worn out – at least near-term. Since the bottom at 1904.78 early August until the intra-day, all-time high of 2011.17 yesterday, the S&P 500 Index (1997.65) has added 5.6 percent. That is too rapid a bounce for a five-week duration. Yes, oversold medium-term technicals were calling for such a bounce/rally, but they are now about done unwinding those conditions. Shorter-term indicators are in a process of rolling over. Forget the fact that the whole time important risk-on sectors such as small-caps have been a laggard. Action yesterday on hitherto-stalwart AAPL does not exude any confidence either. Unless AAPL engineers a huge reversal today, its weekly chart will be flashing a major reversal pattern – bearish, of course. The good thing is, there are still buyers emerging near the level the index broke out of two weeks ago. In a way, it is natural, with traders, however few in numbers as reflected in low volume, trying to defend the breakout. In all likelihood, that support will soon give in. Price simply needs to go lower and test various points that earlier provided resistance. In this respect, the VIX to VXV ratio has just turned up from oversold levels. If it persists — odds are it will — that bodes ill for stocks.

Since we got that VIX-spike signal four weeks ago and subsequent signs that equities are regaining momentum, this is the first time we are getting signals that they are worn out – at least near-term. Since the bottom at 1904.78 early August until the intra-day, all-time high of 2011.17 yesterday, the S&P 500 Index (1997.65) has added 5.6 percent. That is too rapid a bounce for a five-week duration. Yes, oversold medium-term technicals were calling for such a bounce/rally, but they are now about done unwinding those conditions. Shorter-term indicators are in a process of rolling over. Forget the fact that the whole time important risk-on sectors such as small-caps have been a laggard. Action yesterday on hitherto-stalwart AAPL does not exude any confidence either. Unless AAPL engineers a huge reversal today, its weekly chart will be flashing a major reversal pattern – bearish, of course. The good thing is, there are still buyers emerging near the level the index broke out of two weeks ago. In a way, it is natural, with traders, however few in numbers as reflected in low volume, trying to defend the breakout. In all likelihood, that support will soon give in. Price simply needs to go lower and test various points that earlier provided resistance. In this respect, the VIX to VXV ratio has just turned up from oversold levels. If it persists — odds are it will — that bodes ill for stocks.