Velocity of declines in equities breakneck and unsettling

Worse scenario is if oversold bounce/rally gets sold hard near resistance

If consumer/CEO confidence is impaired, Fed’s tool box empty to tackle weaker economy

Another interesting session in the markets!

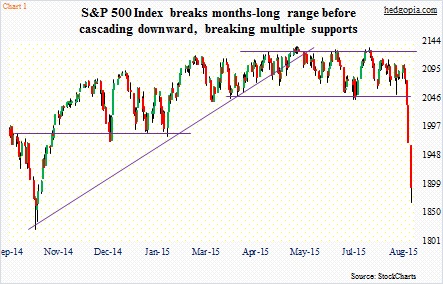

Stocks picked up on Monday where they left off on Friday. As the session progressed, fear began to subside. Cash VIX, which surged to 53.29 right out of the gate, came in, before once again attracting bids in the back half of the session. When it was all said and done, stocks were down, but could have been worse. At one time, the S&P 500 Index (1893.21) was down 5.3 percent, but ended the session down 3.9 percent (Chart 1). All in all, another bloody day.

Amazing how quickly sentiment has shifted from one end to the other. It is therefore fitting to be discussing how we got here, possible effects of recent volatility on investor psyche/board room confidence, and whether or not more pain might lie ahead.

It had been over three years since the S&P 500 has had a 10-percent correction. Although the 9.8-percent pullback last September-October came close. So in a larger scheme of things, there is nothing wrong with the ongoing correction. Excesses get wrung out, giving new money an opportunity to get in. Nothing but healthy – as long as it is a normal correction.

Since the bull market began in March 2009, there have been two severe corrections – one each in 2010 and 2011, during which the S&P 500 fell 17-plus percent and nearly 22 percent, respectively. Hindsight is always 20/20, but as it turns out, even declines of that magnitude turned out to be opportunities to go long. Naturally a question arises as to if the current sell-off is one of those times. Time will tell. Perhaps the biggest tell-tale will be how investors/traders react around resistance.

The sell-off has been brutal. There is no other way to put it. In just two weeks, using the intra-day low yesterday the S&P 500 lost 10.7 percent. From the May high to the low yesterday, it has lost 12.5 percent.

Here are a few things that stand out between this sell-off and the ones before. Leading up to the deterioration in the S&P 500 this month, transports peaked last November, high-yield debt last October. Stocks have diverged with commodities for three years now. Leadership has been narrowing for months. The S&P 500 itself had been going sideways for six months – fatigued – particularly since May. Just comparing the current sell-off with the one last September-October, the S&P 500 did not yet have a monthly MACD crossover back then, now it does.

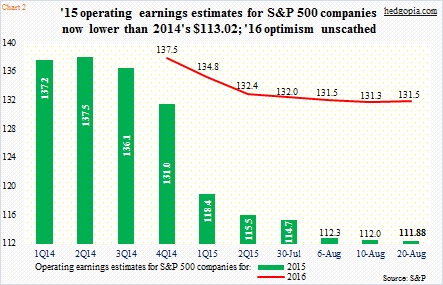

On the fundamental side, one glaring difference is in earnings. Operating earnings for S&P 500 companies this year are now slated to be down over 2014 – $111.88 versus $113.02 last year (Chart 2). Using 2015 earnings, the index trades at 17 times – no longer cheap. This can impact buybacks – the most potent source of buying power.

Put it all together, the current sell-off has the potential to be different. If stocks snap right back – as they have done in the past – it is a moot issue. But if resistance holds, and it turns into a long, drawn-out battle between bulls and bears, risks will rise. The risk of the wealth effect – or a lack thereof – kicking in, by adversely impacting investor psyche as well as CEO confidence.

As things stand now, the way cash VIX spiked but was not able to hang on to gains yesterday (Chart 3), it is possible a decent opportunity to go long will soon be upon us. You stretch the rubber band too far, it will snap. Conditions are way oversold near-term.

Resistance levels need a close watch. The S&P 500 can rally 7.5-plus percent and face massive resistance at 2040. The Russell 2000 can rally 8.5-plus percent and face resistance at 1210. This is true with every major index. There has been damage done on every one of them. If resistance holds, followed by another round of selling, the next thing to drop will be the level of confidence – consumer, board room, you name it.

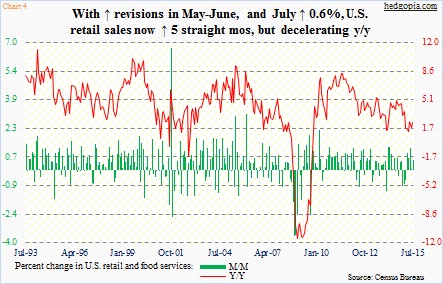

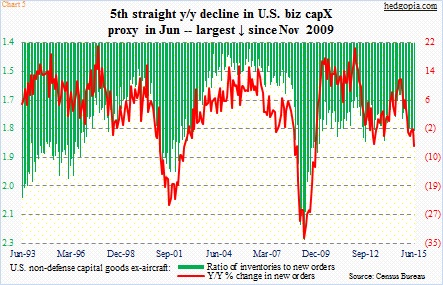

And it is not like the economy is going gangbusters. Except for housing, which has been putting up good numbers of late, most other data points are weak and have gotten weaker over the months. After three monthly drops, U.S. retail sales have been up the past five months, but year-over-year growth has decelerated since last August (Chart 4). Annual orders for non-defense capital goods ex-aircraft have fallen for five consecutive months (Chart 5). The economy is vulnerable.

Let us assume a worse-case scenario, in which a drawn-out decline begins to impact the economy. Then what? Then we fold our hands and pray.

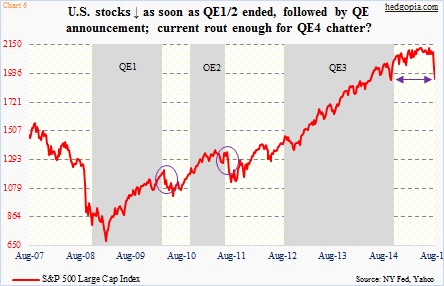

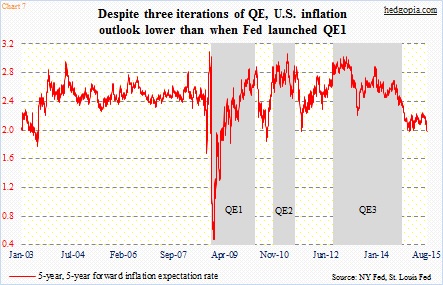

Except for maybe another iteration of QE (Chart 6), the Fed’s monetary toolbox is empty. Short-term rates have been pushed as low as they could possibly go. QE’s impact on financial assets has been undeniably good, but not so on the economy. The Fed wants to ignite a little inflation, and wants to hike, hoping this will steepen the yield curve, building inflation expectations. It has not happened. After three iterations of QE, five-year inflation expectations five years from now are lower than when QE1 began in late 2008 (Chart 7).

This is a global phenomenon, by the way. Everywhere you look, major central banks have cherished asset inflation as a panacea. The crux of the problem – debt – has not been dealt with. Debt levels are higher now than during the 2008 financial crisis. Sooner or later, this will come back to bite us in the rear. Is that time now or sometime down the line?

As long as buy-the-dip mentality prevails, the answer to the rhetorical question above is ‘down the line’. So this better be a plain-vanilla correction, though not betting on it. Fingers crossed!

Thanks for reading!