Ahead of this week’s FOMC, equities seem unsure about the next major move. At this stage, markets want Powell and team to take the fed funds rate north of four percent by year-end. If the Fed manages to sound even more hawkish on Wednesday and stocks react adversely, weakness likely gets bought.

The Federal Reserve is consumed by consumer inflation.

Post-Covid in the early months of 2020, the central bank singlehandedly focused on jobs and utilized both conventional (benchmark rates) and unconventional (balance sheet) to fill the system with liquidity. Along with fiscal stimulus, this helped the economy recover in no time. But the amount of excess liquidity that was sloshing around as a result also helped exert upward pressure on inflation, which Chair Jerome Powell and other officials initially pooh-poohed saying it was transitory.

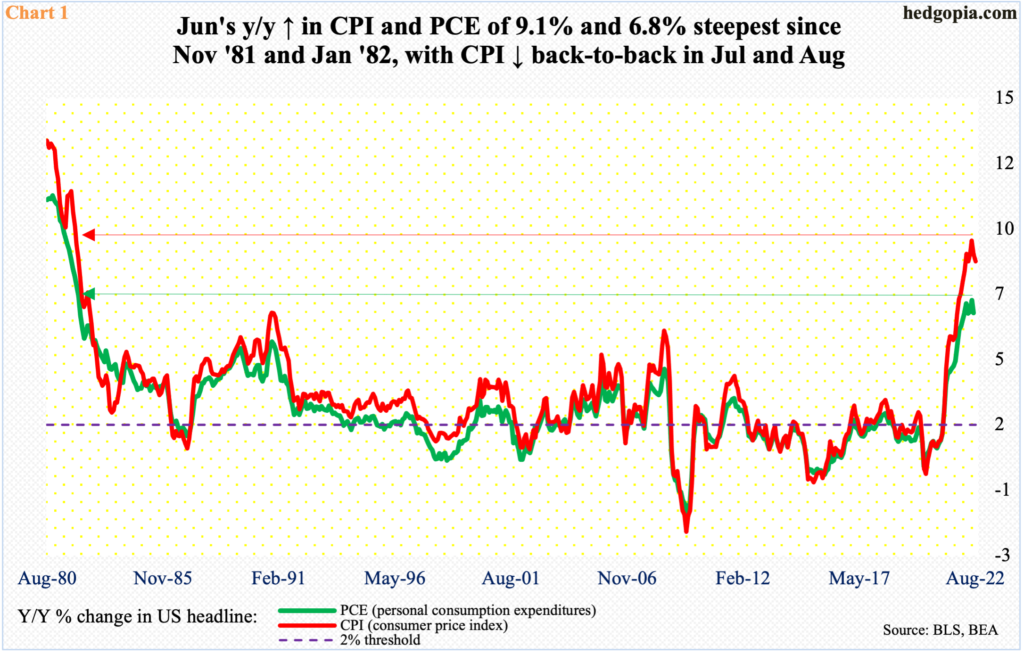

Fast-forward to now, and the rhetoric has changed. Inflation has persisted. In June, both the consumer price index and personal consumption expenditures were rising at four-decade highs, with the year-over-year pace of 9.1 percent and 6.8 percent highest since November 1981 and January 1982 respectively (Chart 1).

Since then, both measures of consumer inflation have softened a bit, with the CPI up 8.5 percent and 8.3 percent in July and August, in that order. Core CPI, however, rose faster y/y in August – 6.3 percent versus July’s 5.9 percent. This was a bit more than the consensus. Markets immediately readjusted their rates outlook.

At the Jackson Hole symposium toward the end of August, Powell decidedly turned hawkish, making it clear that the Fed plans to maintain the current tightening trajectory and that bringing inflation under control was not a quick fix.

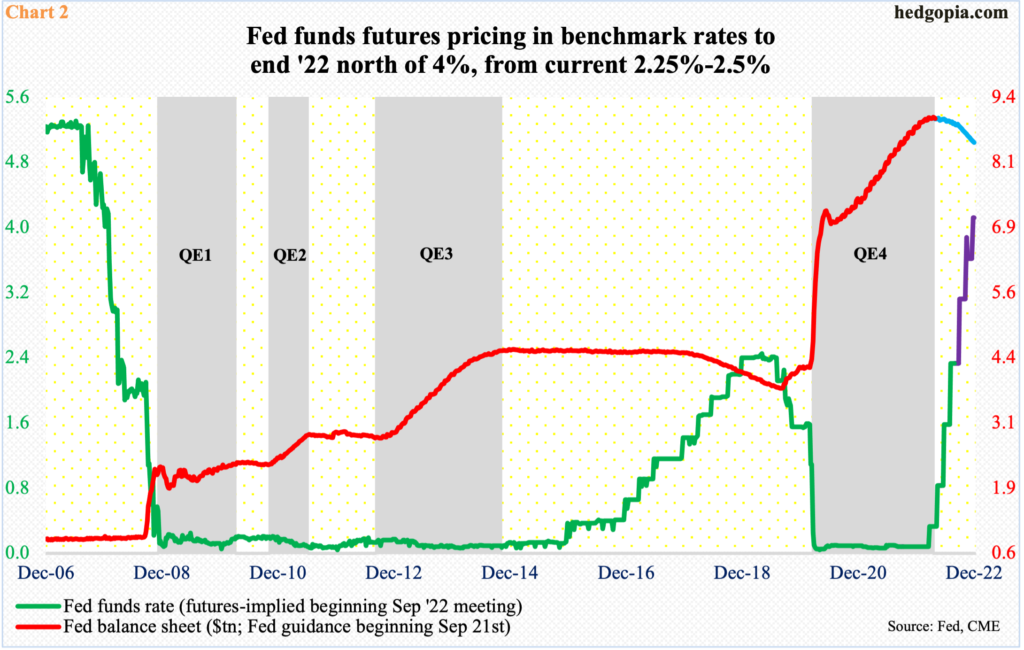

Post-CPI – out last Tuesday – markets one-upped Powell. A 75-basis-point hike is baked in for this week, with futures traders even assigning an 18-percent probability for a full percentage point increase; by December, the benchmark rates are expected to end between 400 basis points and 425 basis points, up from the current range of 225 basis points and 250 basis points (Chart 2).

For reference, the central bank’s June forecast projected that the rates would end 2022 between 325 basis points and 350 basis points. But a lot has changed since then, not to mention the persistency behind inflation. The resultant increase in markets’ hawkishness can mean Powell and team can soften their tone.

This scenario can be friendly for equities.

The S&P 500 last week was unable to build on the positive momentum of the week before. In fact, the week opened strong, with the large cap index up 1.1 percent at Monday’s close. Momentum went the other way soon after Tuesday’s CPI report. By Friday, the index (3873) gave back 4.8 percent for the week, losing 3900 (Chart 3).

Amidst this, bulls may find solace in the fact that Friday’s low of 3837 was bought to produce a potentially bullish hammer session. But the important thing is that 3900 is breached – albeit slightly – and depending on how the FOMC meeting is viewed, this may or may not become a factor. In the event Powell comes swinging and the S&P 500 heads toward the June lows, the weakness in all probability gets bought – if nothing else just for a reflex rally.

It is possible volatility is anticipating this.

VIX (26.30) has been unable to bust through 27.60s for three weeks now. Last week, it tagged 28.15 on Tuesday and 28.45 on Friday but closed poorly. Of late, there have been several daily candles with long upper wicks (Chart 4).

Persistent denial at 27.60s raises the odds of a move lower toward lower supports. Immediately ahead, there is mid-20s. Should this go, low-20s is the next level to watch.

Thanks for reading!