Tech, which led for a while, is now lagging. Amidst this, Tuesday produced interesting price action on both the S&P 500 and Russell 2000, with sellers showing up at crucial price points.

Tech has begun to lag.

The Nasdaq 100 otherwise was a clear leader particularly after the March low, rallying all along a trend line thereof. That support was breached three trading weeks ago. But the index continued higher, rallying along the underside of that trend line. This culminated last Thursday when a new intraday high of 11282.24 was posted. Then it fell the next three sessions, including Tuesday when short-term support at 11000 was breached (Chart 1). Bulls also lost the 10-day moving average. The 20-day at 10841.45 is a stone’s throw away. The index closed Tuesday at 10876.08.

This is a partial victory for bears. They will have secured momentum once the 20-day is reclaimed and the averages roll over. After this, the next battle lies at 10300-10400. The 50-day at 10406 lies there as well.

Tuesday, the S&P 500 (3233.69), too, reversed lower from a crucial spot. If it sticks, this will have marked a major reversal. The large cap index tagged 3381.01 intraday, which was merely 0.4 percent from the February 19th record high of 3393.52, but sellers quickly showed up; by close, it was down 0.8 percent.

Tuesday’s reversal followed a 54-percent rally from the March low, during which one after another resistance fell, including the 50- and 200-day. Last week, the index filled a gap from February 24, before going after its record high from that month. Tuesday’s outside day session followed Monday’s hanging man.

For now, the index remains above both the 10- and 20-day – respectively at 3309.93 and 3273.02 – so it is too soon for bears to be celebrating. But a warning shot has been fired.

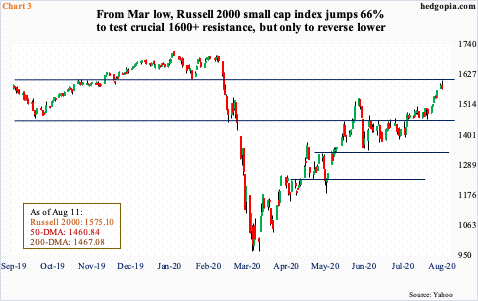

Tuesday also marked a session when sellers came out of the woodwork at a level of high significance on the Russell 2000.

Going back to January 2018, bulls and bears have fought a tug of war just north of 1600. The last time the index closed above this level was on February 24. The February-March selloff ended on March 18 at 966.22. From that low through Tuesday’s intraday high of 1603.60, it rallied 66 percent. A breakout would have been massive, but Tuesday’s sellers were quick on the trigger, with the session ending down 0.6 percent to 1575.10.

The latest move followed a 1450s-60s breakout mid-July. Before a retest occurs, small-cap bears need to reclaim the 10- and 20-day – respectively at 1532 and 1504.84.

On all these three indices, bears have secured themselves an opening. That said, they have had opportunities before which they were unable to make much out of. The difference this time is that the otherwise-leading tech is lagging and both large- and small-caps have reached a crucial juncture.

Thanks for reading!