Stocks in general essentially began 2018 where 2017 left off.

XLF (SPDR financial sector ETF) was up 20 percent last year. In the first four sessions this year, it is up another 1.8 percent. Although major indices have rallied more, with the S&P 500 large cap index up 2.6 percent, the Dow Industrials up 2.3 percent, and the Nasdaq composite up 3.4 percent.

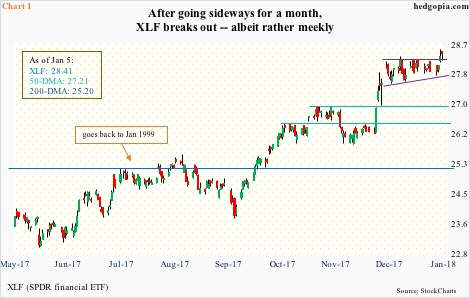

XLF also enjoyed a mini breakout – out of $28.25, which was defended last Thursday and Friday. This followed a month-long sideways move (Chart 1).

The daily chart is extended, with both Thursday and Friday closing outside the upper Bollinger band.

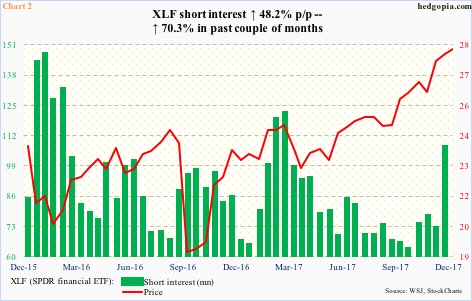

It is possible shorts contributed to this latest rally.

Mid-December, short interest on XLF increased 48.2 percent period-over-period to 107 million – a nine-month high (Chart 2). This only comprises nine percent of the shares outstanding, but in the right circumstances can lead to a squeeze. In fact, it may already have.

This week, JP Morgan (JPM), Wells Fargo (WFC) and PNC Bank (PNC) will report 4Q17 results Friday, followed by Citigroup (C) on the 16th, and Bank of America (BAC) and Goldman Sachs (GS) on the 17th.

Given the rally into these earnings, a ‘buy the rumor, sell the news’ phenomenon is possible. Equally possible is a scenario in which the bulls put their foot down post-earnings and the shorts give up.

As a result, shorts who worked on the premise that the latest consolidation would lead to a breakdown – or at least not lead to a breakout – are in the hole. This is a thesis gone wrong, and requires adjustments. One is to simply bite the bullet and cover and the other is to get a little creative and buy some more time deploying options.

Back on December 14, XLF was hypothetically shorted intraday at $27.84. This was followed on the 19th by a short put earning $0.16. The position is now short at $28. The underlying closed Friday at $28.41.

Going out four weeks to February 2 – by then, financials would have done reporting – slightly-in-the-money 28.50 puts bring in $0.47. If by expiration the short put ends up in the money, the position effectively gets covered for a loss of $0.03. If instead it remains above $28.50, the short price rises to $28.47.

Thanks for reading!