After repeated tries for months now, the 10-year Treasury yield finally broke through one percent on Wednesday. After Democrats won the two runoff Senate races in Georgia, markets are betting on more fiscal stimulus in quarters to come. Bond bears will have the momentum card as long as the Fed goes along with it.

After remaining sub-one percent since last March, the 10-year Treasury yield (1.04 percent) finally recaptured the level on Wednesday. Along the way, it made several breakout attempts.

After rallying to 0.96 percent in June, it again rose to 0.98 percent in November; the latter was on the 9th when Pfizer (PFE) announced positive vaccine news, which rekindled investor hopes that the US economy would get back to normal this year. After that failed breakout attempt, there were several more attempts in that month as well as December, when rates tagged 0.99 percent on the 4th.

But it was not until Wednesday when Democrats won the two runoff Senate races in Georgia, giving them control of both chambers of Congress, as well as the White House, that markets began rerating expectations.

As a matter of fact, since last March, and August in particular, the 10-year yield had persistently made higher lows (Chart 1). Bond bears (on price) were increasingly betting that a breakout would follow.

The next decent resistance is not until 1.4 percent.

On Wednesday, tech sold off and small-caps broke out to a new high. Value stocks have come into focus since the November 3 presidential election, and particularly since positive vaccine news from Pfizer and Moderna (MRNA).

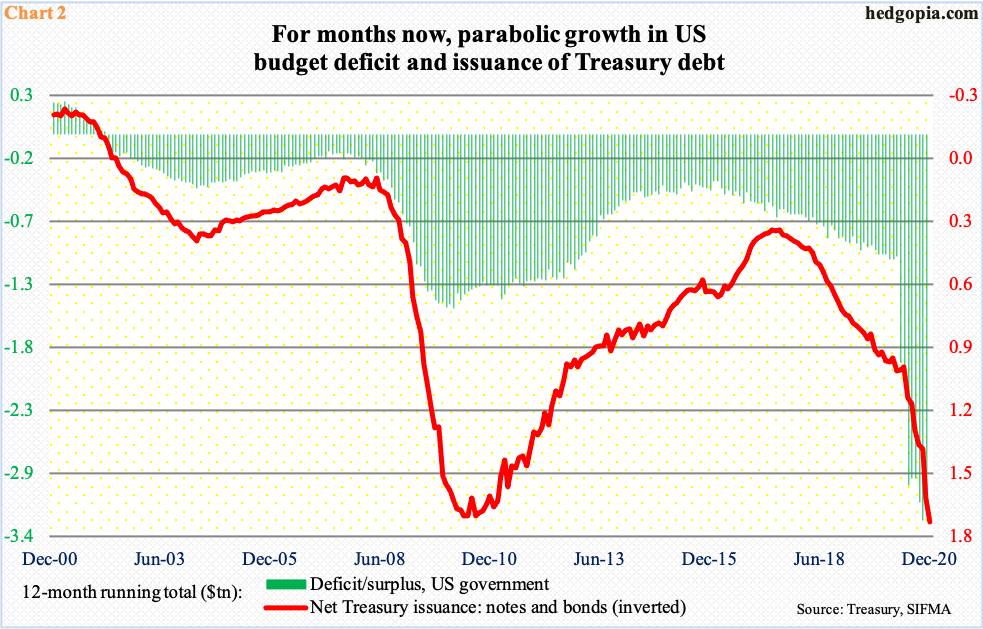

Both equities and bonds seem increasingly confident that President-elect Joe Biden would be able to push through a big stimulus package, maybe even an infrastructure spending package. In this scenario, both the red line and green bars in Chart 2 would continue their uptrend.

In October 2019, the 12-month running total of US budget deficit crossed $1 trillion, jumping to $1.9 trillion last April and ending with $3.2 trillion in November. Issuance of treasury notes and bonds followed, reaching $1.7 trillion in the 12 months to December. In all probability, with the way DC politics is shaping up, the uptrend should continue.

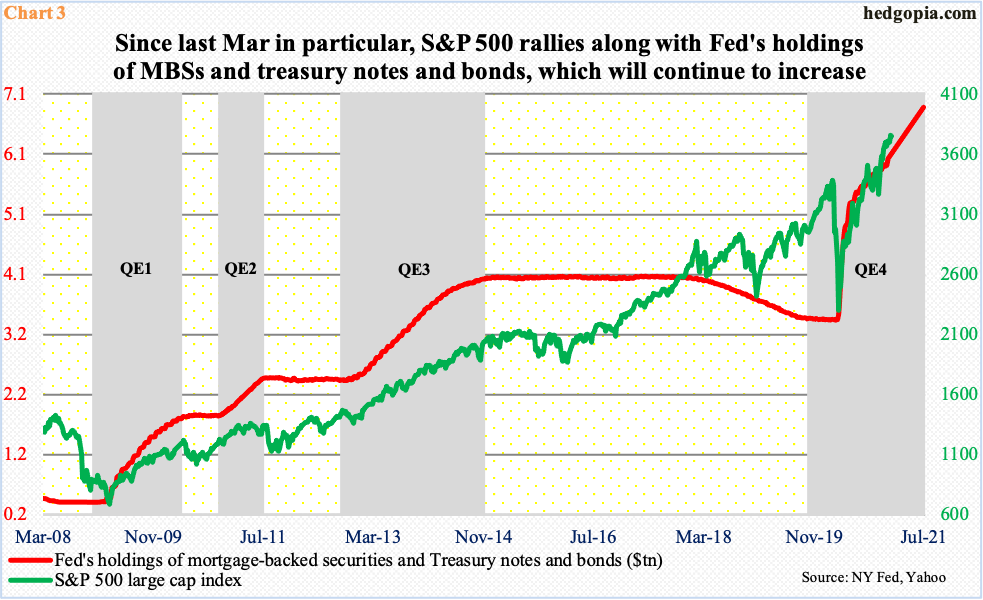

The Fed has been an aggressive buyer of these securities. Last March, it held $2.03 trillion in treasury notes and bonds and $1.37 trillion in mortgage-backed securities. By December 30, these assets had grown to $3.99 trillion and $2.03 trillion, in that order.

Speaking to the press at the end of the December 15-16 FOMC meeting, Chair Jerome Powell said the central bank would adjust its quantitative easing program if the need be but for now would purchase at least $120 billion/month in US treasury bonds and mortgage-backed securities. At this rate, the central bank is on pace to holding $6.8 trillion in six months. This is one reason why equity bulls are so excited.

Last March, the bottom in the S&P 500 coincided with the Fed’s announcement of unlimited QE (Chart 3).

If markets are right about a much better US economy this year, at some point it is possible the Fed will be forced to increase its pace of accumulating these securities. As the economy is heavily leveraged – be it on the federal, corporate or household level – higher rates will bite. Right here and now, much of the rise in rates is due to a rise in inflation expectations. That said, a rise is a rise. The Fed likely does not respond to it right away. It could also be watching the speed of the move.

If the 10-year quickly rallies to 1.4 percent and beyond, then sustainability becomes a question mark. Until then, as long as the breakout remains intact, the path of least resistance is higher. In other words, price goes the other way.

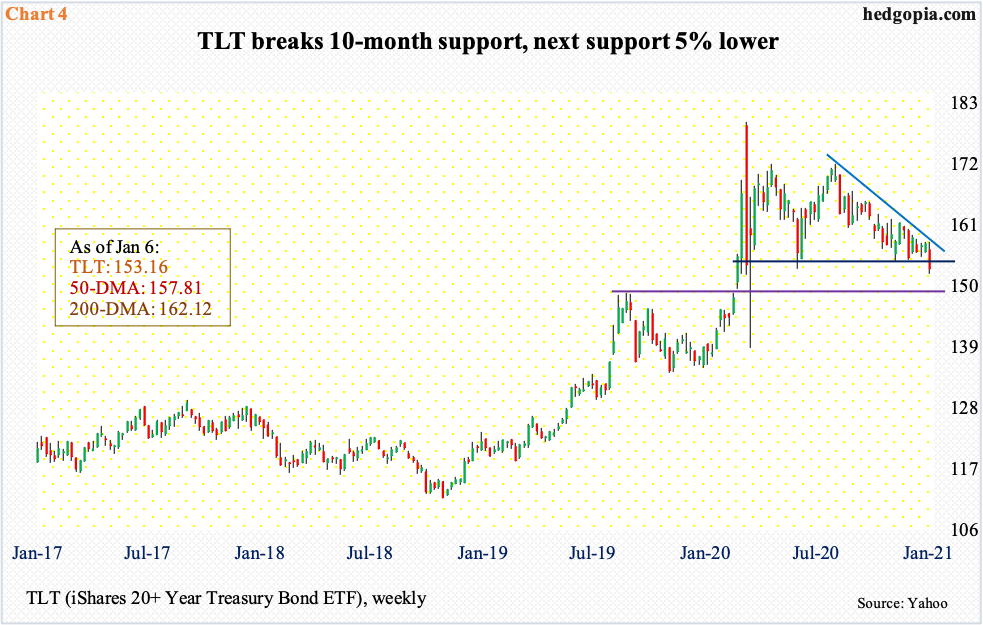

TLT (iShares 20+ Year Treasury Bond ETF) yesterday broke support going back to last March (Chart 4). There is room for the weekly to continue lower. The next decent support is five percent lower from where it closed on Wednesday.

Thanks for reading!