- Bloomberg poll: international investors most bullish on U.S. markets in more than five years

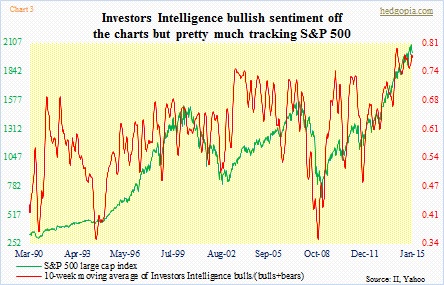

- Giddy sentiment in agreement with message coming out of NAAIM and II

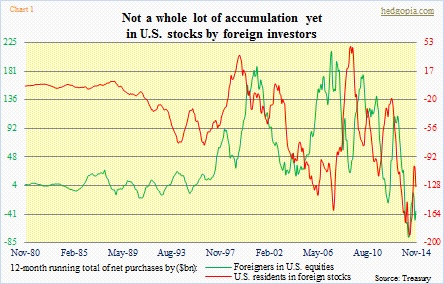

- Inflows from overseas key; as of November they are MIA

Some interesting tidbit came out of a Bloomberg poll yesterday. It was based on interviews January 14-15 with 481 Bloomberg subscribers. Regarding equities, one particular response jumps out – a total 54 percent of international investors thought the U.S. will be among the markets offering the best returns over the next 12 months. Not only is the reading the highest since October 2009 but that there has been a 16 percentage point increase since July last year. Makes you dizzy, to say the least!

It is a global poll. So assuming respondents’ responses reflect their own investing bias – which should be the case – one wonders if U.S. equities are beginning to attract foreign money. We know that that has been the case domestically. Lipper told us late December that $39bn flowed into U.S. equities in the week ended Christmas Eve – the biggest inflow since it started collecting data. But flows from overseas have been missing in action.

Chart 1 plots a 12-month running total of net purchases of U.S. equities by foreigners as well as by U.S. residents in foreign stocks. In November, they respectively were -$36bn and -$129bn.

Given this, there are two possibilities: (1) the Bloomberg poll predominantly reflects U.S. investors’ opinion, and/or (2) there has been an increase in foreign inflows into U.S. stocks, which Chart 1 is yet to capture, as its data is as of November. Indeed, one would think that given the interest-rate differential and the ever-rising dollar U.S. markets begin to benefit from a carry trade.

Of the two possibilities above, if it is (2) that is playing a role in respondents’ attitude toward U.S. stocks, then for bulls’ perspective, that is a welcome development. Maybe the best house in a bad neighborhood is beginning to catch overseas investors’ fancy.

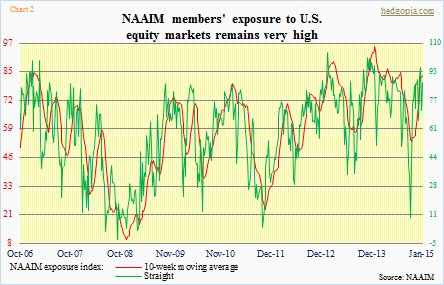

The timing could not be more right for equity bulls. They need new sources of funds. The $39bn inflows were simply massive hence probably rare. Look at the National Association of Active Investment Managers’ NAAIM exposure index. As high as it is (Chart 2), there probably is not much dry powder left out there.

The Investors Intelligence survey pretty much says the same (Chart 3). The red line has been off-the-charts for a while, but for people who follow this closely sell signals are not given until the 10-week average drops below 69. It has been a while. A perfect self-fulfilling prophecy. Stocks remain overbought but up, attracting new funds, which in turn results in overbought indicators such as in Chart 3. For continuation of this, new funds are constantly needed. Corporate buybacks are still a good source. But margin debt has gone sideways for the past several months. And money-market funds are unchanged year-over-year.

Hence the significance of inflows from overseas.