The year’s last FOMC meeting begins today. Tomorrow, we will probably witness the first rate hike in nine years.

On June 29, 2006, the fed funds rate was pushed up by 25 basis points to 5.25 percent, and stayed there until September 18, 2007 when it was eased by 50 basis points.

Markets seem ready for a hike. Or not. A lot will depend on the Fed’s message going forward.

With frenetic action in high-yields leading, stocks suddenly buckled last week. Major U.S. indices lost important support, and are at/near must-hold support.

Speaking of which markets were also expecting a hike this past September, although they were placing lesser odds than they are currently. Right now, fed funds futures are pricing in 75-percent odds of a hike. The two-year Treasury note is yielding 0.97 percent, up from 0.57 percent in the middle of October.

The odds are very low, but should the Fed decide to forego a hike – as it did in September – equities will possibly react the same way as they did in September – down.

The best-case scenario is a ‘one and done’ message, or indication that the cycle will be very shallow. The worst-case is if the message is to the contrary.

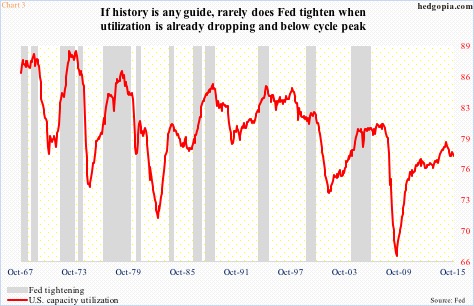

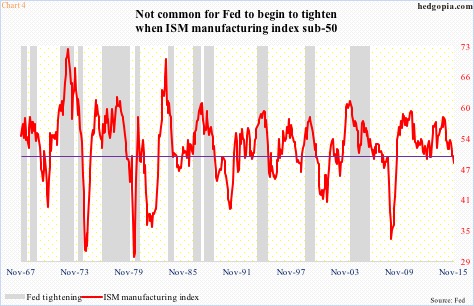

At first blush, it is hard to imagine the Fed going for the latter scenario given Charts 3, 4 and 5. But if it is a Fed that is focused on filling its monetary quiver with arrows – probable – then anything goes.

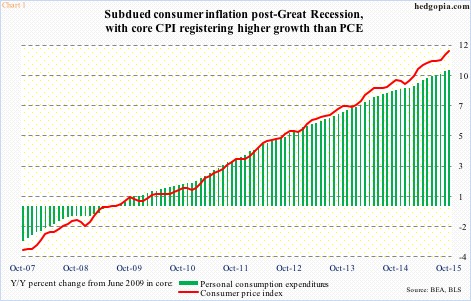

Data continue to come in mixed. Of its dual mandate, the ‘price stability’ objective is far from met, especially considering rather subdued inflation measured by personal consumption expenditures (Chart 1).

Core PCE rose 1.3 percent annually in October, and has been below the Fed’s two-percent target since April 2012. Core consumer price index, in contrast, is running hotter, increasing at 1.9 percent in October. Core CPI grew two percent as early as May last year, and has not dipped below 1.6 percent since. CPI is not the Fed’s favorite inflation gauge, PCE is.

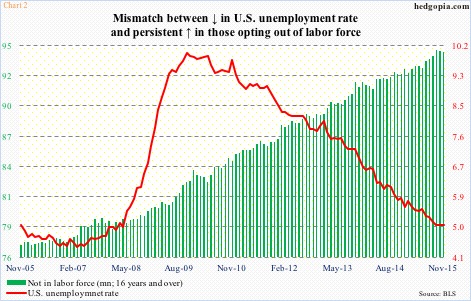

The other half of the Fed’s mandate – employment – is faring much better. Nearly 12 million non-farm jobs have been created post-Great Recession. The unemployment rate has dropped to five percent, which has been cut in half since October 2009. That said, the labor force is shrinking. The ‘not in labor force’ category has gone from 80.9 million in June 2009 to 94.4 million (Chart 2).

FOMC doves can pick and choose from an amalgam of data points in order to drive their point home. Not the least of which are Charts 3, 4 and 5.

At least going back nearly five decades, it is rare for the Fed to tighten when capacity utilization is already dropping from the cycle peak. Utilization peaked at 79 percent in November last year, and stood at 77.5 percent in October. Year-over-year, it has now dropped for six straight months (Chart 3).

Similarly, at 48.6, November’s ISM manufacturing index was the first sub-50 reading in three years. Going back nearly five decades, only once has the Fed tightened when the red line in Chart 4 was sub-50. That was August 1980, with a 45.5 reading; the fed funds rate went from 9.5 percent to 10 percent. Paul Volcker, then-Fed chair, was trying to restrain runaway inflation. In fact, the tightening campaign had begun much earlier – in December 1976, with fed funds at 4.75 percent in late November.

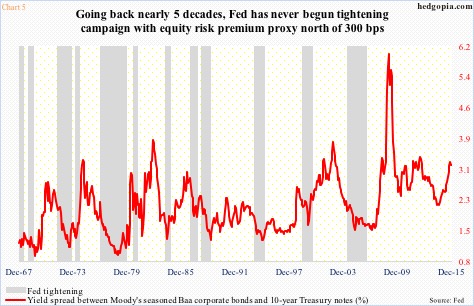

And last but not the least, Chart 5 plots the yield spread between Moody’s Baa corporate bonds and 10-year Treasury notes. Once again going back nearly five decades, the Fed has never begun a tightening campaign with the spread north of 300 basis points, which is the case now.

From this perspective, the Fed would be setting a precedent of sorts should it move tomorrow.

Rates have stayed too low for too long. Seven years of zero interest-rate policy have probably mispriced many an asset, price discovery is lacking, and there are signs of excesses in several assets.

The longer the Fed waits, the worse it gets. The problem is the timing, and the cycle the economy is in. The Fed needs monetary bullets before the next downturn hits.

The question is, would the markets let it? Any hint of a prolonged cycle would probably not be liked by markets currently expecting a ‘dovish hike’.

The Fed is in a tight spot.

Thanks for reading!