What a start? The year 2016 has gotten off to an ominous start. The S&P 500 large cap index is down 4.9 percent in the first four sessions – the worst four-day start to a year. Some others like the Russell 2000 small-cap index are worse, down 6.3 percent.

What may have triggered this?

There is plenty of blame to go around.

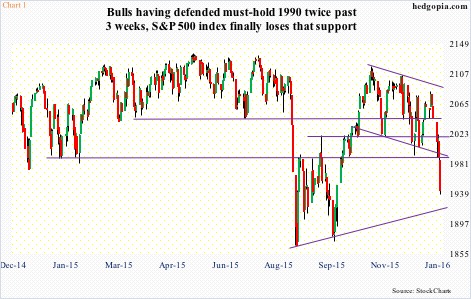

The U.S. bull market is aging. It is merely two months from completing its seventh year – hence only natural that wrinkles begin to show up. The S&P 500 has essentially gone sideways since February last year. And although it peaked in May last year, it was testing those highs as early as last November (Chart 1).

Earnings likely have peaked. Operating earnings of S&P 500 companies for 2015 are now estimated at $106.38, down from $113.02 in 2014 (actual) and from as high as $137.50 (expected) at the end of 2Q14! This year’s estimates, currently $125.56, have been coming down, but will need to grow 18 percent over 2015 to be realized. Probably a pipedream.

Both these factors have become a victim of an economy that, post-Great Recession, always struggled to get going. In six months, the U.S. economy would have expanded for seven years – maturing fast.

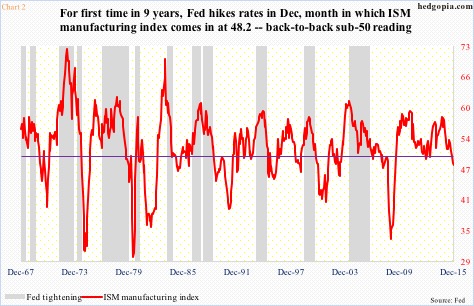

In December, the ISM manufacturing index recorded its first back-to-back sub-50 reading in the current expansion (Chart 2).

Last but not the least, the Fed last month hiked short-term interest rates. The Fed funds rate was zero-bound for nine years. The irony is that the Fed is having to tighten even as the U.S. economy is downshifting (refer to Chart 2). Yes, it is trying to fill its conventional monetary quiver, which is empty, with arrows, but in all probability a year too late. Hence the rattled investor nerves.

With that said, none of these factors are entirely new. They have been around, are well-known, and may already be in the price.

Then there are a couple of other factors that right at this moment could be playing a bigger role in fraying investor nerves.

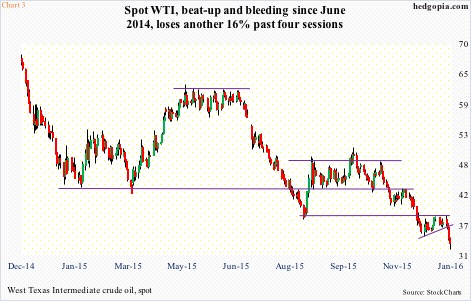

(1) Crude oil has gone through a lot since June 2014, with spot West Texas Intermediate down nearly 70 percent, in the process shattering one after another support (Chart 3). Since the middle of December until last Thursday, the WTI went flat to slightly up. It looked like a 10/20 crossover (daily average) was in the making – potentially a bullish development.

Come Monday, things changed – fast. Between intra-day high and low, the WTI lost 16-plus percent in four sessions. The growing tension between Iran and Saudi Arabia probably played a role. Saudi Arabia already cut the prices it charges for crude oil in Europe.

Iran will soon be exporting oil, so the Saudi move can be seen as a preemptive move to hurt its neighbor. Besides, in a market already oversupplied, Iran’s entry potentially worsens the global supply/demand imbalance.

More worrying, oil’s persistent inability to attract bids is not a vote of confidence in the global economy, which stocks are probably beginning to reflect. Using this logic, oil needs to stabilize for stocks to stabilize.

(2) Then we have the yuan.

Last August, an abrupt near two-percent devaluation of the Chinese currency roiled global markets. Yesterday, the People’s Bank of China cut the reference rate by the biggest amount since that devaluation. China could be looking to help its exporters, but the move could force competitive devaluation from peers, particularly Asian counterparts.

This could already be causing capital flight. China’s foreign exchange reserves were down $108 billion in December and down $513 billion in 2015 – perhaps a sign that outflows are accelerating in response to the yuan drop.

Once the yuan got included in the IMF’s reserve currency basket, the door was open for policymakers to use the currency as a tool. Markets are beginning to bet that the it is headed lower still, which can have repercussions across asset classes. The yuan needs to stabilize for stocks to stabilize.

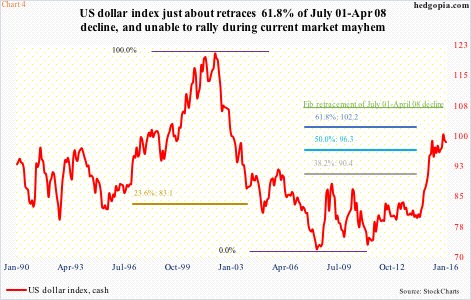

Incidentally, the non-movement in the dollar amidst this carnage is not a confidence-booster for dollar bulls. Yes, the Japanese yen is the pre-eminent risk-averse currency and yes the euro has become a safe-haven proxy along with the yen, but could the US dollar index’s inability to break out on the current market mayhem is a sign that it has peaked?

Indeed, it has just about retraced 61.8 percent of the July 2001-April 2008 decline – perfect spot for pause/reversal in trend (Chart 4). If it has peaked, this in due course can be positive from the perspective of both (1) and (2).

For now, during the current market mayhem, also behaving rather uncharacteristically is spot VIX, which on December 14th shot up to 26.81 before reversing hard. The S&P 500 yesterday undercut the intra-day low in that session by 2.7 percent – losing crucial 1990 – yet VIX was unable to surpass the intra-day high back then (Chart 5).

One way to explain this is that investors/traders are not panicking to buy protection. Either they were already protected or do not anticipate bigger decline in stocks. Using this logic, in the worst-case scenario, the S&P 500 goes and retests August and September lows (Chart 1).

Before that happens, exhaustion footprints should begin to show up in VIX. Keeping an eye out for a spike-reversal.

Thanks for reading!