The Russell 2000 Wednesday broke out of 1450s, although bulls were forced to retest the breakout in the very next session. Wednesday’s low-volume breakout comes against the background of a collapse in small-cap earnings this year and elevated optimism next year.

Bulls and bears have been dueling around 1450s on the Russell 2000 small cap index since late May. A breakout early June was repelled at the upper bound of a rising channel from March, while a breakdown mid-June was defended at 1330s, and several times after that, at the lower bound of that channel (Chart 1).

A week ago, the index fell out of the channel. Bears nevertheless were unable to seize the opportunity. Bulls lost the channel but defended the 50-day moving average for several sessions before gapping up Wednesday for a 3.5-percent rally through 1450s; the 200-day was taken out as well. Bulls were forced to defend the breakout in the very next session. Thursday, the Russell 2000 tagged 1460.48 intraday, closing at 1467.56 – right on the 200-day.

Wednesday’s thin-volume surge came out of nowhere. Conceivably, shorts covered after longs successfully defended the 50-day and reclaimed the 200-day. At the end of June, short interest on IWM (iShares Russell 2000 ETF) jumped 30 percent period-over-period to 124 million shares. If short squeeze is what led to Wednesday’s move, then the breakout is not standing on firm ground.

Wednesday’s strong price action also comes amidst a collapse in this year’s earnings estimates. At this point in time, with six months to go, small-cap investors probably do not care much about 2020 earnings.

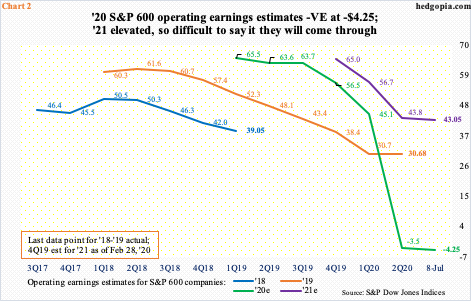

As of Wednesday last week, the sell-side expected S&P 600 companies to lose $4.25 this year. Next year, they are expected to ring up $43.05. When it is all said and done, if earnings end up anywhere remotely close, small-cap bulls will be justified for their optimism.

However, one need to also take into account the prevailing revision trend, which has been in a sharp downtrend. In February last year, S&P 600 companies were expected to earn $67.63 for this year. For that matter, in February this year, 2021 was expected to bring in $64.96, which has now been cut down by one third. Hence the difficulty in having a high level of conviction in 2021 estimates.

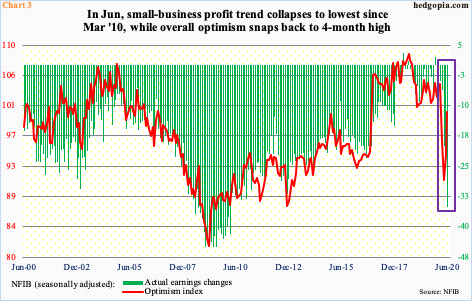

Small businesses are beginning to yet again sound optimistic, but even here there is a divergence. In June, the NFIB optimism index increased 6.2 points month-over-month to 100.6 – a four-month high. In April, the index got down to 90.9. After three months of 90s readings, optimism is back above 100. Before this, the metric continuously remained north of 100 from December 2016 to February this year.

However, the May-June U-turn in the overall index is diverging with the profit trend (box in Chart 3). The ‘actual earnings changes’ sub-index in June dropped nine points m/m to minus 35, which was the lowest since March 2010. The two variables otherwise tend to move hand in hand.

If small businesses are right in their optimism, then the earnings picture will have substantially improved next year. The more the number of investors who buy into this optimism, the easier it should get breaking out of 1450s. As things stand, bulls are trying to save the breakout, while bears are not willing to throw their hands up quite yet.

Thanks for reading!