- Bounces are normal within established downtrends

- 2015 starts out lousy; selling/shorting rallies ka-ching so far this year

- Should Draghi disappoint next week and U.S. stocks get sold, weakness probably gets bought

For ardent believers of “as goes January, so goes the year”, 2015 has not quite gotten off to a good start. The month is only half way through, so there is plenty of time to recover. The tape on the other hand does not act very well.

The Russell 2000 small cap index cannot get going. The National Federation of Independent Business’s optimism index came in at 100.4 in December – highest since October 2006. Small-cap bulls were not able to capitalize on it on Tuesday.

The S&P 500 large cap index has only risen in two out of the 10 sessions so far this year. Rally attempts are consistently getting sold/shorted at resistance. Which is typical in a downtrend. Yesterday, the index opened in the green, pushed a little higher in the very first five minutes, then was pushed down hard amidst a wave of selling near the September 2014 high.

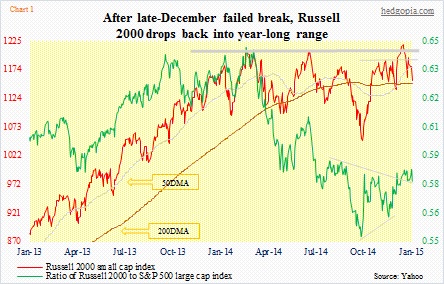

Major indices are approaching crucial levels. The Russell 2000 (1155) is a stone’s throw away from its 200-day moving average, which has flat-lined and seems to be in the process of turning down (Chart 1). The S&P 500 (1993) is one percent away from the December low of 1973. For its own good, the index cannot be undercutting that. There must be tons of stops right underneath.

Bulls must be hoping one of these three scenarios plays out. (1) The S&P 500 does not violate that December low. (2) It gets violated, but the index finds support at 1966, its 200-day moving average. And (3) the average, still rising, manages to rise in the next few sessions to approximate the December low, thus combining into stronger support, which holds.

From this perspective, bulls probably view it as positive that the four major U.S. banks (BAC, C, JPM, and WFC) are done reporting. The damage has been done. All four disappointed, and were punished hard post-earnings. Jefferies, which is on a November quarter, was not a one-off disaster when in December it reported lousy numbers.

Next week, we will hear from tech in earnest. Now here is the thing.

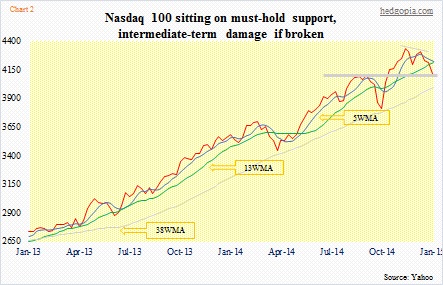

INTC reported its 4Q after close yesterday. Numbers were good. But 1Q15 outlook was not. It expects between $13.2bn and $14.2bn in revenues, against consensus expectations of $13.8bn. The mid-point of the guidance was a slight miss, not beat. Given the run it has had (this thing was up 45 percent last year!), longs will probably take this as an opportunity to cut back/lock in profit. The stock cannot be losing support at 35. This is important not only for INTC but also because the Nasdaq 100 is literally sitting on crucial support (Chart 2).

If Intel is a canary in the tech mine – as was Jefferies in the financial mine – then there is not much hope for that support (on the Nasdaq 100) to hold. AAPL in particular does not act well. The indicators we follow are far from washed out. Intermediate-term, technicals have room to go lower before the overbought conditions they were in are unwound.

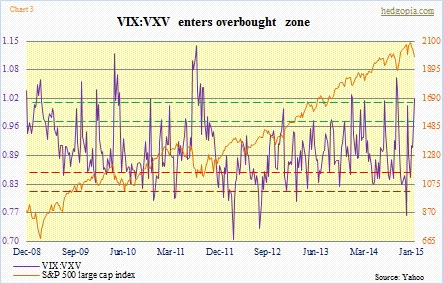

But these things do not move in a straight line. Even within established downtrends, there are bounces. And one is probably due. The VIX is yet to flash a spike-buy signal, but the ratio of VIX to VXV is getting overbought (Chart 3). People are willing to pay much more for near-term protection than further out.

Next week is crucial. If Mario Draghi, ECB president, disappoints on the 22nd, a QE that has been priced in will get unwound quickly, and that will ripple through markets – from currencies to equities to fixed income. The European markets are not betting on that outcome. Both the French CAC 40 index and the German DAX composite rose two-plus percent yesterday responding to the Swiss National Bank ditching a three-year-old anchor to the euro. The thinking is, the SNB is pre-empting an ECB move that will result in a lower euro. But just in case markets are disappointed and U.S. stocks get sold, that sell-off probably gets bought. Whether that merely results in a dead-cat bounce or a decent rally remains to be seen.