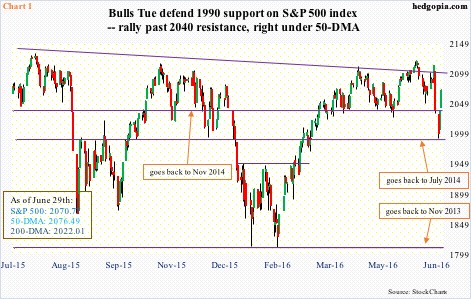

Equity bulls put the foot down where they could possibly have. Support at 1990 on the S&P 500 large cap index was defended on Monday (Chart 1). This followed a post-Brexit 5.3-percent dive in just a couple of sessions. Using Monday’s intra-day low, the two-session drop would have been 5.8 percent. The 5.3-percent swoon is the steepest decline over two sessions since August 24th last year.

Off the Monday low, the index has rallied four percent. In a couple of sessions! A whole host of things could have contributed to this – from month/quarter-end buying to oversold technicals to “easing” Brexit fears to plain-vanilla short squeeze – or any combination thereof.

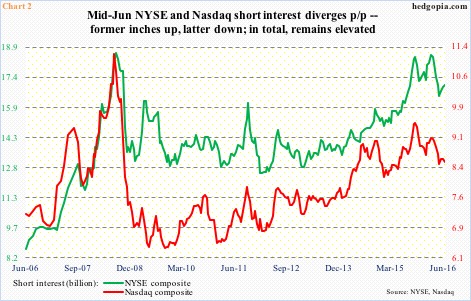

Going by index-based short interest, there was not much change in mid-June – up 0.6 percent period-over-period on the NYSE and down 0.7 percent on the Nasdaq – but historically short interest remains elevated on both, particularly the former (Chart 2).

Once 1990 held on the S&P 500, it would be logical for shorts to get out of the way for now, and wait for the next opportunity. This support stretches back to July 2014 (Chart 1), and has proven to be an important price point. Bulls and bears have fought quite a few tug of wars around here.

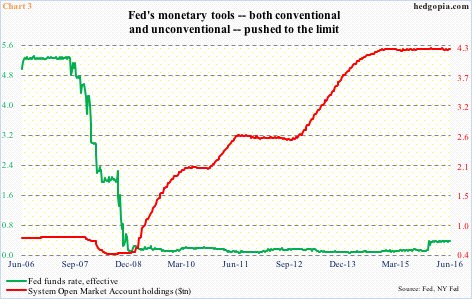

Markets are hoping Brexit would cause major central banks to unleash a coordinated easing action. Though the fact remains that there is not much left in their tool box. The Bank of Japan and the European Central Bank have gone so far as to push their respective benchmark interest rates into negative territory.

In the U.S., the Fed’s monetary tool box – both conventional and non-conventional – has been pushed to the limit. Last December, the fed funds target rate was pushed up by 25 basis points to a range of 0.25 percent to 0.5 percent. This was a first rate hike in nearly 10 years (Chart 3). Right around the time the fed funds rate was pushed to near zero, the Fed began quantitative easing. At the time, SOMA (System Open Market Account) holdings were less than $500 billion. After three iterations of QE, they are now north of $4.2 trillion.

Things have to get really bad before central banks try to pull another rabbit out of their essentially empty monetary hat.

For now, in the past couple of sessions, oversold technicals have done the trick. The 5.3-percent drop on the S&P 500 within a span of two sessions was too much, too quick. The Monday drop not only pushed the index below its 200-day moving average but also lower Bollinger Band.

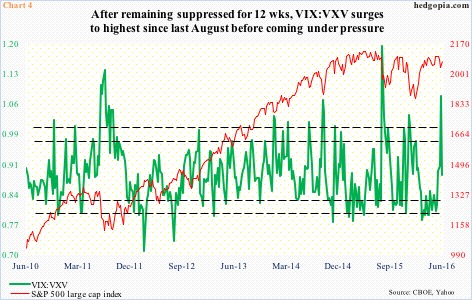

Demand for short-term protection was very high. The VIX-to-VXV ratio last Friday jumped to 1.076 – the highest since last August (Chart 4). This followed several weeks of suppressed readings in oversold zone. The Friday surge pushed it into the other direction, hence rising odds of unwinding, which the ratio is in the midst of.

Rather revealingly on Monday, the S&P 500 lost another 1.8 percent, on the heels of a 3.6-percent drop last Friday. Spot VIX briefly surpassed last Friday’s high, then sold off hard (dark blue arrow in Chart 5). In the end, it shed nearly two points… this on a down day for the S&P 500! That was a tell. On Tuesday and Wednesday, the S&P 500 witnessed a powerful two-day surge.

If Monday’s low held, without getting retested in the next few weeks, this would be quite different from what transpired in the prior two decent sell-offs. Back in August last year and January this year, stocks sold off hard. After the initial trough, and the subsequent rally, those lows were successfully tested in September and February (Chart 1). The rallies that followed were massive on both occasions.

Should the S&P 500 follow that playbook, one area where shorts can begin to get active is the 50-day moving average, which is now slightly dropping and merely six points away. In this scenario, spot VIX can have a successful breakout retest (Chart 5). It is literally sitting on the upper bound of the range it was in.

The problem with this scenario is that momentum near-term is definitely with the bulls, with daily oversold conditions needing to be unwound on major U.S. indices. VIX:VXV has room to go lower (Chart 4).

Medium-term, however, bond vigilantes are not acting in unison with stocks. Monday through Wednesday, the 10-year Treasury yield essentially went sideways.

Thanks for reading!