Bull markets need fuel for continued push higher.

Money can leave other asset classes, such as bonds, and into stocks. Or, they can come out of, let us say, money-market funds into stocks. Foreigners can raise net purchases of U.S. stocks. Corporations can buy back more than they issue. Investors can simply lever up, with a rise in margin debt. And, last but not the least, bears can provide a helping hand.

In the latter’s case, they become so convinced in their bearish thesis that they continue to push up short interest. In the end, that becomes a contrarian signal. Bulls get the opportunity to climb a so-called wall of worry.

We are witnessing one right now.

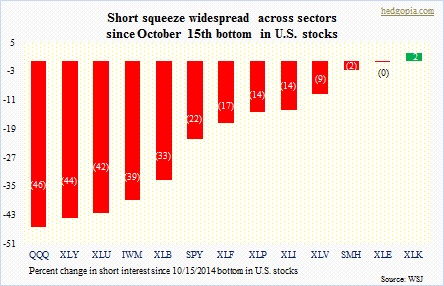

As the chart above shows, since the mid-October bottom in U.S. stocks, there has been a significant decrease in short interest in several sectors. (While creating the chart, short interest has been used as of mid-October. Keep in mind that, in several ETFs, short interest peaked after that date. QQQ, for instance, was 69mn mid-October and peaked at 79mn end-October. XLF was 143mn mid-October and 155mn mid-November. XLK was 14mn mid-October and 20mn mid-December. SMH was 16mn mid-October, and 20mn end-Oct. So if we use most recent highs, short interest would have declined even more. Nonetheless, using mid-October gives us a good reference point.)

Needlessly to say, short squeeze has helped big time since mid-October. The only question is, is there more to come?

On both Nasdaq and NYSE, short interest peaked mid-October at multi-year highs. They currently stand at 8.2bn and 15.1bn – down 9.4 percent and 4.4 percent, respectively from those highs. Nonetheless, they remain high historically. And this is definitely a tool that bulls can use to their advantage. The question is, can they? Last week’s action in stocks, with some breakouts, has probably already resulted in some sort of a squeeze. We will find out when numbers are reported next week.

As things stand now, bulls have momentum behind their back, and it is their loss if they cannot squeeze out more bears.