- U.S. unemployment claims near historical lows, job cuts subdued

- In a sea of stability, could an ocean of troubles be lurking?

- Crude drop in oil price has potential to throw a curve

It is always cheap – and prudent – to buy a sweater in the summer. Winter is when customers get gouged. This so applies to the investing world. When things look too good to be true, that is the time to be thinking about what might cause that to end.

One of the consistent themes on this blog has been the current sub-par growth in the U.S. economy and why that would continue to be the case. Nearly 2.7mn new jobs have been created in the first 11 months this year. But in the big scheme of things the recovery remains sub-par. Six years into it, only 1.7mn more people are employed now versus the prior peak in January 2008. Since the recovery began, U.S. population has grown by nearly 10mn.

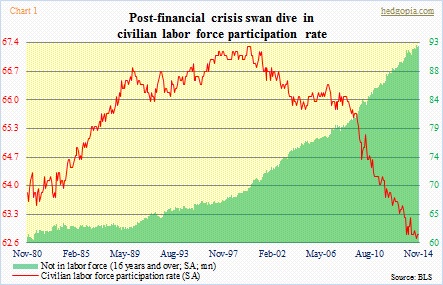

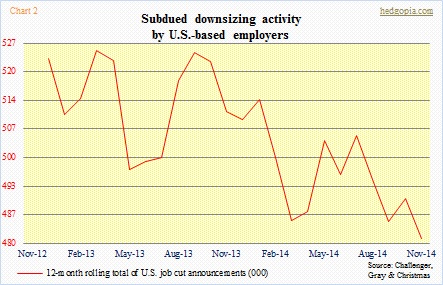

But within that, the labor market is beginning to look tight. Since the recovery began, the ‘not in labor force’ category has gone up by more than 11mn (Chart 1). Corporations are not really gung-ho about hiring, but at the same time are keeping what they have. Layoffs have not picked up (Chart 2). The 12-month running total of job-cut announcements in November was 481k, down from 514k in January this year (courtesy of Challenger, Gray & Christmas).

This fact is reflected in the weekly unemployment claims. One look at Chart 3 and it is easy to see they are hovering near historical lows. Going back decades, the four-week rolling average has tended to bottom out around 300k, which is where we are at currently. This is the good part. Going back to that sweater analogy, this is also the time to be looking out of the corner of one’s eye – try to spot lurking problems.

The way things are looking now, it is not even on the radar screen of the majority of investors. At least that is the signal coming out of the stock market. The economy is doing just fine, with improvement expected in 2015. Ditto with corporate earnings; reported profits for S&P 500 companies are expected to grow 23 percent next year (no, not a typo). So why worry? That is the consensus thinking.

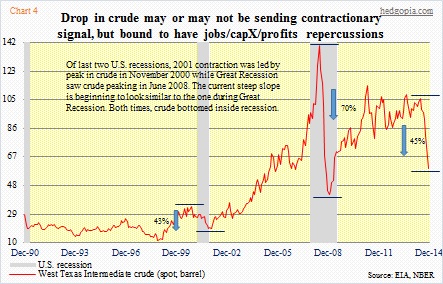

In fact, a reason for worry could very well be in the making. The debacle that is unfolding in the oil pit is no news (Chart 4). What is not known is the extent of damage it can potentially cause in the realms of capital expenditures, employment, and profits. Deutsche tells us that the energy sector accounts for one-third of S&P 500 capex. Earnings estimates for the sector in the current quarter are now in the negative territory – -14.6 percent versus 6.6 percent as early as late September (courtesy of FactSet). We recently heard from the likes of COP and BP how they plan to cut back capex next year. There will be more.

The focus so far is on how cheap oil/gas prices are helping the consumers. Rightly so. This is as good a tax cut as one can get. There is also another side to the coin, however. And that will be less pleasant when it begins to unfold in earnest. And it will. Something to keep in the back of our minds while the going is good.