In the latter part of last week, tech delivered, helping the major US equity indices rally big. Two issues could make or mar this week. The FOMC meets, and two more tech behemoths report earnings.

The FOMC meets this week, and what comes out of it could prove to be crucial for risk assets.

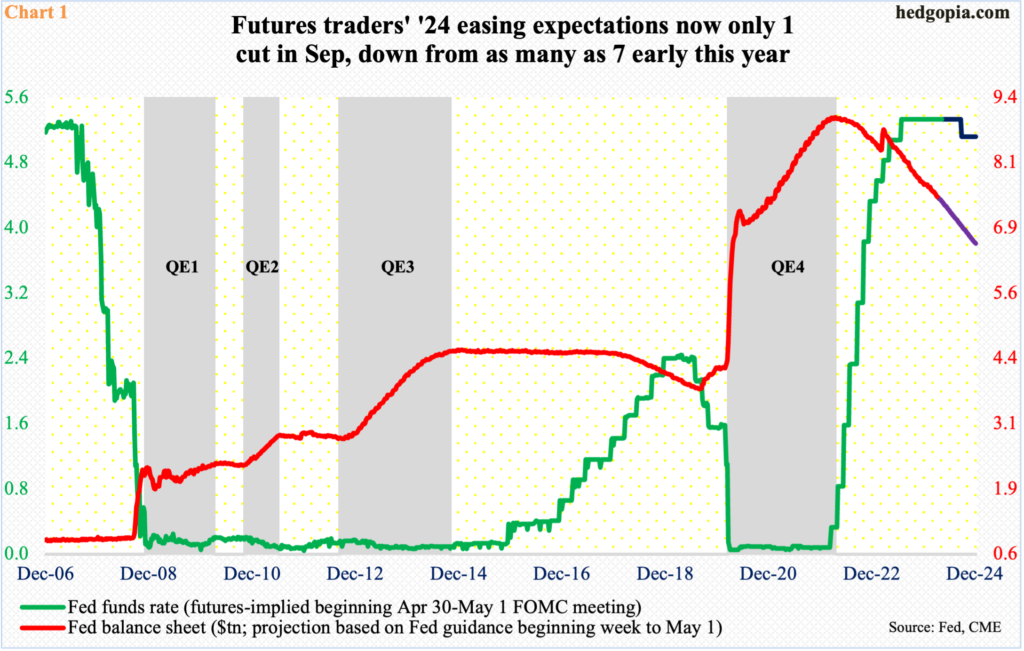

US stocks bottomed last October and took off post-December 13th FOMC meeting when Chair Jerome Powell made a dovish pivot. Soon, the futures market was consistently betting on as many as six 25-basis-point cuts this year – pricing in even seven at one point. This began to get modeled in analyst forecasts, and risk assets, including equities, shifted into higher gear.

Fast forward to now, futures traders now expect only one cut – in September (Chart 1). Earlier, the Federal Reserve tightened from a range of zero to 25 basis points in March 2022 to between 525 basis points and 550 basis points last July, even as it continues to shrink its still-inflated balance sheet.

Persistent strength in most economic data, including jobs, and sticky inflation has forced even the dovish FOMC members to change their tune and lean hawkish. There are some that are now vouching for no cut to maybe one cut. Until the March meeting, the dot plot expected three cuts this year.

It is possible Powell on Wednesday will lean hawkish outright, or at least not sound as dovish as in December or later. From risk assets’ perspective, the worse is if he openly espouses one cut, let alone talk about the possibility of a hike.

For tech investors, with tech-focused indices such as the Nasdaq 100 having rallied massively from last October’s low on optimism of loads of rate cuts, the interest-rate outlook matters. Thus the importance of this week’s FOMC meeting. Then, there is March-quarter earnings.

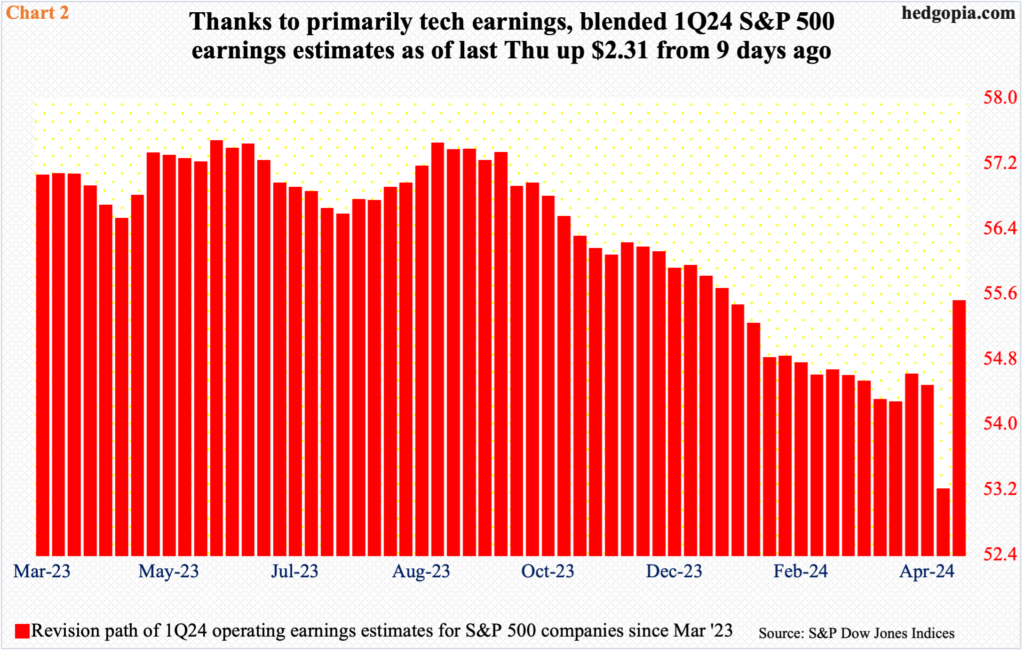

Last week, the big ones delivered. Facebook owner Meta (META) bettered the consensus estimates but its outlook came up short and was punished. Microsoft (MSFT) and Google owner Alphabet (GOOG), on the other hand, pleased investors with both their quarterly results and the outlook.

As a matter of fact, thanks primarily to tech earnings, the blended earnings estimates for S&P 500 companies as of last Thursday jumped $2.31 from nine days ago to $55.49, which is the highest since mid-January (Chart 2). This week, Amazon (AMZN) reports on Tuesday and Apple (AAPL) on Thursday. Going into this, AAPL’s estimates are flat to ever so slightly lower from a month ago, while AMZN’s is flat.

If both these events cooperate – FOMC and earnings – there is room for the Nasdaq 100 to continue to push higher.

Last week, the tech-heavy index jumped four percent to 17718. This followed four consecutive down weeks. Earlier, it posted a new intraday high of 18465 on March 21st but struggled to decisively break out of 18300s for seven weeks before sellers took control. By the 19th, the Nasdaq 100 ticked 16974, down 8.1 percent from the high.

Ahead, the 50-day, which is now slightly pointing lower, rests at 17939, with the index under the average for 10 sessions. At 18000 lies trendline resistance from last month’s high (Chart 3). Even in a scenario in which the index rallies, sellers probably will get active at this resistance.

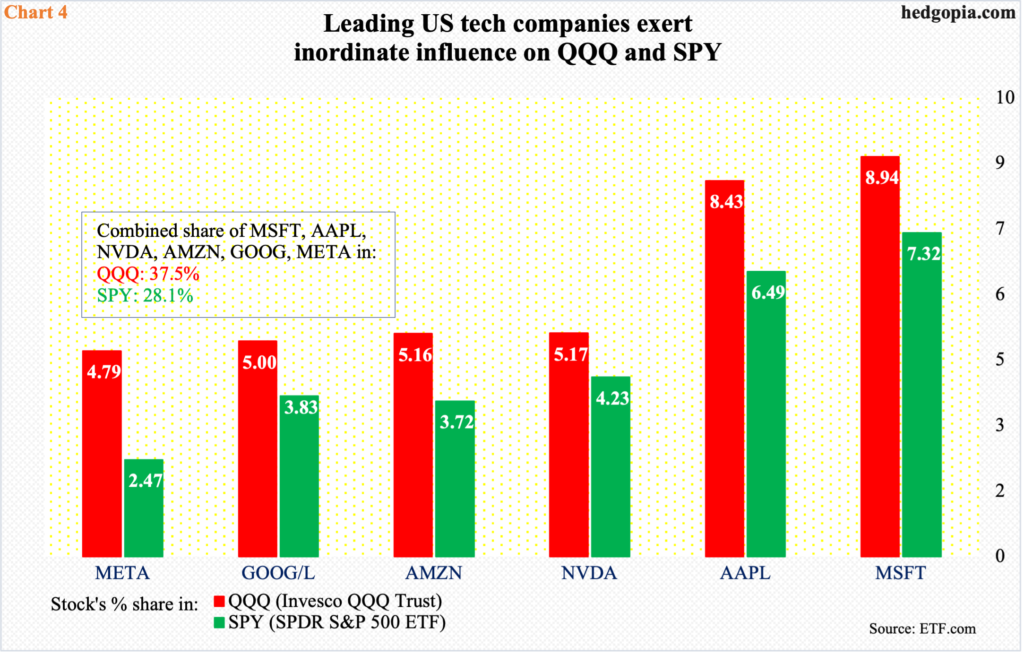

The S&P 500 is the other one to get impacted the most by this. Both these indices are market cap-weighted, and the bigger companies are obviously given bigger weights. The top six – MSFT, AAPL, Nvidia (NVDA), AMZN, GOOG and META – account for 37.5 percent of the Nasdaq 100 and 28.1 percent of the S&P 500 (Chart 4).

This is a massive amount of concentration in just a select a few. This cannot be considered healthy from many respects, but the fact remains that they are also the ones minting a lot of money with healthy margins.

If AAPL and AMZN deliver this week and the stocks rally, the share of the six will only expand.

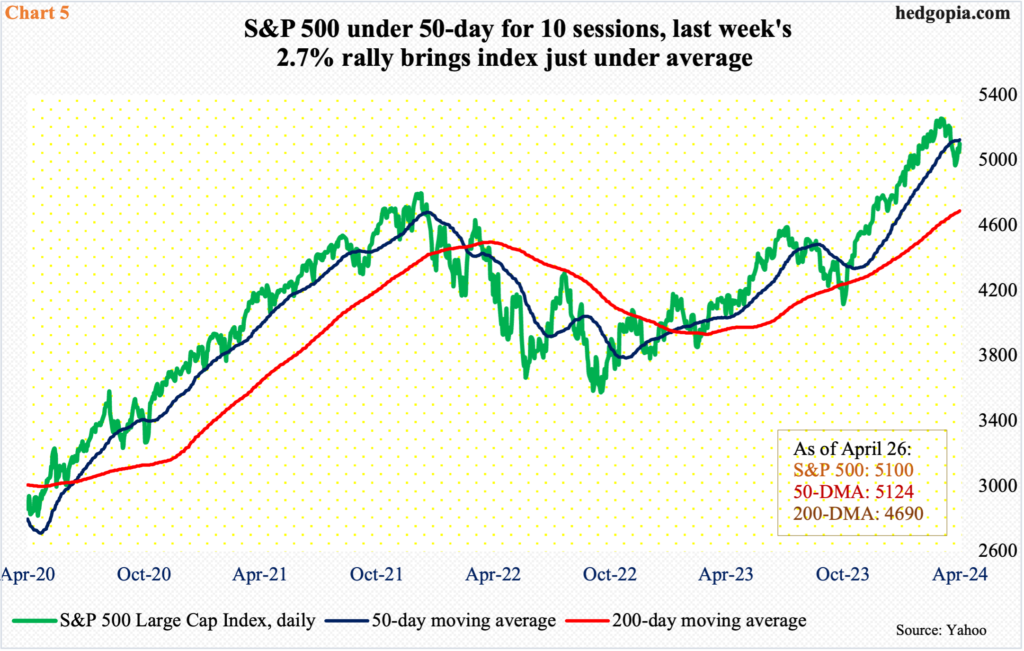

The two are reporting even as the S&P 500 finds itself just under the 50-day. Last week, the large cap index rallied 2.7 percent to 5100, with Friday’s intraday high of 5115 just about testing the average at 5124 (Chart 5).

The index has remained under the average for 10 sessions, having dropped for three weeks in a row before last week’s rally. Earlier, it ticked 5265 on March 28th and turned lower, failing to clear 5260s in three sessions over seven. Bulls put foot down at 4954 on the 19th – for a 5.9-percent drop from high to low.

Importantly, several daily indicators such as the RSI have now risen to the median. This is an opportunity for the bears to force the metric turn down, which will then lead to a reassertion of downward momentum. Bulls put their foot down last week, and they will have to do it again this week. For that, they will need help from both Powell and tech earnings.

Thanks for reading!