Investor sentiment is elevated. This is also evident in the CBOE put-to-call ratio and in VIX. Fund flows, however, continue to remain anemic even though the S&P 500 has rallied north of 20 percent from last October’s lows. Unless fund flows improve, sentiment will struggle to push into frothy territory, instead can begin to unwind.

Nothing changes sentiment like price.

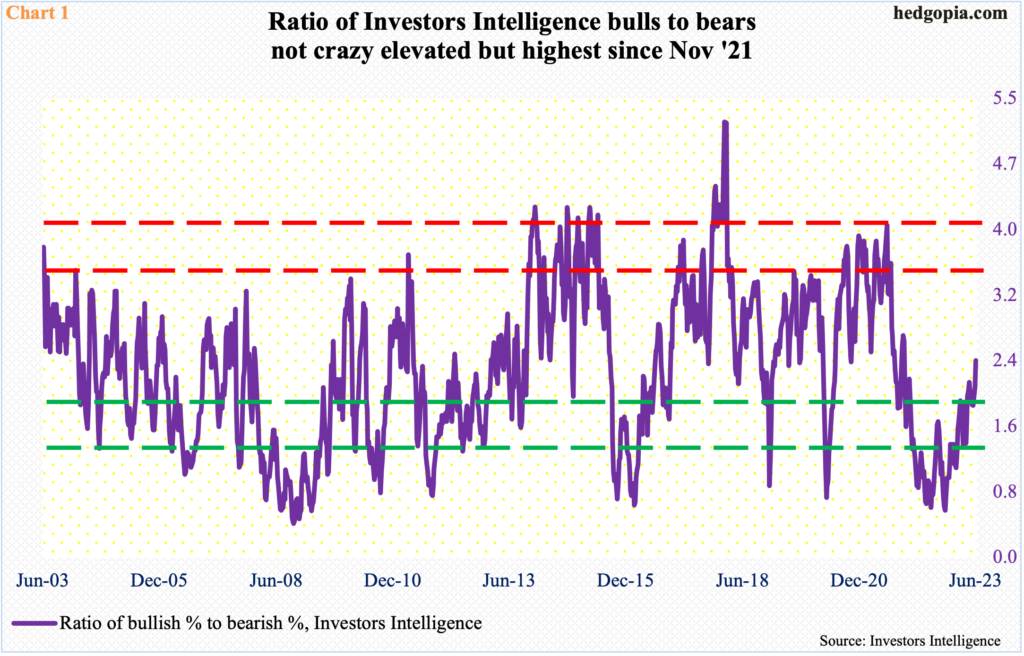

From the low of last October to Thursday’s intraday high, the S&P 500 large cap index jumped 23.1 percent. Back then, in the week to October 11, Investors Intelligence bulls were 25 percent and bears 44.1 percent, which respectively was the lowest since the week to February 10, 2016 and the highest since the week to October 12, 2011. Sentiment was very subdued back then and began to gradually improve as stocks began to rally.

This week (as of Tuesday), the bullish percent increased 3.4 percentage points week-over-week to 51.3 percent even as the bearish percent decreased 1.7 percentage points to 21.6 percent; sentiment had not been as high and low respectively since November 2021. As a result, the ratio between the two rose to 2.4 this week, which once again was the highest since November 2021 (Chart 1). This is not out-and-out frothy territory but does reek of equity bulls beginning to feel smug.

The options market is beginning to send the same vibes.

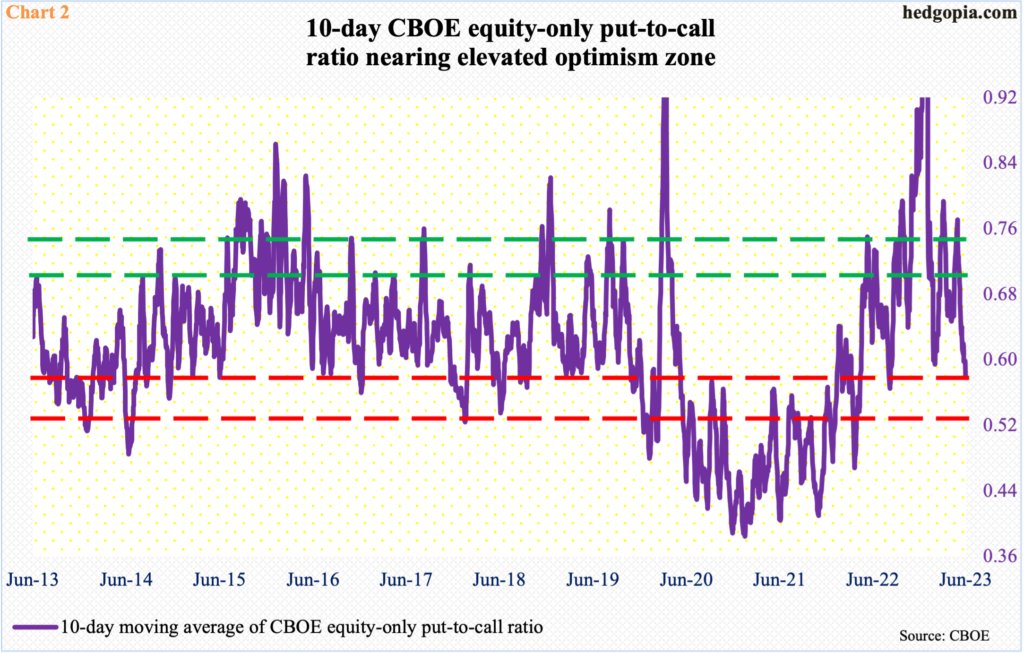

In 12 of the last 14 sessions, the CBOE equity-only put-to-call ratio produced readings in 0.50s, with the other two being in high-0.70s and low-0.80s. The 10-day average dropped to 0.58 on Thursday – reflecting quite a bit of optimism.

Nothing says the average cannot continue lower. In fact, in each of the last three years, the 10-day average dipped to 0.40s – even 0.30s in late 2020/early 2021 – before equities began to come under sustained pressure.

Similar to the Investors Intelligence sentiment, this metric, too, is not frothy yet but it is worth keeping in mind that several times in the past it began to reverse higher from current levels (Chart 2).

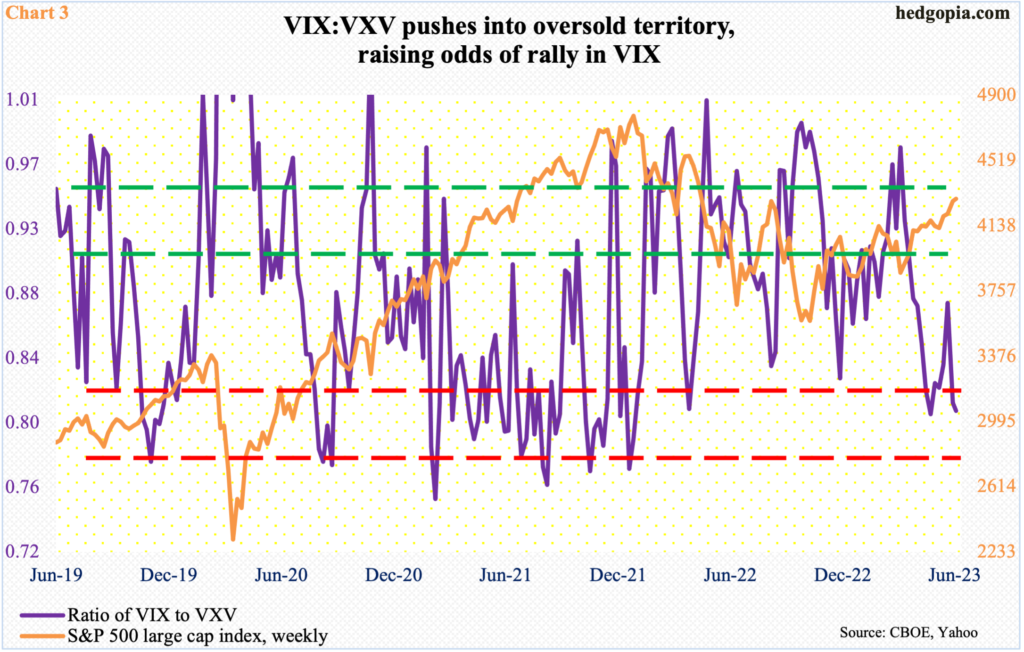

This is also the case with the ratio of VIX to VXV.

VIX measures market’s expectation of 30-day volatility on the S&P 500. VXV does the same, except it goes out to three months. When the investing climate is risk-on, as is the case currently, demand for VIX-derived securities is lower than, let us say, VXV. The opposite is true when sentiment wanes.

Currently, volatility is suppressed. VIX’s intraday low on Thursday of 13.53 was the lowest since February 2020.

This at the same time raises the possibility that volatility begins to go the other way – if nothing else just to unwind VIX’s oversold condition (Chart 3). In this scenario, demand for nearer-term protection should strengthen, in the process unwinding the currently oversold ratio between VIX and VXV. When that happens, volatility goes up and equities go down.

This may have to wait a little longer should fund flows suddenly reverse the current trend.

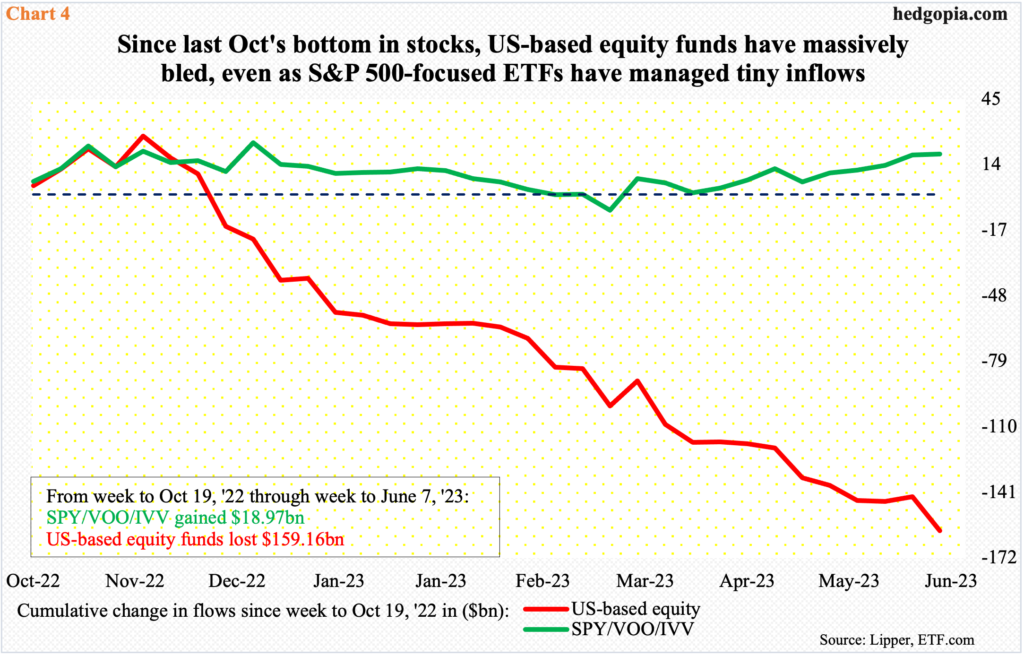

As things stand, improved sentiment among newsletter writers (which is what the Investors Intelligence survey measures) has not resulted in improvement in fund flows.

In the week to Wednesday, US-based equity funds lost another $16.6 billion (courtesy of Lipper). US stocks bottomed last year on October 13. From the week to October 19 through this week, these funds experienced redemptions of $159.2 billion. In contrast, S&P 500-focused three ETFs – SPY (SPDR S&P 500 ETF), VOO (Vanguard S&P 500 ETF) and IVV (iShares Core S&P 500 ETF) – during the period took in $19 billion (courtesy of ETF.com), but this pales in comparison to what has been lost elsewhere.

Unless this changes, it is hard to imagine the already elevated investor sentiment pushes further into frothy territory, in which case unwinding can begin sooner than later.

Thanks for reading!