April’s retail sales released last Friday were better than expected – up 1.3 percent month-over-month and up three percent year-over-year. This was the largest m/m increase since March last year.

Yet, the Treasury yield curve flattened in that session, with the two-year yield unchanged at 0.76 percent and the 10-year down four basis points to 1.71 percent.

The bond market seemed to be saying:

Either (1) the April strength was an aberration.

Indeed, most recent macro data have been on the weaker side. The U.S. economy only added 160,000 non-farm jobs in April. This compares with the year-to-date average of 192,000, the 2015 average of 229,000 and the 2014 average of 251,000. The ISM manufacturing index dropped a point m/m in April to 50.8, after staying sub-50 from October last year through February 2016.

Or (2) if the supposedly strong retail sales data convinces the Fed to tighten come June – or July for that matter – the economy would take another leg lower.

The U.S. economy is hardly booming.

Post-retail sales, the Atlanta Fed’s GDPNow forecast for 2Q16 rose from 2.2 percent three days ago to 2.8 percent. That said, this follows anemic growth of 0.5 percent in 1Q16 and 1.4 percent in 4Q15.

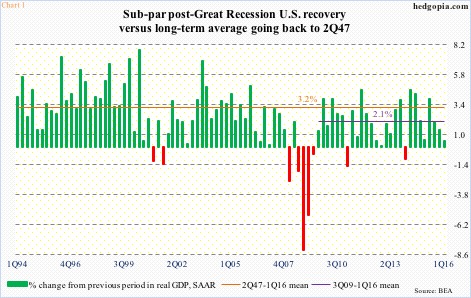

Subdued GDP growth is not some recent phenomenon. Post-Great Recession, real GDP has averaged a mere 2.1 percent, substantially weaker than the 3.2 percent average going all the way back to 2Q47 (Chart 1).

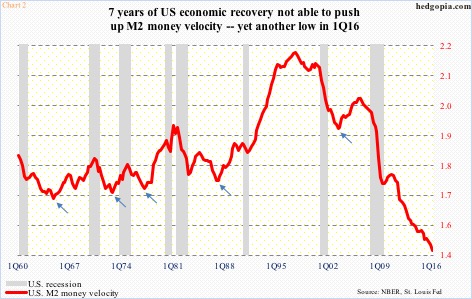

In the meantime, money velocity has collapsed. Unlike in the past when midway through the recovery M2 money velocity begins to turn up (arrows in Chart 2), this cycle has been like no other. Unless we optimistically – and irrationally – assume that the recovery is not even halfway through, the suppressed velocity is an enigma. At 1.458, it just made a new low in 1Q16. When the recovery started, velocity was 1.712.

Ironically, M2 money supply has been growing at an annual rate of five to six percent for at least four years now, much faster than growth in nominal GDP. The difference should have been made up by higher inflation. But that is not the case.

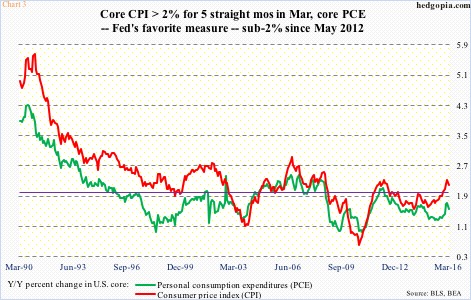

At least going by government’s popular inflation measures, consumer inflation is missing in action. In the past five months through April, core consumer price index (CPI) has risen at north of two percent. Prior to this, the last time core CPI rose at two percent was in February 2013. Similarly, the last time core personal consumption expenditures (PCE) – the Fed’s favorite inflation measure – increased at two percent was in April 2012 (Chart 3).

Blame the decline in money velocity.

With this as a background, is it any wonder the 10-year Treasury yields less than two percent? The last time these notes yielded north of three percent was in January 2014. The last time it closed north of two percent was in late January this year.

In fact, the 10-year has been trading within a descending channel since late December 2013. Within that downtrend, since early last year, it has found a floor in the 1.65-1.7 percent range. Barring a drop in July 2012 to 1.39 percent (arrow in Chart 4), this support goes back to September 2011.

Once again, the 10-year has been testing that floor.

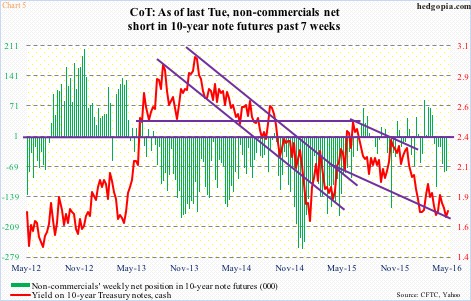

Non-commercial traders in 10-year note futures are positioned to benefit if that floor holds and the 10-year heads higher. Since late March this year – in the past seven weeks through Tuesday last week – they have been net short (Chart 5).

If instead the 10-year breaks this floor and the non-commercials get squeezed, we are looking at a potential breakout on TLT, the iShares 20+ year Treasury bond ETF.

TLT (131.14) is right underneath crucial resistance at 132.50, which goes back to early last year (Chart 6). Over that period, there have been a couple of false breakouts (arrows). For it to potentially break out, macro data probably needs to massively deteriorate from here on, with a clear dovish shift within the FOMC.

Technically, TLT’s daily conditions are grossly overbought. Last Friday’s high of 132.32 nearly tagged the upper Bollinger Band. Yesterday, it fell 0.9 percent, and odds favor it continues to come under pressure – at least near-term.

As things stand, safer play is from the short side.

Thanks for reading!