From a bear call spread to now short IWM, the iShares Russell 2000 ETF, a decision time is at hand.

Hypothetically on May 26th, a June 5th 125/126.50 bear call spread was opened for a credit of $0.56 (short 125 for $0.91 and long 126.50 for $0.35). The ETF traded at 124.43 then.

Last Friday, it closed at 125.40. In this scenario, the short call gets assigned. With the premium collected, it is an effective short at 125.56.

So what next?

Small-caps (represented by IWM) have been leading large-caps (represented by SPY, the SPDR S&P 500 ETF) since early May. The ratio between the two yesterday. The S&P 500 index shook off early weakness yesterday to close the session essentially unchanged, bouncing off its 150-day moving average. IWM rallied strong off intra-day lows and is literally sitting on its 50-day moving average.

More often than not, small-caps’ outperformance can be viewed as a sign that investors are preferring risk-on. At the same time, this risk-on behavior is not evident across the board. The ratio of XLY, the SPDR Consumer Discretionary ETF, to XLP, the SPDR Consumer Staples ETF, peaked last Friday. The ratio of HYG, the iShares High Yield Corporate Bond ETF, to LQD, the iShares Investment Grade Corporate Bond ETF, peaked a month ago, even though it has gone more or less sideways since.

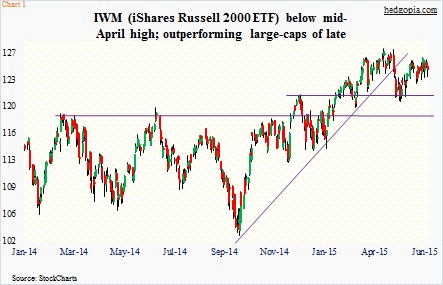

Of late, though, small-caps have caught the fancy of investors. IWM (124.41) still trades below its mid-April high and six weeks ago lost the October 2014 trendline (Chart 1). Nonetheless, it has not stranded too far away from its 50-day moving average.

So it is probably too soon to wonder if small-cap outperformance ended yesterday.

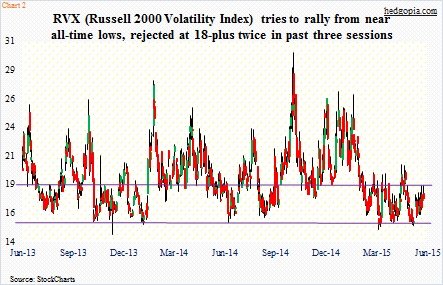

On RVX, the Russell 2000 volatility index, resistance at 18 goes back several years. Once again, this is proving tough to break. The price was tagged once last week as well as yesterday, only to reverse (Chart 2). On a daily basis, RVX is overbought, hence can come under pressure. Let us see if small-cap bulls can take advantage of this.

Speaking of volatility, once again VIX got rejected at 15 yesterday. This was a fifth attempt in the past six sessions, and only once has it been able to close above that level. This has happened even as conditions are getting overbought near-term. This is as good an opportunity as any for S&P 500 bulls to push the index higher. Going back at least a couple of years, barring the nearly 10-percent decline in September-October last year, the index has found support at its 100-day moving average. Currently, it is under that, but only by five points. What happens here has the potential to also dictate the fate of IWM near-term.

Wait-and-see for now.

Thanks for reading!