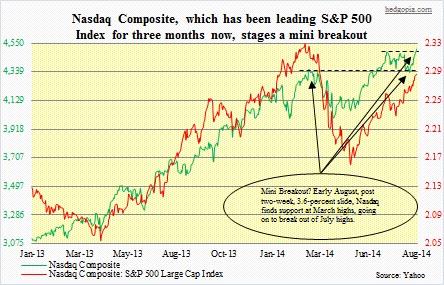

The Nasdaq Composite (4508.31)has managed to pull off a mini breakout, and is trading above the level identified previously. As a matter of fact, indices/ETFs such as the S&P 500 Large Cap Index and XLF (financials) have convincingly taken out those levels, whereas SMH and IWM have done so rather unconvincingly. The Dow is a laggard. It lagged its two other major brethren (Nasdaq and S&P 500) going into the latest rally, as it was the only one to have tested its 200-day moving average in the mid-July to early-August slide. So far into the rally, the Nasdaq clearly leads. It has not only rather quickly erased the 3.6-percent decline, but has also notched a 14-year high, and a mini breakout to boot. On a relative basis, it has led large cap-laden S&P 500 Index for three months now. Early this month, buyers showed up near March highs (Nasdaq) on cue. Volume remains anemic, and this must be helping the bulls. At a time when buyers are on strike, it does not take much to stage a breakout. Yesterday, the index gapped up, gave back some of the early gains in the first 15 minutes, then buyers stepped in at July highs. A classic case of resistance turned into support.

The Nasdaq Composite (4508.31)has managed to pull off a mini breakout, and is trading above the level identified previously. As a matter of fact, indices/ETFs such as the S&P 500 Large Cap Index and XLF (financials) have convincingly taken out those levels, whereas SMH and IWM have done so rather unconvincingly. The Dow is a laggard. It lagged its two other major brethren (Nasdaq and S&P 500) going into the latest rally, as it was the only one to have tested its 200-day moving average in the mid-July to early-August slide. So far into the rally, the Nasdaq clearly leads. It has not only rather quickly erased the 3.6-percent decline, but has also notched a 14-year high, and a mini breakout to boot. On a relative basis, it has led large cap-laden S&P 500 Index for three months now. Early this month, buyers showed up near March highs (Nasdaq) on cue. Volume remains anemic, and this must be helping the bulls. At a time when buyers are on strike, it does not take much to stage a breakout. Yesterday, the index gapped up, gave back some of the early gains in the first 15 minutes, then buyers stepped in at July highs. A classic case of resistance turned into support.

Where to from here?

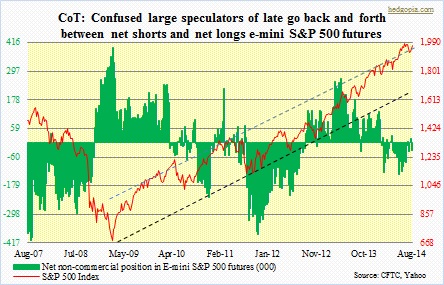

While the lack of volume continues to point to the fragile nature of this rally, price action must be respected. Monthly charts are so extended when selling begins in earnest it is bound to be ugly. But we could have said the same thing six months ago, a year ago, perhaps longer. For now, the S&P 500 Index (1971.74) has retaken its 50-day moving average, and 2k is just a stone’s throw away. Will it get there, or near its recent highs? Probably. Will it stay there? That is the question. Medium-term, the VIX has turned lower and looks to want to go lower. Should that happen, that will put upward pressure on the S&P 500 in particular and equities in general. We might get some clues this Friday in the futures pit when the CFTC reports positions as of today. Remains to be seen if large speculators take the recent strength in equities as an opportunity to add to net shorts. As of last Tuesday, they were net short 33k contracts in E-mini S&P 500 futures, but in recent weeks have acted indecisive, vacillating between net longs and net shorts. One more clue can come this Friday, when Fed Chair Janet Yellen speaks at Jackson Hole. The likelihood of her shifting policy from dovish to hawkish is essentially zero. She is focused on the labor market and believes more can be done on that front. A telltale sign will be market participants’ reaction to a continued dovish tone. Or did they react already to what might come out of Jackson Hole?

While the lack of volume continues to point to the fragile nature of this rally, price action must be respected. Monthly charts are so extended when selling begins in earnest it is bound to be ugly. But we could have said the same thing six months ago, a year ago, perhaps longer. For now, the S&P 500 Index (1971.74) has retaken its 50-day moving average, and 2k is just a stone’s throw away. Will it get there, or near its recent highs? Probably. Will it stay there? That is the question. Medium-term, the VIX has turned lower and looks to want to go lower. Should that happen, that will put upward pressure on the S&P 500 in particular and equities in general. We might get some clues this Friday in the futures pit when the CFTC reports positions as of today. Remains to be seen if large speculators take the recent strength in equities as an opportunity to add to net shorts. As of last Tuesday, they were net short 33k contracts in E-mini S&P 500 futures, but in recent weeks have acted indecisive, vacillating between net longs and net shorts. One more clue can come this Friday, when Fed Chair Janet Yellen speaks at Jackson Hole. The likelihood of her shifting policy from dovish to hawkish is essentially zero. She is focused on the labor market and believes more can be done on that front. A telltale sign will be market participants’ reaction to a continued dovish tone. Or did they react already to what might come out of Jackson Hole?

Technically, if the S&P 500 takes out its July highs, as has the Nasdaq already, the possibility of a rather hurried rally past 2k is there. This then opens up the probability of a major peak. October is known for that. A safer route would be this: equities turn back down soon, successfully test recent lows and recharge for another go at 2k. The more a resistance is beat from underneath, the higher the odds that it cracks. After all, the S&P 500 Index is struggling to stay near/above the upper end of a five-year trend channel.