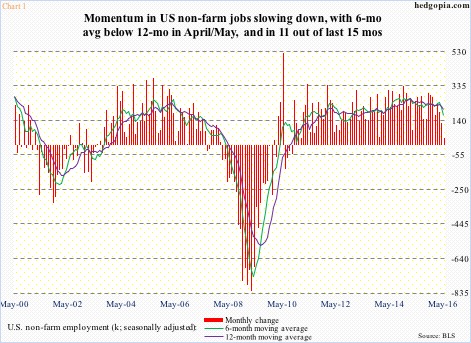

The chart below (Chart 1) caused a lot of stir last Friday – across asset classes, primarily in the U.S., and elsewhere.

The U.S. economy only added 38,000 non-farm jobs in May, much weaker than expected and the lowest monthly total since January 2010. Prior two months were revised lower by 59,000. Momentum has shifted downward.

The monthly average in the first five months this year is 150,000, much weaker than the average last year of 229,000 and 251,000 in 2014.

As Chart 1 shows, the six-month moving average of the monthly change in non-farm payroll remained below the 12-month average in both April and May, and has done so in 11 out of last 15 months. Deceleration in non-farm momentum has been in play for a while now.

This runs in contrast to what we are seeing elsewhere… or does it?

In the week ended April 16th, unemployment claims (seasonally adjusted) were 248,000. This was the lowest since 233,000 in November 1973. On this score, things are humming along just fine.

However, there is this to consider.

Back in 1973, claims started rising from that low, which is also the case this time around, although only by a little. These are two low a reading for the economy to be able to sustain for an extended period.

On a four-week moving average basis, claims bottomed at 256,000 in the week to April 23rd, rising to 276,750 in the latest week. It is too soon to say if this is THE bottom, but the red line in Chart 2, when the time comes, can/will rise… a lot.

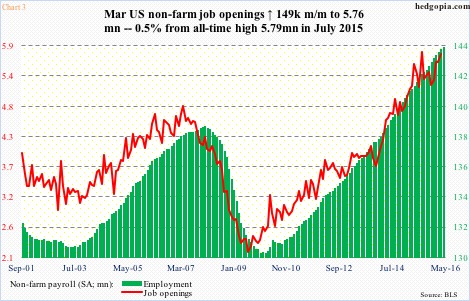

Similarly, job openings (JOLTS) tend to lead jobs. April’s numbers are due out this Wednesday. March was up 149,000 month-over-month to 5.76 million. Openings have been rising since November’s 5.2 million, but the March high was essentially on par with 5.79 million last July. In other words, they have gone sideways for nine months (Chart 3).

Viewed this way, the May non-farm-payroll disappointment may not be one-off rather at an inflection point. Markets clearly do not entertain this as a likely scenario, but did react last Friday to the jobs number.

The reaction was most pronounced in the Treasury yield curve. The two-year yield – most sensitive to Fed action – dropped 11 basis points to 0.78 percent, while the 10-year was down 10 basis points to 1.71 percent. Fed funds futures took a hit in all timeframes. XLF, the SPDR financial ETF, dropped 1.4 percent, and was down as much as 2.5 percent at one time.

The FOMC meets next week, on June 14-15. This is the year’s fourth meeting, and there will be four more left after this (July 26-27, September 20-21, November 1-2, and December 13-14).

June, September, and December have post-meeting press conference scheduled. With last week’s jobs report, June is now out of the question. July is possible – not probable – but does not have a press conference scheduled. The November meeting is right in front of the November 8th U.S. presidential election.

The window of opportunity for the Fed to move – if ever there was one this year – is narrowing. This has implications for the U.S. dollar.

The dollar index last Friday fell 1.6 percent (arrow in Chart 4), losing its 50-day moving average.

For over a year now, it has been range-bound between 100-plus and 93-plus. Last Wednesday, it rose to 95.91 before retreating. Then came the Friday swoon. Weekly momentum indicators are turning down from the median. More weakness probably lies ahead. A break of the afore-mentioned range will be a major negative. That said, this scenario should be a positive for U.S. exports and corporate earnings.

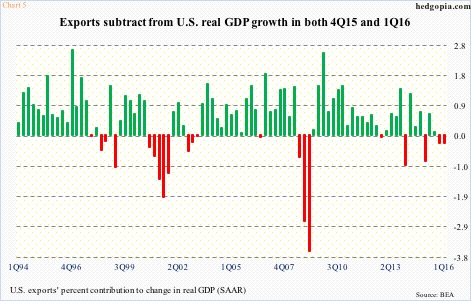

U.S. exports have taken a hit (Chart 5), thanks to both a strong dollar and a weak global economy. Between July 2014 and March 2015, the US dollar index jumped north of 25 percent, before entering a range.

In 1Q16, exports of goods and services came in at a seasonally adjusted annual rate of $2.1 trillion, down from $2.12 trillion in 4Q14, making up 12.7 percent of real GDP. Exports’ share peaked in 4Q13 at 13.2 percent.

In fact, in both 4Q15 and 1Q16, exports subtracted 0.25 percent from real GDP growth (Chart 5). The trend has been decidedly down since 4Q13.

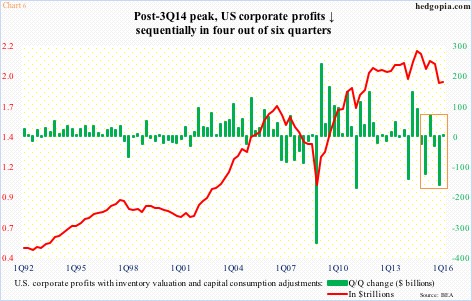

Corporate profits are the same way. Profits adjusted for inventory and depreciation peaked at $2.16 trillion (SAAR) in 3Q14, and dropped to $1.9 trillion by 1Q16. Sequentially, profits have contracted in four out of the last six quarters (Chart 6). A strong dollar hurts U.S. multinationals.

However, a strong dollar is just one factor in exports slowdown and/or profit deceleration/recession. There are other factors, not the least of which is softer end demand. Besides, even if the dollar index continues to weaken in the weeks and months ahead, it will be a while before this gets reflected – positively, of course – in exports and profits.

For equity investors, at issue right now is where major U.S. indices stand, and their likely path of least resistance near- to medium-term.

Chart 7 shows the crucial juncture the S&P 500 large cap index finds itself in right now. Off the February low through the April high, it rallied just under 17 percent, retaking both 50- and 200-day moving averages, and most importantly, knocking on the trend line resistance drawn from the May 2015 all-time peak.

Understandably, plenty of buying power has been expended in rallying the index up to this resistance, which goes back 16 months. This is an area where for the umpteenth of time rally attempts have been denied. In the present context, this is even more important as both daily and weekly conditions are overbought.

The good thing is, bulls were able to defend the 2085 region for six straight sessions, including last Friday. That said, the daily chart now has three consecutive hanging man candles – potentially bearish.

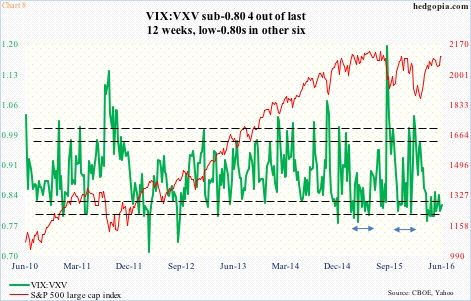

As things stand, risk/reward dynamics favor shorts near- to medium-term. Particularly so if VIX:VXV begins to rise from extremely suppressed level.

The ratio has languished in oversold zone for 12 weeks now (Chart 8). Spot VIX has not broken out of 16-17 resistance for nearly three months now, and is at the bottom of the range currently, with last Friday dipping below 13 intra-day. Hence the suppressed VIX:VXV – and the odds of a rally sooner than later.

Thanks for reading!