From down 7.1 percent between the all-time high of July 25 and the intraday low of August 18 to up 4.8 percent from that low through last Friday’s high, the Russell 2000 small cap index has offered opportunities for the bulls and bears alike.

The 7.1-percent decline was preceded by persistent resistance since December last year at a rising wedge (Chart 1), followed by loss of one after another support. Now it is trying to repair the damage.

The 50- and 200-day moving averages that were lost earlier were recouped last week. It also slid back into a months-long rising channel that was briefly lost during that decline.

Most importantly for the bulls, they were able to successfully defend the lower bound of a months-long rectangle between 1340s and 1390s.

The top end of that rising channel draws to 1465, or thereabouts. The weekly chart has room to push higher. But the daily chart is beginning to look extended.

So where to from here? Non-commercials likely hold the key.

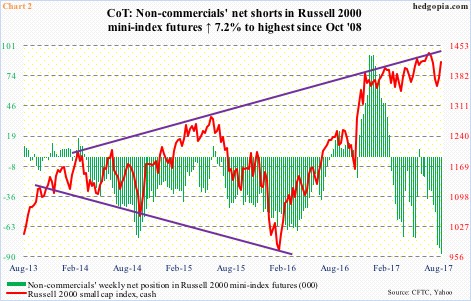

As of last Tuesday, these traders had amassed massive net shorts in Russell 2000 mini-index futures – a total of 87,578 contracts. These were the highest since October 2008 (Chart 2).

If the bulls can force a squeeze here, the cash gets a tailwind. As a matter of fact, this may have already taken place last week. Since Tuesday close through Friday, the cash rose 2.2 percent, past the 50-day. (We will find out Friday as holdings as of tomorrow are reported.)

Flows are another important variable. At least last week, IWM (iShares Russell 2000 ETF) longs took advantage of the rally. In the first four sessions, $1 billion was redeemed (courtesy of ETF.com), even as the ETF rallied 2.1 percent.

The bulls sure hope this does not continue this week.

Flows need to improve if non-commercials are to come under pressure to cover, and if the Russell 2000 is to head toward the upper bound of the afore-mentioned channel.

A lack thereof opens the door to a test of the 50-day (1408) or the top of the rectangle (1390s).

Thanks for reading!