Small-caps have come alive in the past month, with the caveat that the Russell 2000 small cap index is still 1.4 percent from its all-time high of July. The bulls’ best hope near term: squeeze non-commercials.

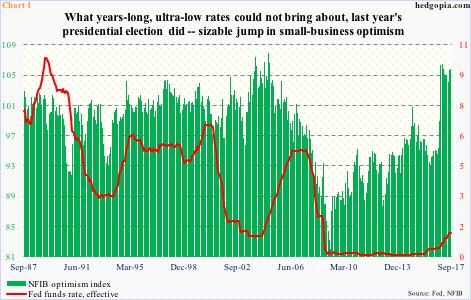

Post-U.S. presidential election last November, small-business optimism surged.

In October, the NFIB optimism index stood at 94.9. By January, this had jumped to 105.9 – a 12-year high. August was 105.3, with readings of 100-plus for nine straight months.

Insofar as small-business optimism is concerned, the election results achieved what years of ultra-low rates could not (Chart 1).

What drove this was President Trump’s promises to reduce regulations, cut taxes and enhance infrastructure spending, among others.

Small-caps inherently are domestically focused. Higher economic growth combined with lower taxes would go a long way, should it come to pass.

Thus far, however, not much progress has been made on this front. This has not deterred small businesses from sticking with their optimism. They express their view in a survey. Where real money is involved, optimism has been wobbly, to say the least.

Post-election, the Russell 2000 small-cap index rallied vigorously – up 16.5 percent (no typo) between November 9 and December 9. Then it began to digest those gains. For months, the index remained range-bound between 1340s and 1390s, followed by false breakouts in February, April and June.

Down below, 1340s persistently drew buyers, including one mid-August subsequent to which the index rallied 6.1 percent. This preceded a 7.1-percent decline from the all-time high of 1452.09 on July 25.

Yet, the Russell 2000 is nearly 20 points from that high. Its major U.S. peers are at/near new highs.

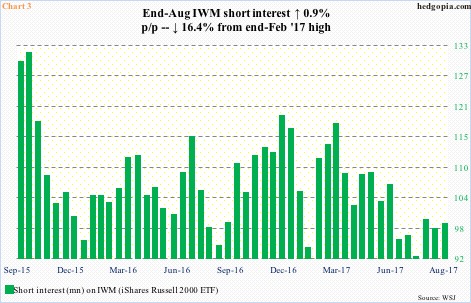

At least looking through the lens of IWM (iShares Russell 2000 ETF), shorts have not been much of a help to the bulls’ cause.

Most recently, short interest peaked at the end of February this year at 117.6 million, and stood at 98.3 million at the end of August. From 90.6 million mid-July, which was the lowest since mid-February 2015, short interest has risen, but not a whole lot.

The Russell 2000/IWM bottomed August 18, before rallying. During the August 16-31 period, IWM short interest even inched up 0.9 percent. Relatively speaking, short interest remains low, and is less likely to sustainably provide a squeeze tailwind.

A squeeze can play a role elsewhere. Potentially. At least the bulls hope so.

In the futures market, non-commercials are bearishly stuffed to the gills. In the week ended June 13 this year, they were net long 7,542 contracts in Russell 2000 mini-index futures. Then they flipped. As of last Tuesday, they were net short 102,325 contracts – a nine-year high. Between the periods, the cash was essentially flat (arrow in Chart 2).

The fact that these traders have gotten aggressive with their bearish bias even as the cash has been bobbing up and down shows that they are not yet ready to give in. Will it change, should the Russell 2000 rally to a new high? Better yet, do the bulls have buying power left to push it to that resistance, and beyond?

The daily chart in particular is extended.

For non-commercials, who are trend followers by nature, to cover, they have to get convinced that a new uptrend has begun on the cash, particularly past the channel it is in (Chart 4). With the Russell 2000 already up six percent in the past month, that is a lot of work facing the bulls, but a squeeze helps, if they can force one.

Thanks for reading!