Last week’s breakout in the Russell 2000 is diverging from small-caps’ profit momentum. It is possible the index is pricing in elevated earnings estimates for next year. It is equally possible the breakout occurred primarily due to short squeeze. In this scenario, the impending breakout retest will be a big tell.

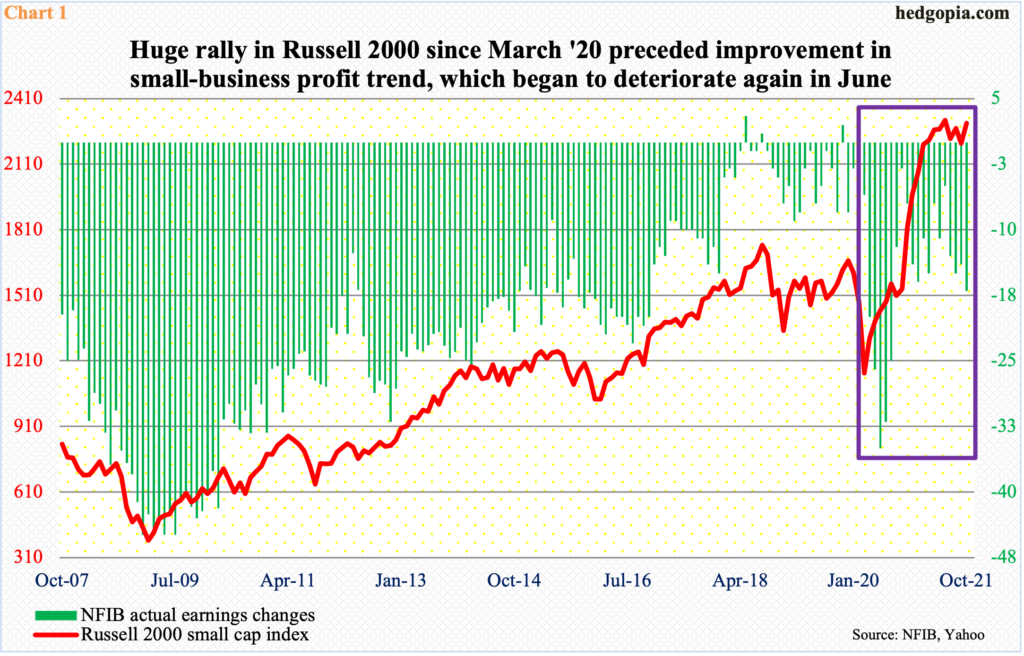

In October, the National Federation of Independent Business’s ‘actual earnings changes’ sub-index dropped three points month-over-month to minus 17. The metric has deteriorated since it posted minus five in June.

The green bars and the red line in Chart 1 have begun to diverge, although not by a whole lot until October. The Russell 2000 put in a major low in March last year. This was soon followed by a bottom in small-business profit momentum in June. They then moved higher pretty much hand in hand.

In March this year, the small cap index peaked at 2360 before consolidating the one-year 144-percent gains. Profit momentum came under pressure In July through October.

Chart 1, which uses the closing monthly price hence does not capture the intraday highs and lows, shows the Russell 2000’s performance up to October. Until then, the index was still trapped in a box. From March last year, when the index peaked, it was rangebound between 2350s and 2080s, and between 2280s and 2150s within this rectangle.

As soon as November began, it decisively broke out of 2280s, landing right on the upper bound of the rectangle, which gave way on the 3rd (Chart 2). If it is a genuine breakout, technicians, using measured move, in due course would be hoping to hit 2600.

Based on this, the Russell 2000 has now substantially diverged from small-cap profit momentum (Chart 1).

It is possible the index is tracking earnings expectations.

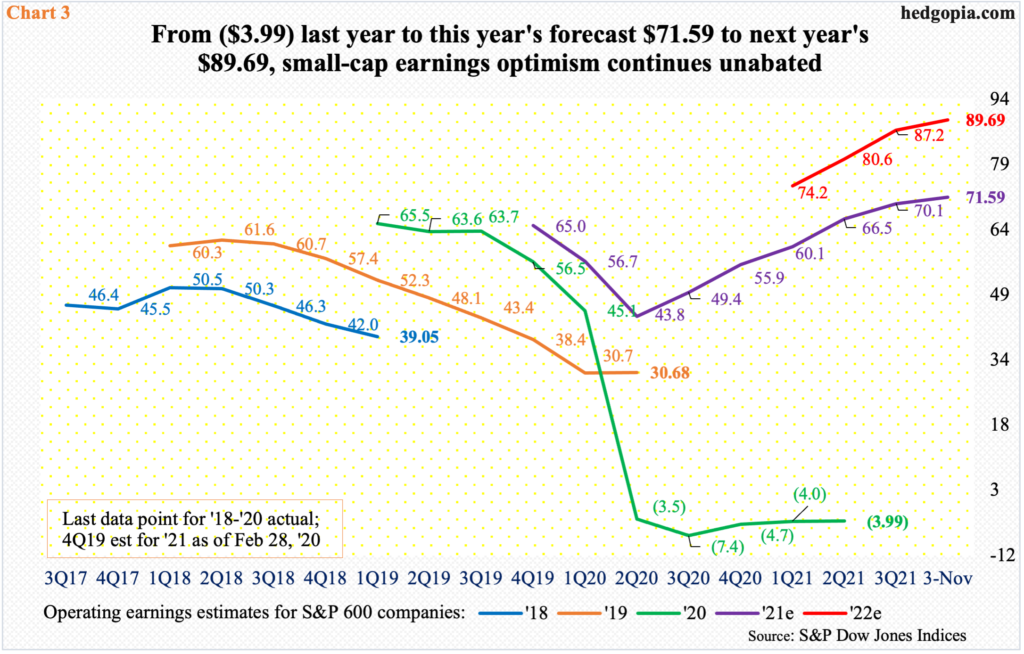

In 3Q thus far (as of last Wednesday), blended operating earnings estimates for S&P 600 companies stood at $19.33, better than the $18.22 expected at the end of September. The revision trend has been positive for the remaining five quarters through the end of 2022 for a while now.

Last year, these companies lost $3.99. This year, with 3Q results nearly over, they are expected to bring home $71.59. This is then expected to grow another 25.3 percent next year to $89.69. This is heady growth if it comes true.

Small-caps tend to have larger exposure to the domestic economy than their large-cap brethren, which also have international exposure. Last week’s box breakout can be viewed as markets’ way of saying the US economy will do just fine next year, or even perform better.

But it may also be too soon to reach that conclusion. In the futures market, non-commercials were heavily net short Russell 2000 mini-index futures (more on this here). This week’s (as of Tuesday) numbers are delayed because of Veterans Day holiday and will be out next Monday.

If the breakout primarily resulted from short squeeze and not much by longs (either adding or opening new positions), then sustainability becomes a question mark. Hence the importance of how the Russell 2000 acts in the sessions ahead.

After last week’s breakout, this week started with additional gains on Monday but the bulls were also unable to hang on to the gains, with the session posting a new high of 2459 but ending with a shooting star. The Russell 2000 (2390) then went on to drop in the next couple of sessions.

As things stand, it is merely 1.2 percent from testing last week’s breakout. It will be a major test. If the breakout is genuine, this should attract bids. Else, the index sooner or later follows the worsening profit momentum in Chart 1.

Thanks for reading!