This market wants to rally. Plain and simple. In a seasonally favorable period, Friday’s red-hot CPI report was embraced by equity bulls. The S&P 500 is itching to break out. If Powell on Wednesday sounds more hawkish that currently priced in and equities sell off, that likely gets bought – for now.

Stocks want to go higher. At least that is the impression one gets seeing how they reacted to Friday’s consumer price index report.

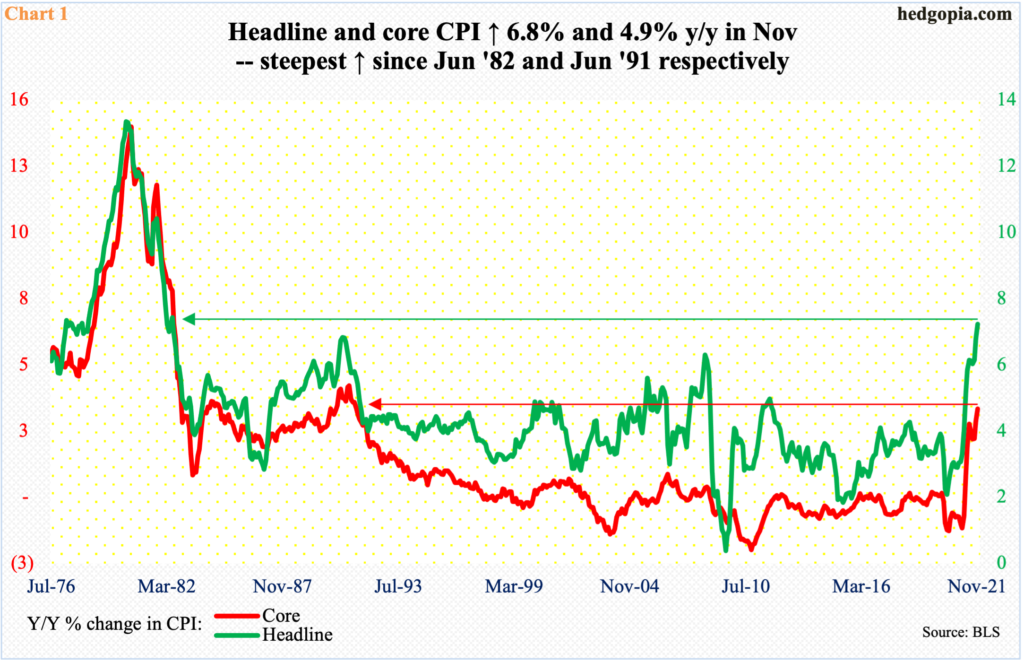

Inflation is persisting. In the 12 months to November, headline and core CPI respectively jumped 6.8 percent and 4.9 percent. This was the steepest price increase since June 1982 and June 1991, in that order (Chart 1). In May last year, headline CPI bottomed at 0.1 percent and one month later core CPI bottomed at 1.2 percent.

The pace of price rise is nowhere near what it was in the late ‘70s-early ‘80s, but the vertical look to it is beginning to concern many. Jerome Powell, Fed chair, recently said he would no longer use the word “transitory” to describe inflation.

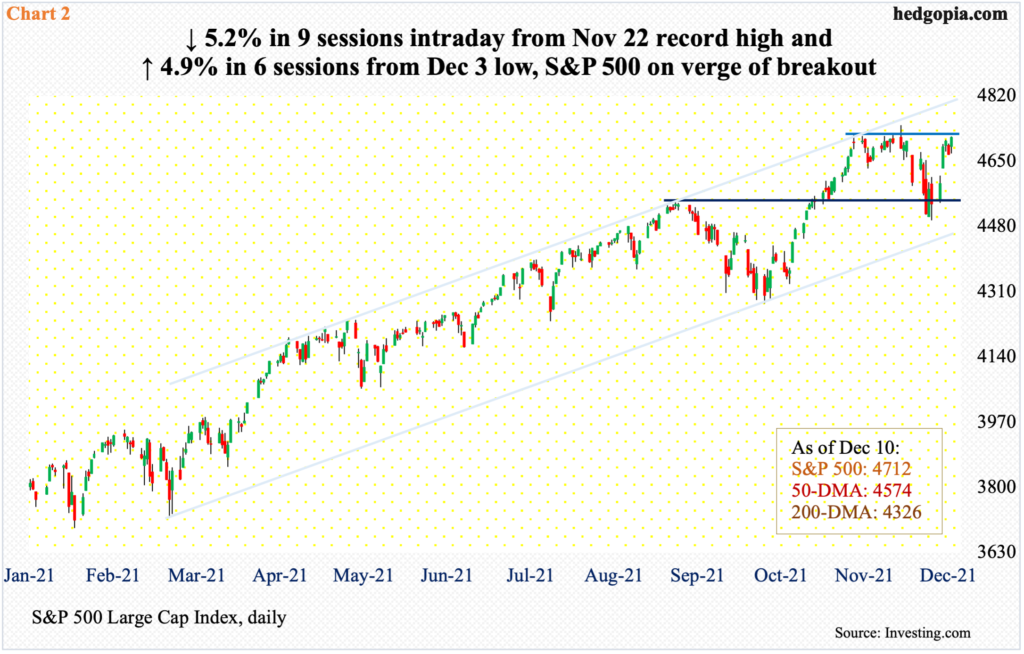

Equities, on the other hand, beg to differ. Last Friday, the S&P 500 rallied nearly one percent to a new closing high 4712. It is itching to break out. Since November 5, the large cap index has struggled to bust out of just north of 4700 (Chart 2). A breakout looks imminent.

Early this month, bulls defended the 50-day. From November 5 through December 3, the S&P 500 dropped 5.2 percent, breaching the average ever so slightly. For well over a year now, bulls have successfully used the average to buy dips. This time was no different. From the December 3 low through Friday, the index then quickly rallied 4.9 percent.

The November 22 intraday record high of 4744 is merely 0.7 percent away. For months now, the S&P 500 has gone back and forth within an ascending channel, the top end of which lies north of 4800. In a seasonally favorable period, bulls are probably eyeing this.

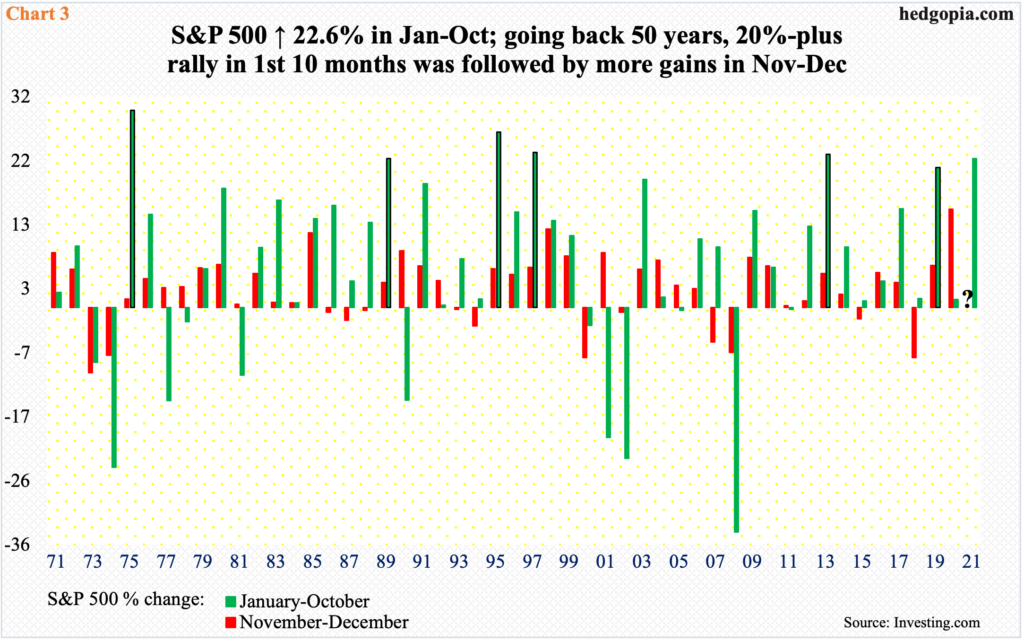

Chart 3 was originally featured in the November 1 post, pointing out the S&P 500’s performance in January-October this year and what that might mean for the remaining two months.

Going back five decades, there have been six years in which the index rallied north of 20 percent in the first 10 months, and each followed up with more gains in the remaining couple of months (green bars with black borders). This year, the S&P 500 was up 22.6 percent in January-October. With three trading weeks left, the index is up 2.3 percent in November-December. The year-end seasonality playbook is playing out as expected.

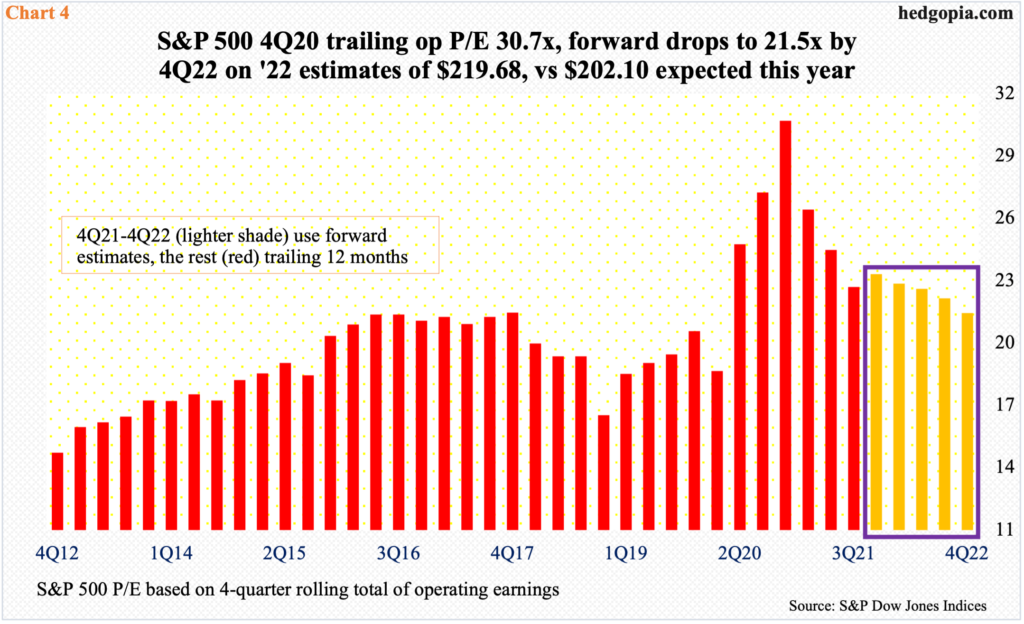

Multiples are extended, but this has ceased to be a factor.

On a trailing 12-month basis, the price-to-earnings ratio for S&P 500 companies reached as high as 30.7x in 4Q20. Concurrently, operating earnings estimates were persistently revised upward. At the end of 2020, the sell-side expected these companies to earn $164.40 this year, which has now grown to $202.09; similarly, 2022 estimates in March this year were $199.50 versus $219.68 now. This has helped pushed the forward ratio lower. If next year’s earnings come through, using the S&P 500’s current price, the ratio drops to 21.5x on 2022 earnings, which is still expensive.

Not surprisingly, US households have equities in their asset portfolio up to the gills. In 3Q21, their equity allocation dropped a tad to 37.4 percent from 37.8 percent in the prior quarter (chart here). This is set to rise to a fresh high this quarter. With three trading weeks left, the S&P 500 is already up 9.4 percent in the current quarter.

Thanks to trillions of dollars in fiscal and monetary stimulus post-Covid, money is sloshing around in the system.

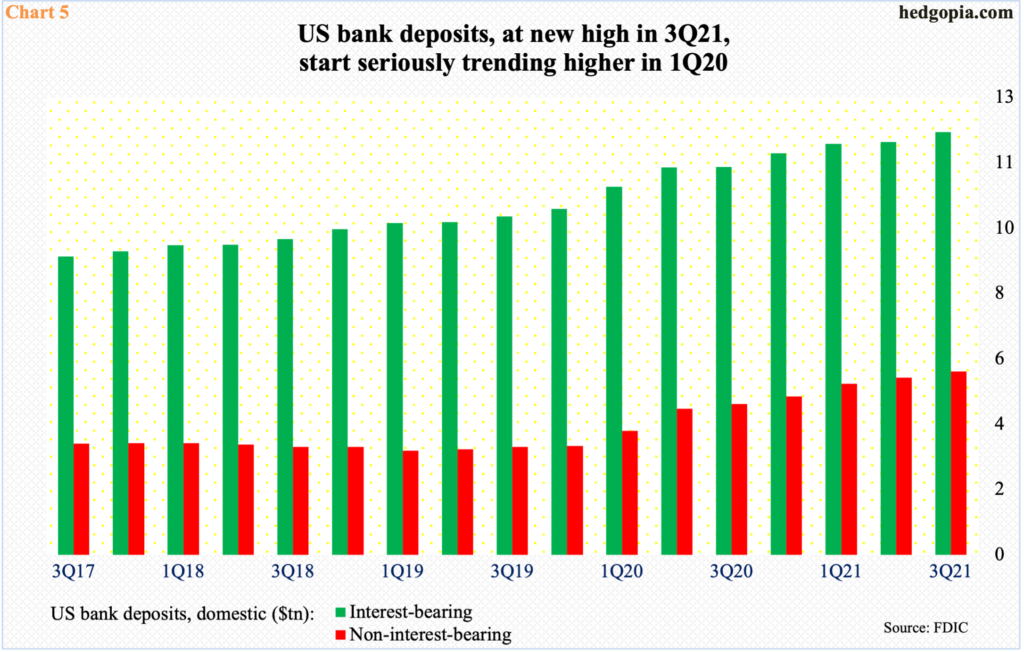

In 3Q21, US commercial banks and savings institutions held $12.3 trillion in interest-bearing and $5.3 trillion in non-interest-bearing deposits; both are at new highs and are up from $10.1 trillion and $3.2 trillion in 4Q19 (Chart 5).

Similarly, as per the Fed’s Z.1 report out last week, US households in 3Q21 held $3.7 trillion in checkable deposits and currency and $10.7 trillion in time and savings deposits; this is up from $1.2 trillion and $9.8 trillion in 4Q19.

That is a lot of buying power lying dormant, and likely finds its way into the economy next year. This is one reason why the economy is unlikely to fall apart in 2022 – unless of course the Fed is forced to act aggressively.

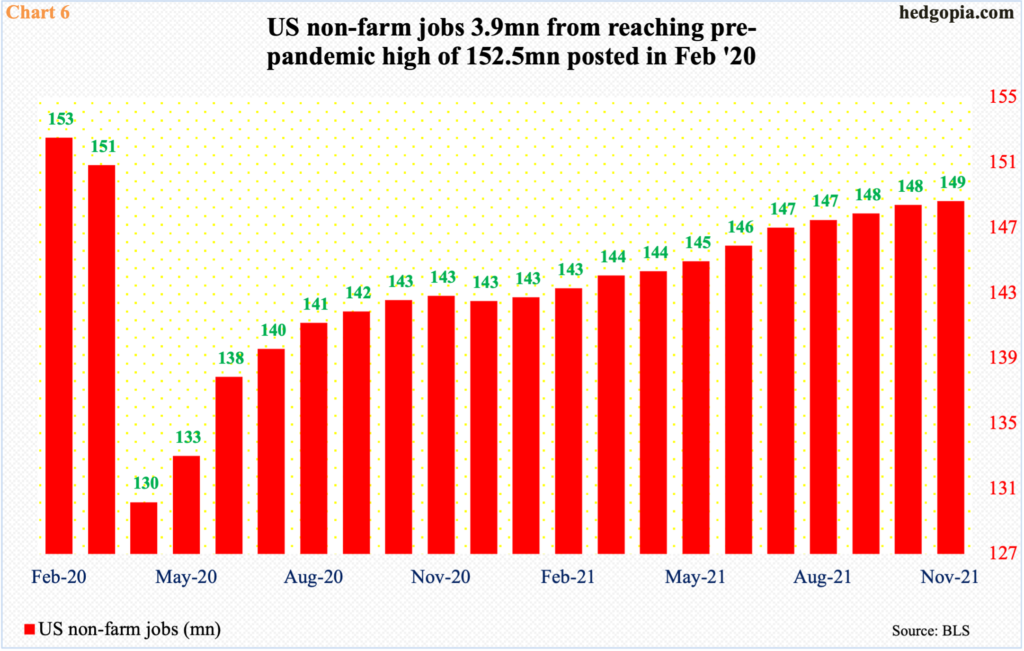

The central bank has a dual mandate of maximum employment and price stability. As the virus brought the economy to its knees in the first half last year, jobs vanished. Non-farm jobs cratered from the all-time high of 152.5 million in February to April’s 130.2 million. The economy lost 22.4 million jobs in a matter of two months.

Rightfully, the Fed solely began to focus on its jobs mandate. Gradually, things began to improve. By 1Q21, nominal GDP surpassed its pre-pandemic high and real GDP achieved that feat a quarter later. By November, non-farm jobs had recovered to 148.6 million, just 3.9 million jobs short of the February 2020 high (Chart 6).

Dynamics have now changed, particularly because inflation is persisting.

On November 30, Powell told Congress that “I think it is probably a good time to retire that word and try to explain more clearly what we mean.” He was referring to the word “transitory”, which until then he for months used to describe inflation. He also floated the idea of accelerated taper of bond purchases, which at the current place of $15 billion a month is set to complete by the middle of next year. This by default also implies they will bring forward rate-hike plans.

Currently, the Fed sits on $8.7 trillion in assets, more than twice what it held in early March last year. By the middle of next year, this is on pace to hitting $9 trillion, or more. Benchmark rates have remained zero-bound since March-April last year (Chart 7).

In the futures market, traders are currently anticipating up to three 25-basis-point hikes in the second half next year. The Fed’s guidance is nowhere near that. Given Powell’s slightly hawkish tone recently, all eyes and ears are therefore focused on this week’s FOMC meeting.

If come Wednesday he sounds more hawkish than the markets currently anticipate and equities sell off, this likely gets bought. Right here and now, the S&P 500 is itching to break out. Next year is another story.

Thanks for reading!