With a couple of tough weeks, both large- and small-caps last week suffered a slight breach of support, but not decisively just yet. Concurrently, VIX is flashing signs of fatigue. For equity bulls, if there is going to be a surprise in the sessions ahead, it is likely on the upside.

Bloodbath continued last week on major US equity indices, with the S&P 500 down another 5.8 percent following a 5.1-percent drubbing in the prior week. Last week’s was the 10th down week in 11. From the January 4th high of 4819 through last Friday’s low of 3637, the large cap index (3675) tumbled 24.5 percent.

In other words, selling has been wayward, with rally attempts quickly meeting with failure. Last week, after five consecutive down sessions, the S&P 500 reacted to Wednesday’s 75-basis-point raise in the fed funds rate with a rally, but the session high of 3838 occurred right at Monday’s gap-down resistance; there was another gap-down in the session before that.

By the time last week was over, trend-line support from last October was breached, albeit ever so slightly (Chart 1). Amidst this, two daily spinning tops formed in the last three sessions – on Friday and Wednesday – indicating indecision between bulls and bears. Conditions are oversold. Should a rally ensue, gap-down resistance lies between 3830s and 4000.

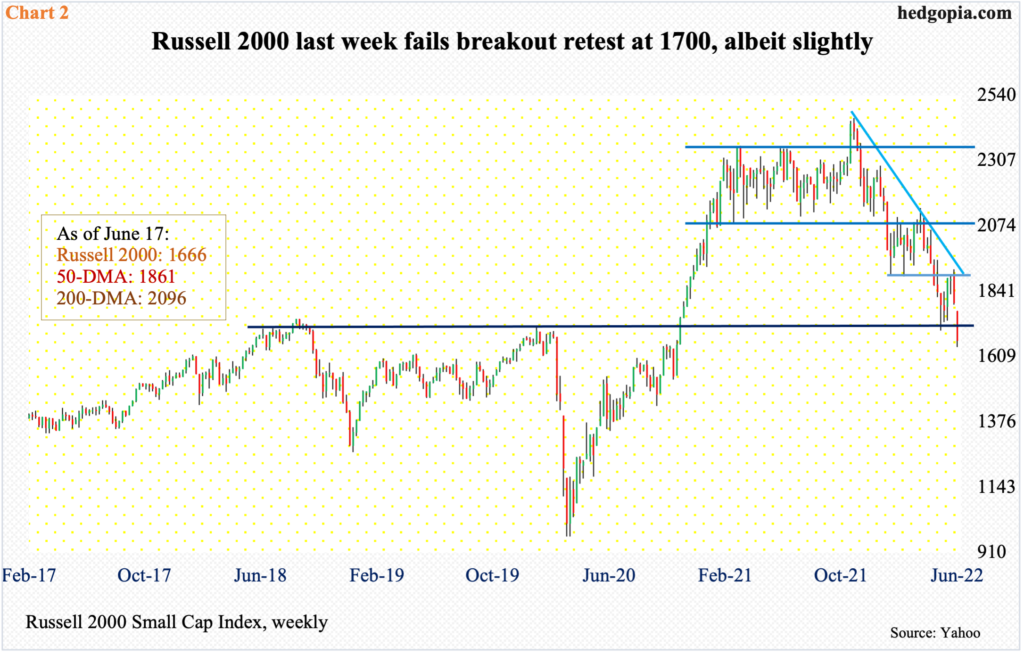

The Russell 2000, too, suffered a slight breach of support last week. This represents yet another range breakdown in the past several months.

Mid-January, a major breakdown occurred, losing 2080s; for 10 months before that, the small cap index played ping pong between 2080s and 2350s. Then for three months through late April, it went back and forth between 2080s and 1900 before the floor gave way.

Six more weeks went by and another breach resulted. In November 2020, there was a major breakout at 1700, which eventually led to a fresh high of 2459 a year later. Six weeks ago, a breakout retest took place – successfully. Last week, it failed; the index tagged 1641 intraday Thursday, closing the week at 1666 (Chart 2).

Through all this, from last November’s high through last week’s low, the Russell 2000 cratered 33.2 percent. Not surprisingly, things are way oversold, particularly on the daily. In the event of a rally – likely – 1700 is a make-or-break as far as small-cap bulls are concerned.

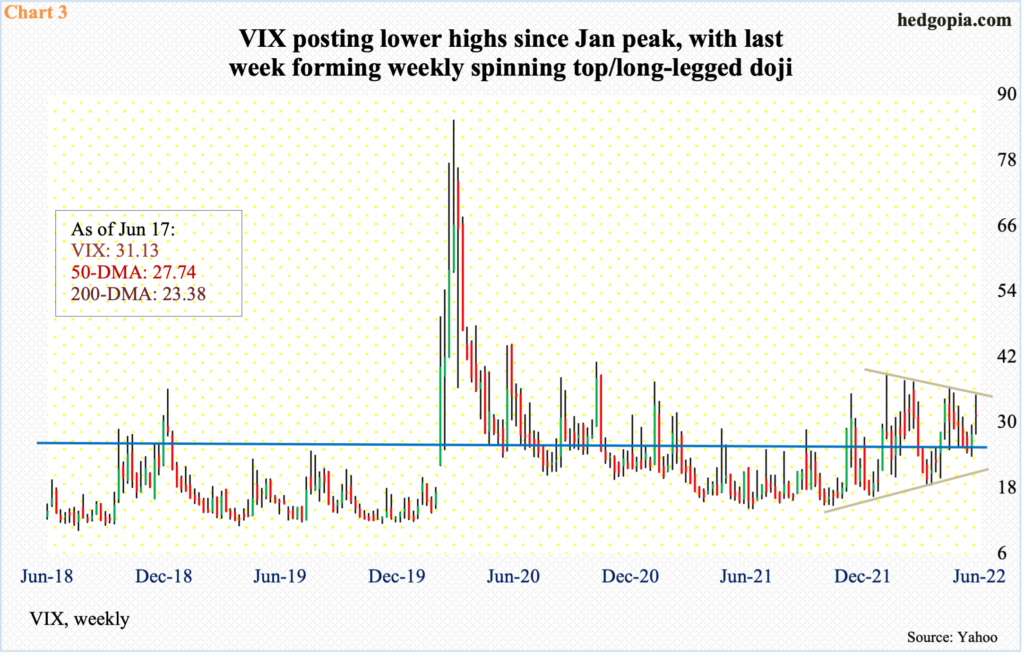

Concurrently, volatility bulls last week failed to hang on to all of the weekly gains. VIX’s high was registered on Monday, even as the S&P 500 reached its low on Friday.

Monday’s intraday print of 35.05 was yet another lower high in a series of lower highs since January this year when the volatility index tagged 38.94 (Chart 3). At the same time, VIX since at least last November has posted higher lows. Last week’s high kissed the upper end of this pennant, with a weekly spinning top/long-legged doji.

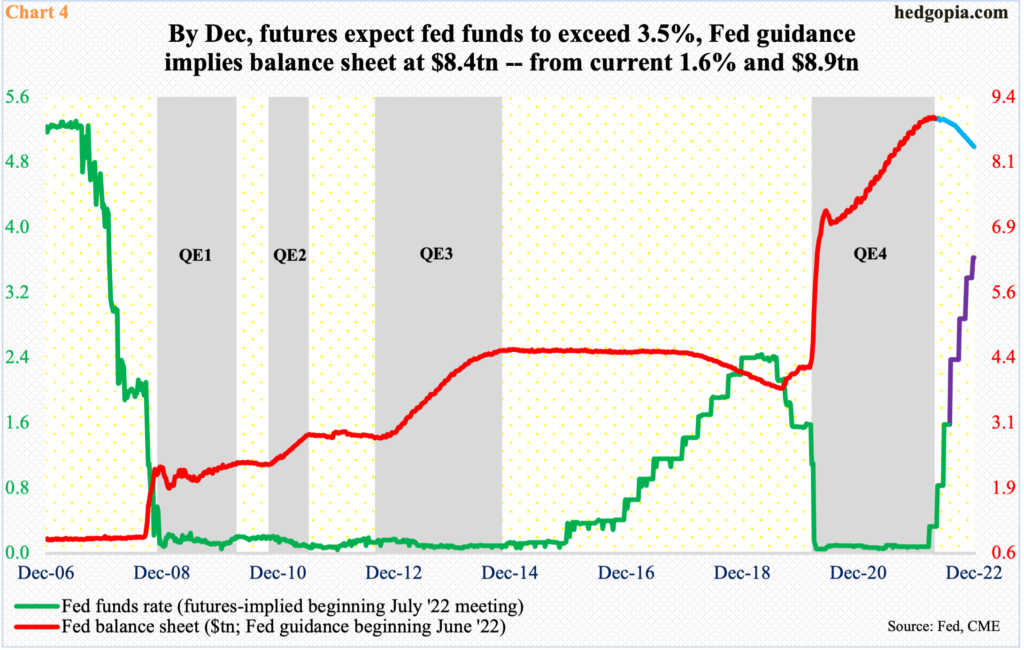

The selloff of the last two weeks was triggered by May’s CPI report, which came out on the 10th this month. In fact, the S&P 500 was already on its way down, having peaked on the 7th. Post-CPI, markets demanded a tighter Fed. Before the report, a 50-basis-point hike was priced in last week’s FOMC meeting; after the inflation report, this was raised to 75 basis points, which the Fed acquiesced to.

This was the year’s fourth scheduled meeting; four more remain. Leading up to this, the Fed raised twice – by 25 basis points in March and 50 basis points in May.

In the futures market, traders now want another 75 in July, a 50 each in September and November, and a 25 in December, ending 2022 between 3.5 percent and 3.75 percent, from the current range of 1.5 percent to 1.75 percent. Along the same way, Fed guidance suggests its balance sheet will hit $8.4 trillion by year-end from the current $8.9 trillion (Chart 4).

If there is any good to all this, it is that markets in all probability have adjusted to this. Equities, as previously explained, have had a rough couple of weeks and the 10-year treasury yield rallied from 3.04 percent on the 9th to 3.48 percent on the 14th, with last Friday closing at 3.24 percent.

This raises the odds of an upside surprise in the sessions ahead as far as equities are concerned – particularly so given how volatility behaved last week.

Thanks for reading!