Since March lows, large-caps led, and tech led the large-caps. Short squeeze helped. Amidst signs of distribution in the Nasdaq 100 the past several sessions, relief likely awaits bruised shorts near term.

Shorts have gotten squeezed – for the most part, anyway.

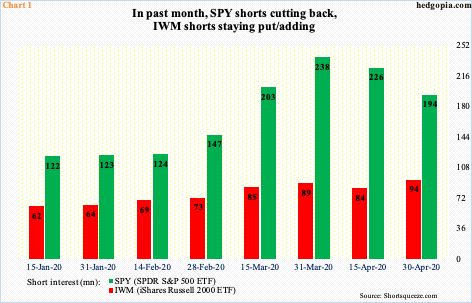

At the end of April, short interest on SPY (SPDR S&P 500 ETF) dropped 14.2 percent period-over-period to 193.9 million shares. In the past month, it is down 18.6 percent (Chart 1). Off the March lows, large-caps rallied strongly, with the S&P 500 Large Cap Index up nearly 35 percent between the March 23rd low and April 29th high.

Small-cap shorts, however, are staying put. Between the March 18th low and April 29th high, the Russell 2000 Small Cap Index jumped north of 42 percent, although that was enough to retrace just over 50 percent of its February-March collapse, versus the S&P 500 which retraced 61.8 percent.

On IWM (iShares Russell 2000 ETF), end-April short interest rose 11.7 percent p/p to 93.7 million shares. Shorts are staying put. They will have scored victory should the Russell 2000 (1275.74) lose crucial support at 1250s.

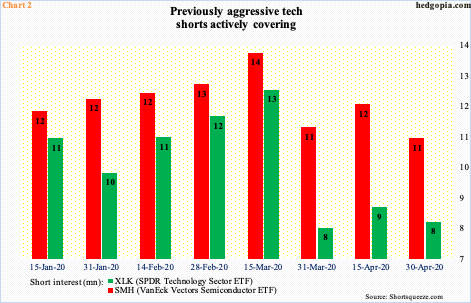

Despite the slight divergence between large- and small-caps, the story is different in tech, which has led the large-cap leaders. Through Tuesday’s intraday high of 9354.45, the Nasdaq 100 Index was up 7.1 percent for the year and was only 4.1 percent from its record high from February 19th! So much for the Covid-19 crisis. Shorts lent a big helping hand.

Short interest on SMH (VanEck Vectors Semiconductor ETF) tumbled from 13.8 million shares mid-March to 11 million end-April and on XLK (SPDR Technology Sector Fund) from 12.6 million to 8.2 million (Chart 2).

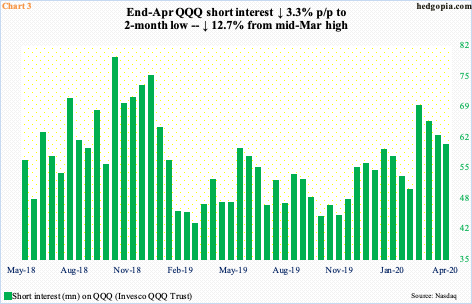

QQQ (QQQ Invesco Trust) is the same way. From mid-March to end-April, short interest declined 12.7 percent to 59.8 million. The mid-March high was at a 15-month high (Chart 3). Or, take Nasdaq short interest, for that matter. Between the periods, short interest fell 6.1 percent to 8.8 billion, with the mid-March level the highest since mid-October 2015 (not shown here).

Viewed this way, even after the most recent drop, short interest remains elevated. In the right circumstances for equity longs, there is still room for short squeeze, which was their plan all along, and they succeeded. That said, right here and now, relief likely awaits shorts.

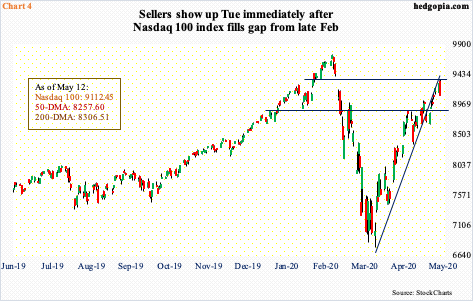

Major US equity indices have experienced massive rallies off of the March lows. Last week, the Nasdaq 100 shot up 5.8 percent, but there were also subtle signs of distribution, with a couple of daily dojis and a shooting star. As a matter of fact, the index (9112.45) lost a rising trend line from Mach eight sessions ago but had been rallying all along that broken line. Tuesday, it just about filled a gap from late February (Chart 4).

The daily in particular remains way overbought. Shorts could get active here. Nearest support lies at 8900, which approximates the 20-day. A loss of the average opens the door to a test of the 50- and 200-day – respectively at 8258 and 8307.

Thanks for reading!